Lubricant trends

Advances in automotive lubricant design

04 March 2025

Please note this article was published in March 2014 and the facts and opinions expressed may no longer be valid.

11 March 2014

Integrating the needs of Asia Pacific into automotive lubricant specifications

Insight reports on the keynote presentation delivered by Chris Locke, Infineum Vice President for Marketing and Technology, as part of the 2014 F&L Asia week in Singapore.

2014 sees the 20th anniversary of the Fuels & Lubes Asia Conference, which this year joins the 8th Asia-Pacific Base Oil, Lubricant & Grease Conference to form F+L Week.

Chris Locke contributed to the debate with his keynote presentation on the history of automotive lubricant specification development, the rise of Asia in the last decade and its potential influence on future specifications. In particular, he gave some thoughts on how Asia should be better integrated into the lubricant specifications world.The convergence of two of Asia's premier industry events makes a very powerful sounding board for the latest developments in base oils, greases, industrial and automotive lubricants, transportation fuels and petroleum additives.

The presentation started with a look at the universal process used to set new specifications. Driven by consumer demands, for example for better air quality or improved fuel economy, regional legislation is developed that must be met by vehicle manufacturers.

The OEMs, oil and additive companies then work together to develop products that help enable the OEMs to deliver against these requirements. A very current example is the development of the new PC-11 and ILSAC GF-6 specifications in the US, and next generation ACEA specifications in Europe, the combination of which represents a huge industry challenge.

Currently, these API and ACEA specifications provide the foundations for the majority of lubricants found in Asia – despite the fact that these specifications were not developed with Asia as a key areas of focus, and that the Asian OEMs are largely outside these specification setting processes.

In a world in which Asia is becoming an increasingly important and assertive player, and is starting to bring indigenous or modified hardware to market, we must ask: does the leveraging of these existing specifications provide an optimal long term solution?

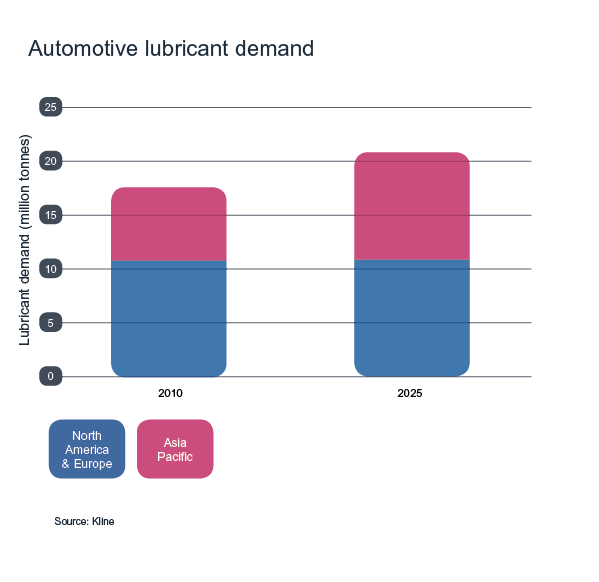

In recent years the booming sales of vehicles in Asia Pacific, and in particular China, has positioned it as one of the most attractive automotive markets in the world. And, with lubricant demand in the traditional growth regions of North America and Europe remaining stubbornly flat, Asia also provides a real bright spot in the otherwise lacklustre global lubricants market.

Total vehicle sales in Asia Pacific exceeded 74 million in 2012, with China alone accounting for more than 40%. Many expect this year to promise more of the same, with CAAM for example setting a sales growth target of 8%-10% - which actual sales will almost certainly cruise comfortably past.

However, the vehicle split is very different from the typical European or North American picture with motorcycle sales dominating the market.

Europe and Asia - sales by vehicle type 2012

To service this attractive market, Asia has the largest global range of OEM diversity – from local brands, hitherto relatively unknown outside of their home country, right through to the major market players like General Motors, Toyota and Volkswagen. Many of these OEMs have divergent or even in some cases mutually exclusive lubricant needs.

The vehicle split and wide range of OEM requirements are just two of the factors that differentiate the Asian market from the rest of the globe, although complexity is also introduced via a further set of factors.

