Lubricant trends

Advances in automotive lubricant design

04 March 2025

Please note this article was published in November 2016 and the facts and opinions expressed may no longer be valid.

09 November 2016

Lubricant quality upgrade continues in China

Despite some of the challenges brought about by China’s slowing economic growth, emissions and fuel economy regulations continue to drive up the quality of vehicle technology. Infineum’s DJ Shee, talks about some of the impacts this trend is having on the lubricants market.

The lubricant market in China is going through a period of significant change. In a slow economy, 2015 proved to be another tough year for lubricant companies, some seeing their sales decline by as much as 30%. With the economic slowdown expected to continue, many predict that the next three years will be equally challenging.

There are a number of issues that lubricant companies operating in China will need to overcome to ensure future success.

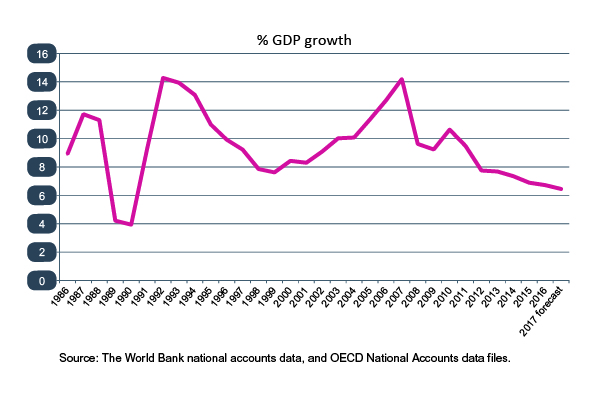

While China has achieved extraordinary economic growth in the last three decades, it is now in a period of much slower economic growth.

In the last five-year planning cycle, China’s Central Government announced that in the coming 15 years the driver for long term economic growth in China will be domestic consumption. Policies have been put in place to encourage private sector entrepreneurship, innovation and service industry developments. At the same time, GDP growth from manufacturing, foreign investments and exports has been de-emphasised and restrictive measures have been implemented to curb real estate growth and to control credits.

The restructuring has slowed economic growth over the past four years. This downward trend has hit lubricant consumption, particularly in the commercial transportation and industrial areas. And, since the third quarter of 2014, there has been a drop in lubricant demand.

Keeping up with the speed of product and technology innovation, which is being driven by emissions legislation and fuel economy targets, is another major challenge for lubricant suppliers.

A 2010 report from China’s Ministry of Environmental Protection, identified emissions from motor vehicles as the major source of air pollution in China’s large and medium sized cities. As vehicle ownership continues to rise, more pressure is being put on air pollution control agencies in these cities to enforce stricter control.

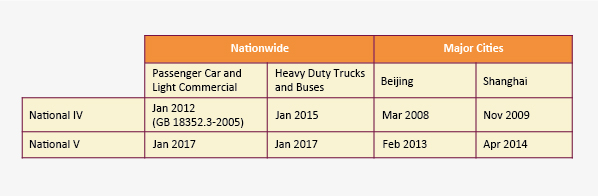

The current legislative requirement for emissions from private and commercial vehicles is equivalent to Euro V in major cities such as Beijing and Shanghai, and Euro IV across all other cities in the country. However, by 2017 the Euro V equivalent will apply nationwide. In the wake of mounting pressure to improve air quality, the central government has pledged to strictly enforce these emissions regulations.

China legislative requirements for emissions from private and commercial vehicles

China legislative requirements for emissions from private and commercial vehicles

At the same time, the industry is focusing on meeting increasingly stringent fuel economy standards, which are being phased in over the coming years to cut CO2 emissions.

Increasingly stringent fuel economy standards are being phased in

Increasingly stringent fuel economy standards are being phased inTo be allowed on the roads, all new vehicles produced in China must meet these emissions and fuel economy targets.

Many car and truck manufacturers have developed aggressive technology programmes so that new engines and emission control technologies are ready to deploy.

Some OEMs expect oil companies to work with them to co-engineer lubricants with their emerging hardware technologies. However, this poses a major challenge to those medium and small sized local oil companies who do not yet have the technical capabilities to satisfy the needs of the OEMs.

