Lubricant trends

Advances in automotive lubricant design

04 March 2025

Please note this article was published in September 2012 and the facts and opinions expressed may no longer be valid.

01 September 2012

China still presents the biggest growth opportunity

The best future opportunities for growth in the automotive and lubricants markets lie in the so called BRIC economies; with China leading the way Insight examines the country’s huge potential for growth.

China, the world’s second largest economy, is currently trying to maintain steady economic growth and social stability in an increasingly uncertain world economy. While its economy is no longer on such a vertical takeoff trajectory the country still presents the biggest growth opportunity for the automotive and lubricant industries.

China’s real gross domestic product fell by just over 1% last year dropping back into single figures. These results led many economists to ponder the question ‘just how fast will China slow?’

The country’s economic policymakers are committed to continued growth in 2012, despite what they call an ‘extremely grim’ global outlook. Official statements indicate that China will introduce ‘fairly prudent’ policies so that consumer prices and the currency remain stable.

This slowing of the economy is essential to stem rising inflation and, if they continue to get the balance right, the economy will keep growing at a good pace.

Last year the rate of new vehicle sales slowed as government incentives came to an end. However, as Mr Zhao Jiang, Vice President of Technology, Sinopec Lube Oil Company, explains vehicle sales remain healthy and the vehicle parc is still growing.

“At the end of 2011, automobile sales in China for the entire year were in excess of 18 million units. With this, our automobile ownership has reached 224 million units at the end of the year, comprising more than 100 million cars.”

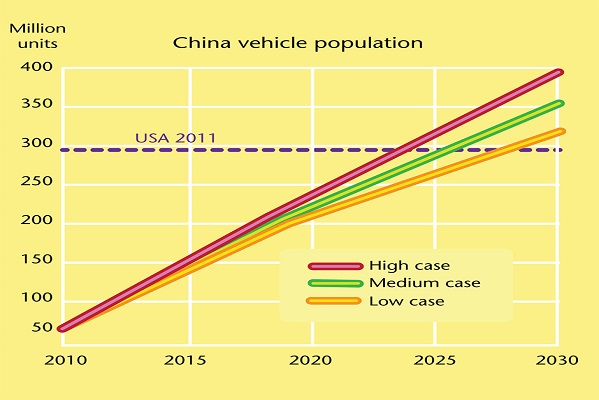

These results prompt industry commentators to forecast that China will become the world’s largest vehicle market in the next ten to fifteen years, although car density per capita will remain substantially lower than in the US or Europe.

“Vehicle production and sales are expanding at an unprecedented rate,” confirms Limin Fu, Managing Director of Infineum China and China Venture Manager. “This growth is expected to continue over the next 10 years, with light-duty vehicle sales in China expected to reach 30 million per year by 2020.”

The Government has reiterated its commitment to boost imports in order to balance trade. This move will be popular with European and US vehicle exporters, who have been unhappy with the trade surplus China has been running.

But, in the same breath, China’s Commerce Ministry has announced a tax on imports of small cars from the US. This anti-subsidy and anti-dumping duty, expected to last for two years, will affect many US-based car makers including General Motors, Chrysler and Ford.

The US has complained to the World Trade Organization and the Obama administration has said it will continue to fight to ensure that China does not misuse its trade laws and violate its international trade commitments to block exports of American-made products.

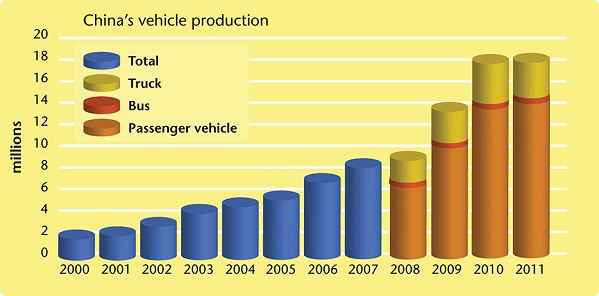

To meet the State Council Development Research Centre’s 2015 market demand estimation of 25 million units, China has steadily increased vehicle production. In the passenger car market, local brands account for almost 30% of the fourteen and a half million cars produced last year.

Rapid expansion is encouraging foreign automakers to open new manufacturing facilities or to form joint partnerships with existing Chinese carmakers.

General Motors (GM) and Volkswagen (VW) are the strongest performing foreign brands in China – accounting for more than 30% of new vehicle sales.

