Fuels

Reported sludging incidents rise

04 November 2025

10 December 2024

Enhanced fuel solutions support maritime industry decarbonisation ambitions

As the International Maritime Organization (IMO) firms up on its decarbonisation ambitions, towards a net zero 2050, the maritime industry is looking for the best ways to cut greenhouse gas emissions. Infineum Fuels Technologist, Frank Simpson, explores the future fuel options, assesses the challenges they present to the industry and highlights the work Infineum is doing to overcome some of the technical issues associated with the use of methanol to help it become a more viable marine fuel option.

Major engine manufacturers worldwide are investing heavily in sustainable transportation solutions, many focusing on electric vehicles (EVs), hydrogen fuel cells, and biofuels to reduce emissions. Innovations in engine design, hybrid technologies, and the use of sustainable materials are also key strategies being employed. Additionally, collaboration with governments to develop necessary infrastructure, such as charging stations, is crucial for the transition to greener transportation options.

A multi-fuel, multi-technology approach aims to address the pressing challenges of climate change, while also meeting consumer needs for reliable and affordable mobility solutions.

This presents a huge challenge and raises the question - how can future transportation be sustainable?

The issue is further complicated in non-road industries, such as shipping, where electrification using batteries is more difficult. This is mainly down to challenges related to scaling up battery size, the difficulty of bringing electricity to vessels for charging, ship weight constraints and scarcity of critical raw materials needed for large battery production.

The barriers to electrification mean the production of internal combustion engines capable of running on sustainable fuels is essential for the maritime industry.

Exactly which fuels still remains to be seen, as there are a wide range of options being considered across the industry, all with their advantages and challenges. The leading candidates in this area appear to be methanol, ammonia and hydrogen. In addition, there is a strong interest in cashew nut shell liquid (CNSL) and bio-oils (derived from pyrolysis of waste products). However, many of these sustainable fuels will face production and supply issues in the first half of this century, leading most forecasters to suggest there is unlikely to be one lead candidate, rather that the marine industry will adopt a mix of these fuels by 2050.

Firstly, it means huge uncertainty moving forward. Many factors, such as government and IMO regulations, which have seen numerous changes in the past decade alone, are out of the OEMs’ control. Production of green fuels may not meet demand, which could cause their uptake to slow and, because fuel prices are very unpredictable, the economics are especially difficult to plan.

Secondly, it means they need to act today to find technical solutions to enable the use of these new fuels and to ensure they can meet market demand in the future. This has been a huge issue for the industry and significant investments in R&D have been necessary to engineer innovative solutions in these future fuels areas. With many different fuel options still being considered, and no clear picture on which will dominate and by when, OEMs are having to run simultaneous research projects across several fuel areas.

The technical challenges associated with these new fuels fall into three main categories:

Combustion. The extent of which depends on the fuel itself. For example, when compared to diesel fuel, ammonia and methanol are harder to ignite, so a combustion solution including a pilot fuel such as diesel may be needed. In contrast, hydrogen ignites more readily, which causes issues with pre-ignition requiring an alternative solution, such as a specialised engine oil for hydrogen fuel.

Corrosion. This will also differ between the fuels being used, the metals in contact with them and environmental conditions, such as exposure to air or nitrogen blankets, likelihood of water being present and storage temperatures and pressures. This makes finding a cost-effective solution that protects the entire engine and delivery system in all conditions a massive challenge for OEMs. The concern here is that incompatible materials may corrode over time and the metals could become weaker, and break under stress, resulting in severe damage to the engine.

Lubricity. Future fuels all have drastically different lubrication qualities compared to the diesel being used in the field today. While most parts of the engine are lubricated by the engine oil, there are still some areas in fuel injectors and pumps that rely on the fuel to lubricate metal-on-metal contact. The significant sulphur reductions in diesel, mean almost all diesel fuel today includes lubricity additives to compensate for the loss of natural lubricating properties. In cases where the fuel has not provided adequate lubrication, catastrophic damage and wear to the injectors have been observed, causing parts failure within just a few thousand kilometres.

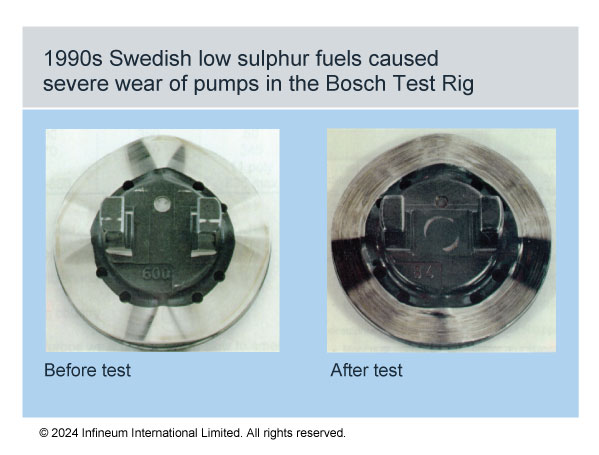

In the context of lubricity, the most widely known example of a drastic change to the fuel quality was enforced in Sweden in the 1990s in an effort to combat the emissions of harmful sulphur-containing pollutants. After a low sulphur limit was imposed on the diesel being used, a sharp rise in engine failures due to damaged fuel injectors occurred. This was because the heteroatoms, such as the sulphur in the fuel, had provided the lubricity between the metal surfaces and protected these engine parts. When they were removed, the lubrication was no longer provided and the engines were damaged as a result.

