Fuels

Reported sludging incidents rise

04 November 2025

13 April 2016

Middle East refineries turn to fuel additives to meet export fuel specifications

As the Middle East ramps up its low sulphur diesel fuel production for the export market John Maddox, Infineum Account Manager for the Middle East region, examines the role that fuel additives play in ensuring the fuels meet regional specifications.

The refining industry in the Middle East is experiencing some of the largest changes in its history as it undergoes a plethora of expansion and modernisation programmes to allow it to meet increasing local demand and compete on world markets.

Over the last 10 years, a number of new refineries have been built and others upgraded to allow the production of ultra low sulphur fuels. Despite some recent slow down, in the light of current crude prices, these projects are expected to continue to 2020 or beyond. These changes in the Middle East refining industry will have a significant impact on the current diesel export flows.

By 2025 the Middle East is expected to become the largest diesel exporter in the world.

All of this activity increases the potential for the region to export finished diesel to other markets including Asia and Europe and, depending on market conditions, to the US. However, these opportunities are creating challenges, as refineries work to meet the varied specifications of their global customers. Additives are now playing an increasingly significant role in helping the refiner to meet the specifications requirement of the export destinations.

To enter the export market the refiner must first gain a good understanding of the specifications required by the potential markets and make a decision about which can best be targeted. However, meeting specifications is only part of the story - export destinations are also economics driven, which means some will be far more attractive than others.

Most US states adopt ASTM D975 as their diesel fuel specification. Although seven different grades are specified, only two grades containing a maximum of 15 ppm sulphur (S-15) are of interest as export fuels. The first S-15 grade is No. 1-D, which is a special purpose light distillate for automotive diesel engines. The second is grade No. 2-D, a general purpose middle distillate, which can also be used in non-automotive applications.

However, ASTM D975 does not provide all the information that a refinery needs to produce diesel for export to the US. Lubricity targets are clear, being set at 520 μm High Frequency Reciprocating Rig (HFRR) average wear scar diameter at 60°C. But, ASTM D975 does not specify cold flow requirements; rather it provides guidance (Appendix X5) to help assure successful vehicle low temperature operability.

The ASTM believes it is unrealistic to specify low temperature properties that will ensure satisfactory vehicle operation at all ambient conditions.

Instead, they suggest that the fuel supplier and purchaser should agree appropriate low temperature properties to ensure that the diesel supplied is suitable for the intended use. A number of tools can be used to help reach this agreement including the Low Temperature Flow Test (LTFT) and Cold Filter Plugging Point (CFPP) test, which are used to estimate vehicle low temperature operability. The tenth percentile minimum air temperatures can be used to help to estimate expected regional target temperatures for use with cloud point, LTFT and CFPP test methods.

However, any diesel fuel transported in the US fungible pipeline system must meet the specific pipeline company specifications. Typically these are similar to ASTM D975 with the addition of fuel stability, visual haze rating and corrosion performance requirements. To assure trouble-free transport, pipelines specify both fuel cloud point and pour point. Typically this requires the cloud point to be below -9°C and pour point to be below -18°C in the winter months. A relaxed maximum specification of -7°C cloud point and -12°C pour point is set for the summer months.

In Europe, automotive diesel fuel quality is controlled by the European Standards Organisation (CEN) under the EN 590 specification, which provides a range of both temperate and Arctic grade options.

Potential exporters to Europe should be aware that local specifications, including off-taker requirements, exchange agreements and sometimes tax incentives, can cause the EN 590 specification to be superseded.

The lubricity requirement is clear and consistent for all grades being set at 460 μm HFRR average wear scar diameter at 60°C. However, the cold flow requirement is more complex. Cloud point is not specified in EN 590, but often forms part of exchange agreements and country specifications, and must be considered by fuel exporters. CFPP is set by individual countries according to a standard table at levels from +5 to -20°C. But, having said that, local agreements can and do enforce more severe specifications, for example, Germany’s winter requirement of -22°C.

In Asia Pacific, the market lacks the degree of coordination seen in the US and Europe. However, the Singapore spot market, where both cold flow and lubricity requirements are clearly defined, can provide some consistency for exporters to target. Here CFPP is set to -5°C and lubricity to 460 μm HFRR average wear scar diameter at 60°C. While other specifications exist in this region, targeting the Singapore spot market specification allows refineries to take advantage of the wide customer base this opens up.