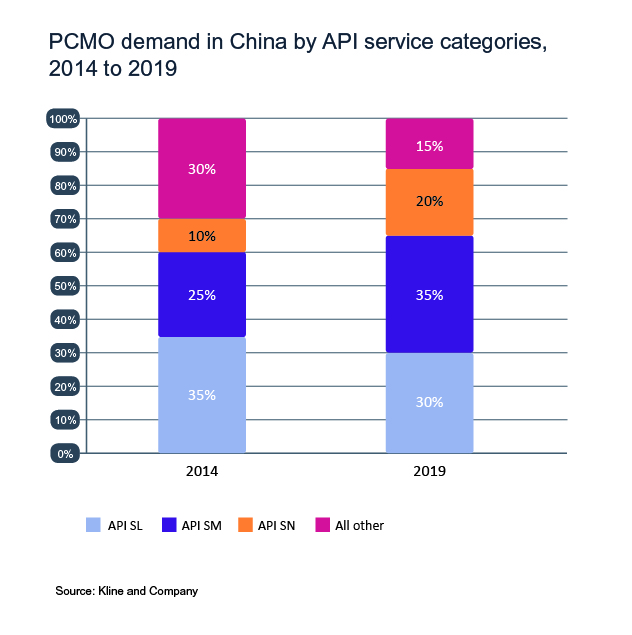

To meet the needs of the latest cleaner and more fuel efficient passenger cars, OEMs are upgrading their lubricant specifications, driving the market to higher quality levels.

The current mandatory National passenger car motor oil (PCMO) specification, GB1121-2006, is equivalent to API SL (ILSAC GF-3). Local suppliers have been working to improve lubricant quality and SL quality grades and above enjoy 70% of the PCMO segment, with further quality upgrades expected to move ahead quickly.

Although the ILSAC GF-6 First Available Use (FAU) date has slipped beyond April 2018, oil marketers are eager to launch ILSAC GF-6 products in China to build up reputation and brand recognition in the market.

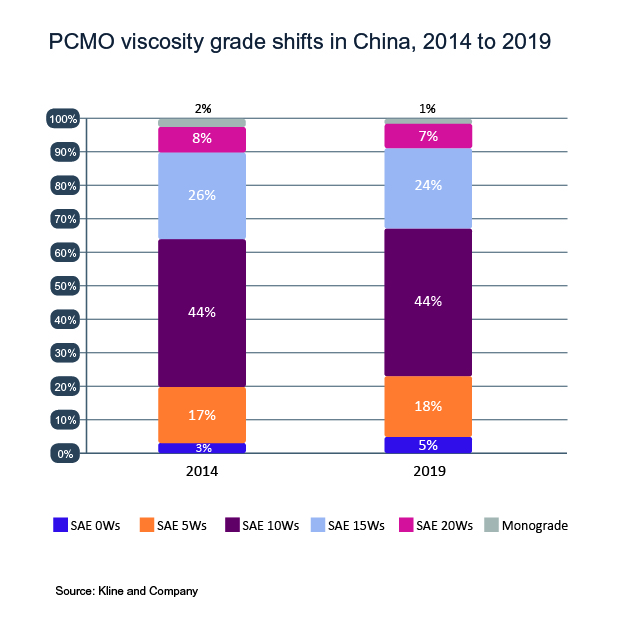

Fuel economy restrictions are also impacting PCMOs, driving them towards lighter viscosity grades. It is estimated that SAE 5W-30 grades and below account for approximately 20% of the PCMO segment. Their use is expected to grow quickly in the next five years, especially in the SAE 0Ws. segment, driven primarily by OEM recommendations to achieve fuel economy targets. However, it is essential to strike a careful balance between reduced viscosity and engine durability.

The growing demand for higher quality lubricants that can also deliver fuel economy benefits is impacting the base stock market, where the demand for Group III and Group III plus continues to grow strongly.

The rapid pace of lubricant quality upgrades that are required to satisfy China’s emissions and fuel economy legislation means oil marketers have the opportunity to introduce higher quality products.

Lubricants with attributes including: lower viscosity, aftertreatment system compatibility and longer drain capability, will be needed to meet the emerging needs of OEMs and consumers.

Oil marketers who can deliver the right technologies and can better differentiate their products could position themselves for better value capture and more sustainable profit growth.

Lubricant companies will need to compete harder for business in a shrinking market. However, those who control their costs and invest with the right partners to build competitive technology advantages, could emerge as winners when the economic restructuring is complete and the market regains its high growth momentum.

Regulations and engine technology changes will continue drive the global industry to improve lubricant quality – the impact of which will be felt by oil marketers, OEMs and base stock suppliers.

Infineum has been involved in the development of the latest ILSAC and ACEA specifications, which means our people are well aware of the challenges ahead. By investing in manufacturing and R&D facilities in China and by working closely with industry stakeholders Infineum is ready to provide the most reliable lubrication solutions to the China market.

Sign up to receive monthly updates via email