Base stocks

The latest on base stock trends

30 September 2025

Please note this article was published in December 2012 and the facts and opinions expressed may no longer be valid.

We have since written an updated article which you may find more useful.

01 December 2012

on trends in global base stock markets

The economic slowdown, changing demand patterns and the anticipated influx of high quality base stocks are all impacting the global supply and demand balance for base stocks. With this as a backdrop, Alan Outhwaite, Business Development Manager for Chevron Base Oils, talks about global base stock trends and developments at Chevron.

Alan Outhwaite has been in the lubricants industry for 29 years – the last 18 at Chevron. Throughout his career he has held a wide variety of roles in technology, product planning and marketing, and this, combined with his interaction with organisations regarding the strategic and technical aspects relating to base oil supply, means he is ideally placed to comment on factors affecting the market.

With the global economic slow down far from over, questions around its impact on the supply/demand balance for base stocks, and particularly Group IIs, were high on the agenda. “The slowdown in the demand for finished lubricants has created some length in the market, although this picture is slowly changing as refineries consider alternative values of feed stocks,” confirms Outhwaite.

“The increasing demands and diversification of industry with the added manufacturing complexity that OEM specifications can bring, mean that we are seeing continued and growing interest in our Group II base oils.”

There has been continued debate in the industry about changing demand patterns and the impact that an influx of high quality base stocks might have.

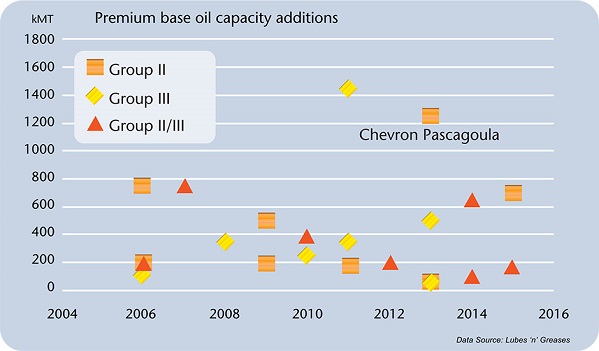

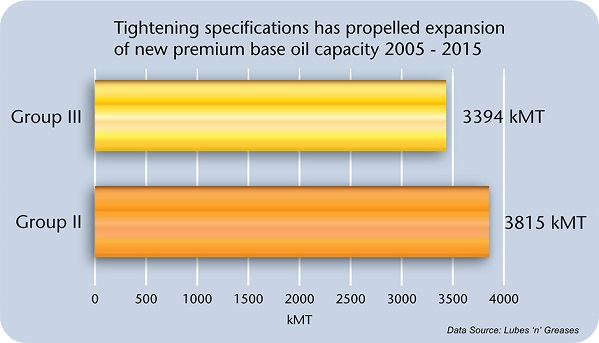

Outhwaite explains the situation from his viewpoint. “In the 2005 and 2015 timeframe over seven million tonnes of hydroprocessing capacity is forecast to come online – around 15% of today’s global manufacturing capacity. This takes the volume of hydroprocessed base stocks to around 30% of total base oil production.”

“Despite the short term situation, global demand for finished lubricants should increase and, in our estimation, revisions to industry and OEM performance standards mean that over 45% of future demand will be for premium base oils.”

With over 2.3 million tonnes of capacity between two plants Chevron, like many other North American producers, has begun exporting Group II base stocks.

“Currently we are supplying Group II base oils, which are seen as an economic alternative to the traditional Group III and Group I/III blends, to Europe and Latin America from our plant in Richmond California. Our Pascagoula Base Oil Project represents a significant investment at over $1.4 billion and will have a capacity of up to 1.250 million tonnes of Group II base oils.”

“When it comes on line in late 2013, the plant will meet the increasing demands for premium base oils in Europe and Latin America as well as serving local North American customers. This will free up Richmond production capacity for the local market and to meet increased demand for premium base oils from Asia.”

With base stock demand already very soft in many parts of the world, we asked what impacts he expects the increase in capacity of high quality base stocks to have on Group I plants.

“The demand for finished lubricants is expected to pick up, which will help to absorb some of the capacity coming online. However, a number of industry analysts have forecast that some high cost producers, typically those with smaller, older plants, may face challenges in the future.”

In Europe, where production is primarily Group I today, Outhwaite believes that the significant capacity of Group II and III coming online outside the region means that increased demand is likely to be met through imports, although a number of projects have been announced that will increase local Group II and III production.

This situation gives rise to concerns about how demand for bright stock for marine lubricants, and light viscosity oils for additives and transformers will be met. “We do not anticipate severe shortages of any of these grades,” explains Outhwaite. “Hydroprocessing can yield products in the 2-5 cSt region that are suitable for the low viscosity applications mentioned.

As for marine lubricants, I am aware that some additive organisations are developing technologies for marine applications in Group II, given their increased availability. But many Group I producers are now focusing on bright stock production, which should alleviate potential shortages.”

A growing trend, which we have covered with interest in the Infineum Trends presentations, is the increased availability of re-refined base stocks.

“Most reputable re-refiners employ modern, although low-pressure, hydroprocessing systems. This, combined with the use of feed stocks with increasing percentages of Group II and III base oils, means a re-refinery can manufacture Group II base stocks suitable for some applications”.

There has been some debate about the quality of re-refined products, which we were keen to explore.

“The quality of Group II oil produced by re-refiners varies considerably because there is a trade off between hydrogen consumption and catalyst life on one hand and product quality on the other. Re-refineries do not operate at high enough pressures to convert Group I and II base oils to Group III.

To make Group III, they [re-refiners] would have to use carefully selected feed oil containing mostly Group III and Group IV base oil – which would be very unusual.”

In North America, the lubricant industry focus has been tuned into the evolving ILSAC GF-6 and PC-11 specifications to anticipate the impacts they might have on our world.

We asked Outhwaite what they might mean to base stock producers? “The specification revisions will continue the trend for higher-quality base oils. For the lowest viscosity grades of passenger car motor oils (PCMO), some or all-Group III or Group IV may be required, depending on additional OEM performance requirements.”

“These very low viscosity oils will probably provide some small incremental improvement in fuel economy compared to current ILSAC GF-5 oils.”

“With the increasing use of turbochargers in passenger cars, and the growing popularity of smaller engines of much higher power densities, we expect many new cars to use SAE 5W-30 to maintain adequate wear protection. “

“PC-11 will also enable some lower viscosity grades to be used in heavy-duty engine oils (HDEO), which will provide some modest improvement in fuel economy. New engines will probably require some redesign and use of new materials to take advantage of these oils without compromising wear.”

Higher quality base stocks will play an important role in the development of thinner, fuel efficient grades with robust Noack properties, which are needed to improve fuel economy, reduce emissions and offer wear protection.

“The practically zero sulphur content of Chevron Group II base oils, when combined with appropriate additive technologies, ensures emission system compatibility and the viscosity profile can lead to some fuel efficient grades whilst helping to maintain durability, particularly in the case of HDEO. For PCMO applications, some common fuel efficiency standards can be met with Group II+ base oils.”

To round off the interview we asked what he sees as the biggest challenges for base stock suppliers – and particularly Chevron – over the next five years.

“Suppliers face a number of challenges in the medium term,” Outhwaite confirms. “In addition to secure supplies of base stocks, we must see an alignment of additive technology and supply to meet emerging performance standards.”

“From a Chevron perspective, implementation of our global supply network to support production of over 2.6 million tonnes of base oils from three refineries that are within our global product slate is key to our success.”

Sign up to receive monthly updates via email