The High Frequency Reciprocating Rig (HFRR) test was developed to determine the lubricating quality of the fuel and was validated using a +1000 hour Bosch pump test rig. This short HFRR test, using a steel disc and ball bearing with a 200 g weight suspended load to generate a wear scar, was added to diesel fuel specifications in the automotive and marine industries around the world and has been in use for decades. Adding it to the fuel specification meant that the fuel provider, rather than the engine manufacturer, had to ensure the fuel being produced would not damage the engine.

The marine industry has fuel specifications that are used today for conventional fuels such as diesel and heavy fuel oil (HFO). This does not stop some fuel providers from supplying low grade fuels though, and issues with fuels are commonplace. Ship operators often have to clear sludge from their HFO tanks, purifiers and filters, as standard practice. As a result, OEMs like to ensure robust performance across a broad range of fuels that meet the relevant specifications, in order to ease the concerns of the ship operators. The issue with the fuels of the future is that this will be a very difficult task.

Sustainable fuels will bring greater variation in their chemistries and constituents, as they will be derived from a wide variety of sustainable feedstocks, making consistency and predictability of the fuel especially challenging.

Some industry working groups are already starting to outline specifications for future fuels. For example, ISO TC28/SC4/WG18 has published an initial specification for methanol for use in a marine engines. One of which (Marine Methanol A) contains a lubricity based requirement. Further specifications for other fuels are also expected to be produced before 2030 in order to support IMO decarbonisation ambitions.

It remains to be seen if OEMs will be comfortable to accept these fuel specifications and to hand over some of the responsibility for safe engine operation to fuel producers. If not, and they continue to search for engineering solutions to the challenges, it will have a massive impact on the rest of the industry. Apart from costing the OEMs many more millions of dollars and several years in research, it will also delay the adoption of future fuels for global shipping, which in the short term will no doubt result in higher greenhouse gas (GHG) emissions too.

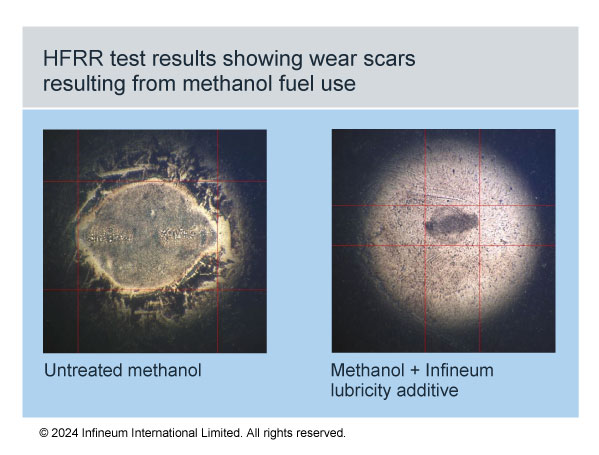

Infineum has already made great strides to enable the adoption of future fuels, especially green methanol. We have developed a novel test method specifically tailored for methanol. This method builds upon the HFRR test, incorporating adjustments to account for methanol’s unique characteristics, which has since been adopted for a Marine Methanol Fuels Specification. Untreated methanol is dry and causes a much more severe wear scar than on-spec diesel in this test. Having a test method that allows the lubricity of the methanol to be determined is the first step in solving this complex problem.

Our research and development teams have meticulously explored methanol-compatible lubricity, corrosion and combustion-enhancing additives and have successfully found additive solutions in all of these areas.

Infineum has a new lubricity additive for alcoholic fuels, such as methanol and ethanol, ready for 2025.

This additive will be the first of its kind, and will be perfectly timed to support the early adopters in the industry with their transition to green fuels. Furthermore, the additive will be compatible with retrofit vessels, achieving enhanced lubricity performance compared to on-spec diesel with less than 1000 ppm treat rate.

It is a great example of how Infineum is able to collaborate with OEMs, fuel providers and industry working groups to find viable solutions to the complex problems facing the marine industry today. With 3% of global GHG emissions currently resulting from shipping, and the need for sustainable transportation growing every day, technical solutions to key challenges, such as methanol lubricity, could have a huge impact on the decarbonisation of the industry.

Sign up to receive monthly updates via email