With cold flow and lubricity requirements being the two key performance parameters that must be considered, it is important that the export refiner has some knowledge of the additives that will be needed to meet them.

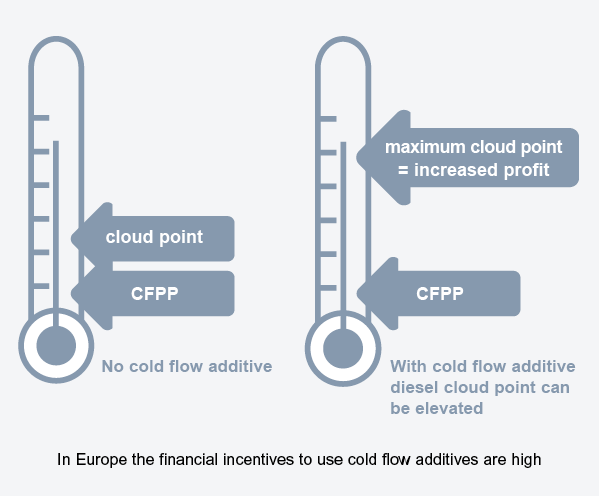

Refineries use cold flow additives to meet CFPP targets and to improve refinery economics. Without cold flow additives the cloud point and CFPP of a diesel fuel are quite close together.

The use of cold flow additives widens the gap between the two parameters, allowing refineries to raise cloud point and maximise the economics of diesel production. However, it is not possible to expect every additive to provide an economic advantage.

The additive must be precisely matched with the alkanes that precipitate when the fuel is cooled below the cloud point. Without this match the additive may fail, which at best will result in poor economics.

Selecting the right cold flow additive is typically done through a complex laboratory testing process that requires representative diesel samples to be available.

However, this test-based approach is impractical for refineries going through upgrades and for new builds, so a more speculative approach needs to be taken in collaboration with a knowledgeable and experienced additive supplier at an early stage in the project.

Vehicle manufacturers see lubricity as a critical parameter because certain parts of the engine depend entirely on fuel for their lubrication.

A fuel with poor lubricity will not meet HFRR specifications and can cause catastrophic levels of wear to critical pump components resulting in fuel pump failure.

The lubricity of diesel fuel is defined by its ability to prevent or minimise wear in these critical areas, and is a function of the way it has been refined and blended. Hydrotreatment to remove sulphur and the blending of diesel with kerosene to improve low temperature performance both lower the fuel’s lubricity.

A fuel with poor lubricity will not meet HFRR specifications and can cause catastrophic levels of wear to critical pump components

The use of lubricity additives is the lowest cost way of meeting specifications and retaining vehicle performance.

Although the addition of fatty acid methyl ester (FAME) is also effective, it is more expensive than a lubricity additive, unless the use of FAME is mandated as part of the diesel composition.

The key parameters to consider when selecting a lubricity additive include:

A key element in the selection of both lubricity and cold flow additives is the balance that needs to be struck between supply security, storage and handling. These additives are often subject to long supply chains – in some cases as long as 60 days. In addition, supply routes can be subject to trade restrictions and unplanned delays, which mean securing supply from a local company can have a high value.

Before supply can be arranged the refinery must consider how it will store the additives locally. This can be split between the additive supplier’s facilities and onsite refinery facilities. However, it is important to ensure the tank sizes take account of the length of the supply chain, the additive treat rate and how much diesel will ultimately be produced.

In our experience, additive storage facilities, handling requirements and injection methods need to be agreed early in the design phase to avoid issues during project execution.

Pulling these factors together to strike the best balance between supply, storage and handling for each individual refinery is critical to achieving successful application of cold flow and lubricity additives.

The export of diesel fuel can be complex because cold flow and lubricity specifications are not straightforward. However, careful use of additive technology is the most effective and economic way to meet HFRR and cold flow specifications, but their use needs to be considered at the refinery project design phase.

Careful use of additive technology is the most effective and economic way to meet HFRR and cold flow specifications

Working closely with a knowledgeable additive supplier such as Infineum, with experience of refinery start-ups in the Middle East and who has a local manufacturing capability, can contribute to the success of the project and help to minimise implementation issues associated with the use of cold flow and lubricity additives.

Sign up to receive monthly updates via email