GM has posted record sales in China for the first six months of 2012, with almost 1.42 million vehicles sold, an increase of 11%. Kevin Wale, President of GM China Group, said in a statement, “Despite signs of slowing economic growth in China, demand for GM products rose in all key segments in the first half of the year. We expect sales growth to remain steady in the second half, driven by demand in China’s interior provinces.”

Earlier this year VW Group extended its commitment in China by signing a contract with its partner, SAIC Motor Corporation, to build a new plant in western China. It also announced that it had agreed to extend its joint venture with China First Automobile Group Corp (FAW) for a further 25 years.

China is reportedly the Group’s largest market, with sales last year totalling 2.26 million. The two VW Chinese joint ventures, Shanghai-Volkswagen and FAW-Volkswagen, have stated that they plan to invest more than $17 billion by 2016, mainly in new product development and expanding environmentally-friendly production capacity.

Dongfeng Motor Co, Nissan’s joint venture (JV) in China is also an active player. The JV recently announced an $800 million investment in a new manufacturing facility, which by 2014 will have an annual production capacity of 150,000 vehicles.

In a press statement Hiroto Saikawa, Executive Vice President of Nissan Motor Co. Ltd. said, “China is our largest market today and will continue to be one of Nissan’s most important engines of growth... the Dalian plant in the northeast will be an important addition to our local supply base to realise our sales target of two million units in China by 2015.”

With all this investment activity we can expect to see more vehicles on China’s roads, which means the challenges of increased pollution in major cities requires action.

For light passenger vehicles the Chinese Government has introduced National IV emission limits nationwide which are equivalent to Euro IV/4. Implementation started in January this year although, with the exception of some major cities, the fuel supply is still Euro III quality. For commercial vehicles, implementation has been delayed indefinitely owing to these fuel quality issues.

As emission standards evolve oil marketers have an opportunity to promote high quality, long-drain lubricants to meet the needs of advanced hardware technologies.

It is essential to have a firm understanding of the quality of fuel in China as this need to cut emissions becomes increasingly important.

A recent Infineum survey of fuel quality from refineries in four of China’s regions revealed significant differences in the quality of the fuels leaving the refineries.

Sally Hopkins, Infineum Fuels Development Technologist, explains, “The crude oil source and the refinery set up varies considerably from refinery to refinery and from region to region. We found the resulting fuels differed considerably in composition. Sulphur levels in some of the fuels were very high, which could be a problem as tighter emissions standards are implemented.” The survey also highlighted opportunities for improving refinery economics.

Analysis of the fuels indicates that some may have been blended with significant amounts of kerosene to improve cold flow performance. “There is an opportunity to release the kerosene back into the more profitable aviation pool, which would improve refinery economics,” explains Hopkins.

Clearly the refineries would need an alternative method to improve cold flow characteristics. “Significant inter-refinery variations in both cloud point and wax content mean it is essential for refineries to work with an additive supplier to understand the best way to treat their fuels to improve quality and maximise profit.”

As the established lubricant markets of Europe, North America and Japan flatten out in terms of volume and the world-wide lubricant market grows by only one or two percent each year, the challenge for our industry is to sustain success and make sufficient returns on investments.

The best future opportunities for lubricant growth are undoubtedly Brazil, Russia, India and China - the so called BRICs.

In China, the increased vehicle population and aggressive emission control upgrades are helping to position the country’s automotive lubricant market as potentially the highest growth market in the world.

“The driver for lubricant volume growth in the east can almost be summarised in a single word – China,” says Chris Locke, Infineum Crankcase Business Manager. “In the space of one decade it has gone from being a relatively marginal producer of vehicles to being the largest producer in the world by a factor of two.”

Many foreign oil companies have already established local blending and in some cases marketing operations – although most foreign imports are marketed through distributors. These imported oils are successfully competing in the less price sensitive premium quality segments of the market.

Currently state-owned Petro China and Sinopec dominate the market while Shell is the biggest global oil major in China, followed by ExxonMobil, BP and Chevron.

China currently has a big market for low tier oils, and Group I base stocks have more than 60% market share.

Group II base stocks are used mainly in mid-tier oils and have about a 30% market share, while Group III and IV base stocks, which are only used in top tier oils, currently account for less than 10% of the market.

We expect the quality of lubricants to improve, although there will still be a big gap compared with US and Europe.