Emissions legislation, which varies widely in severity across the region, directly influences the quality of fuels. Currently we are still seeing huge variations in fuel quality across the region, with some, especially in rural areas, still containing well over 1000 ppm sulphur. These high and variable sulphur levels are incompatible with modern engine technologies and present real issues for OEMs who want to ensure trouble free operation of their vehicles.

| Country | Emissions legislation1 | 2012 fuel sulphur range2 |

|---|---|---|

| Malaysia | Euro I - M2 | 313-398 ppm |

| Vietnam | Euro II | Not sampled |

| Indonesia | Euro II-III | 125 – 3090 ppm |

| Philippines | Euro II-III | Not sampled |

| India | Euro III-IV | Not sampled |

| Thailand | Euro III-IV | 16-45 ppm |

| China | Euro III-V | 68-1399 ppm |

| Korea | Euro V | 4-6 ppm |

| Japan | Euro VI | 4-9 ppm |

Fuel sulphur levels in Asia can be high and are extremely variable

1 The legislation noted is either the actual level, or closest equivalent for ready comparison, 2 Data from 2012 Infineum Winter Diesel Fuel Quality Survey

To compound this challenge, vehicle duty cycles across the region vary considerably, with commuters in overcrowded cities stopping and starting frequently, while users in rural areas often overload their vehicles and thus put significant additional stress on the lubricant.

On top of these issues, vehicles in this region must also cope with extremely harsh operating conditions, including both high and low temperatures and extremely dusty conditions, all of which contribute to the very high degree of market driven complexity.

Lubricant specifications in Asia Pacific are typically leveraged from the North American API and European ACEA categories, which are developed as the result of considerable debate by representatives from the regions’ OEMs, oil and additive companies.

The resulting specifications are typically based on a set of performance criteria designed to handle the specific local needs of the North American and European markets, on top of which OEMs can develop their own specifications to handle specific requirements.

As Asia continues its development into the most complex, diverse and varied market in the world, with a wide range of challenging issues to address, there is growing evidence that its local needs are not completely satisfied by the current API and ACEA specifications.

The case for action for regionally oriented specifications is strong - the concept of a single global set of specifications is not realistic, with significant performance overhead and cost likely to be incurred in developing markets.

However, if we need a new specification for any emerging market, this does not mean we cannot streamline the process; we must look for the best and most appropriate available engine tests (based on a global review) in order to define the lubricant performance needed by that market, as demonstrated by field performance. This may mean the same test at different performance levels for different markets, for example.

We are already seeing some reuse of tests, and procedures, and in our view the premise of ‘global tests, local specs’ really does apply. Thinking about how to effectively use all the tools at our disposal, regardless of where they originated, can only bring a greater level of speed and efficiency – something all industry stakeholders will benefit from.

Asia Pacific has rapidly established itself as the business growth driver of the lubricant world, and as a consequence we are rapidly approaching a tipping point in specification development.

US, Japanese and European OEMs are all highly represented across the Asian markets. In China for example, CAAM reports that in 2013 the market share of Chinese brand passenger cars has continued to decline. Sales of foreign brands now account for over 59% of total passenger car sales – with Germany leading the way.

Asia is now the number one global market for a number of Western headquartered OEMs, which really makes the concept of the Western ‘home country’ specifications, driven by volume of vehicles sold and then deployed in smaller markets, increasingly out-dated and means it is increasingly important to fully integrate the needs of Asia into the specification mix.

However, in doing so, we must seek to minimise unnecessary complexity and focus on delivering real consumer value – for example, by ensuring we avoid duplication and redundancy in engine test requirements.

Clearly this is not going to be easy – it will require a significant amount of understanding, co-ordination and careful integration. But, if we can get it right, the gains in terms of reduced complexity, cost and uncertainty combined with increased value, speed to market and sustainability will bring benefits to all industry stakeholders.

So how do we go about this integration of the needs of Asia into the specification mix?

First we need to have meaningful industry dialogue to establish exactly what we expect industry standard specifications to deliver.

In our view they should define a good quality, widely available lubricant on which consumers can rely to provide baseline protection to their vehicles. They should not be the highest performance level that can be negotiated and agreed within the competing needs of all the stakeholders.

Once we are sure we understand exactly what industry specifications are designed to deliver we can, as an industry, work to challenge redundancy and duplication, ensure tests are robust, fit for purpose and have a clear line of sight to real world field performance, and really focus on those items that bring clear consumer value.

In order to integrate Asia Pacific into the global lubricants market we must work together to accommodate the complex and diverse needs of the region into a more focused specification system. In practice this is likely to require the formation of a new, Asian focused, tripartite body (OEM/oil company/additive company) analogous to those that already exist in the US and Europe.

If we carefully seek out commonality, remove redundancy and avoid destructive complexity, we can all focus our attention and investments on delivering lubricant solutions that bring real consumer or marketing value – faster than ever before – to ensure a sustainable future for us all.

| ACEA | European Automobile Manufacturers' Association |

| ACEM | Motorcycle Industry in Europe |

| API | American Petroleum Institute |

| CAAM | China Association of Automobile Manufacturers |

Sign up to receive monthly updates via email