Mr Fu highlights some of the drivers for this lubricant quality upgrade. “The vehicle parc increasingly comprises new and more sophisticated cars, vans, buses and trucks. Foreign OEMs are introducing their latest models and technology.

Government and consumers are focusing on fuel economy and emission issues. And, as the availability of high quality Group II and III base stocks improves in Asia Pacific, more marketers are focusing on selling higher quality lubricants for better margins.”

China’s national lubricant specifications are similar to the API system and lubricant companies tend to follow API specifications.

In 2009 almost 70% of passenger car oils were API SJ or below – a picture that we expect to change in the coming years.

“Oil quality level is primarily driven by two factors: OEM recommendations, and also oil company brand positioning,” explains Locke. “If we look at the China market, the very rapid rise in the number of new vehicles in that market has driven a very rapid quality upgrade aligned with meeting the requirements of those new vehicles.

By the middle of this decade we expect API SL lubricants to become the largest market segment.”

“The rapid growth of the vehicle population will naturally lead to lubricants and fuels growth,” confirms Mr Fu. “In addition to the increase in absolute volume, lubricant quality levels in China are also rapidly improving.

Many industry commentators forecast that by 2018 China will be the world’s largest additive market.”

Fuel economy is also receiving some attention. Mr Zhao explains, “Consumption figures show that the demand for Chinese petrol and diesel from such a huge consumer group exceeds 150 million tonnes. If we are able to slightly raise the fuel efficiency of each automobile, this reduction in energy consumption would do wonders for China’s economic development.”

The China State Council has stated that the country will try to lower average fuel consumption of automobiles produced in 2015 to 0.069 litres/km (34.2 mpg) and those produced in 2020 will see average consumption drop to 0.05 litres/km (47 mpg).

In order to achieve these goals, Phase III of China’s fuel efficiency legislation for light-duty passenger vehicles was introduced in January this year. Locally manufactured vehicles must exceed the required fuel economy limits before they can be put on the road, while imported vehicles will be subject to additional taxation if they do not comply.

To meet tightening legislation it is likely that lower viscosity oils will increase their market share.

This view is supported by Mr Zhao. “In terms of lubricant formulation technology, after fulfilling the prerequisite of automobile lubrication needs, low viscosity could be a trend.”

“We predict that SAE 15W-40, which is mostly used in China today, will gradually be replaced by SAE 5W-30; and there might be exceptional cases of automobiles making use of SAE 5W-20. By reducing fuel consumption through lowering viscosity, but at the same time ensuring adequate lubrication, we can simultaneously raise fuel efficiency and reduce emissions.”

Improving the fuel economy of conventional vehicles is not the only way China plans to improve its green credentials.

In April, China’s State Council said that the country will move faster to develop its energy-saving and new-energy vehicle industry to ease pressure on resources and the environment. Prioritising purely electricity-driven vehicles will be China’s major strategic route.

The State Council says that China’s accumulative output of pure electric and plug-in hybrid electric vehicles will be half a million by 2015 and 5 million by 2020.

In its quest to become the world leader in green car production the Chinese government is pushing foreign automakers to share their electric vehicle technology with local OEMs.

For vehicles made in China, a subsidy that amounts to about $19,000 per car is on offer. This strategy has encouraged western OEMs, including GM and BMW, to form joint ventures with local OEMs – effectively moving a substantial part of their future electric vehicle development to China.

In order to make sure consumers warm to the new electric vehicles, China has made significant investment and now boasts the most extensive charging facilities in the world.

It is clear that the best future opportunities for growth in the automotive and lubricants markets lie in the BRICs; with China leading the way. However, it is important to watch the other emerging economies, like Indonesia and others in Asia, which are also showing very attractive growth rates of more than 5% per annum.

Infineum has a long standing commitment to the Asia Pacific region and is working to ensure it can continue to meet the needs of its customers.

“We already have a truly world scale facility in our Singapore manufacturing plant on Jurong Island. We have also announced our investment in a new salicylates manufacturing facility and will continue to assess the needs of our customer base in the region,” explains Locke.

“As we look to the expansion of our business in the east we have undertaken a number of studies with both OEMs and customers to identify the size of the market. Infineum is fully committed to meeting these projections and has plans to build its supply capability accordingly,” Locke concludes.

Sign up to receive monthly updates via email