Commercial vehicles

PC-12 on track for 2027

26 August 2025

Please note this article was published in March 2014 and the facts and opinions expressed may no longer be valid.

11 March 2014

Is the market for natural gas vehicles finally opening up?

With changes in the natural gas world, Ryan Welton, Infineum Market Manager for Gas Engine Oils in EMEA, gives Insight readers an update on the future of gas as a transport fuel.

Only three years ago, an Insight article on gas engines commented on the potential for gas in mobile applications. At the time, although the industry understood the significant benefits gas could bring to the transport market, it really seemed that there were just too many barriers to its broad application.

How things can change. Today, gas offers the same benefits: it’s clean, in abundant supply and economical, but the investment being made in refuelling infrastructure means it is now becoming more viable for use in mobile applications – like cars, trucks and buses.

To date, there has been only a slight increase in the number of gas vehicles on our roads – mainly because the barriers of patchy infrastructure, high vehicle costs and fairly lengthy return on investment period are only just starting to be addressed.

Currently, of the more than a billion vehicles in use today, only some 18 million are powered by gas – 95% of which are light-duty vehicles. But, forecasters expect reasonable growth and suggest that by 2020 there could be over 35 milion gas vehicles – with trucks and buses accounting for around 9%.

By 2020 35 million gas vehicles are expected to be in use

There are four main fuels that are being used in transport: compressed natural gas (CNG), liquefied natural gas (LNG), liquid petroleum gas (LPG) and dimethyl esther (DME). Each presents different challenges.

| Fuel | Challenge |

|---|---|

| CNG | Compression to 3,600 psi (250 bar) means longer filling times |

| LNG | Chilling to minus 160°C means LNG tanks slowly vent methane into the atmosphere when the truck engine is not in use |

| LPG | More costly than LNG and CNG |

| DME | Still in development |

Right now, CNG and LNG are most commonly in use, with the decision on which to implement tending to be fleet and region specific.

We are currently seeing a strong regional split, linked to infrastructure, with Europe and North America moving towards CNG vehicles whilst China prefers LNG.

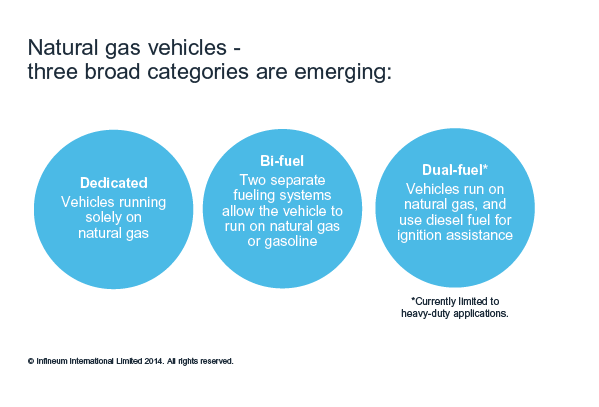

In terms of the types of natural gas vehicles (NGV) on our roads, three broad categories are starting to emerge.

In addition, in the large engines market, aftermarket conversions are a popular option for many fleet owners, who can be reticent to invest in brand new vehicles.

Retrofitting moves them across to dual or bi-fuel systems, which can alleviate concerns about the operating range of their vehicles and reduces initial capital expenditure. These vehicles typically retain their original fuel tank and are retrofitted with an additional, smaller-capacity natural gas tank.

In the past, the consumption of gas in the transport sector has mainly been in the non-OECD regions of Asia Pacific, the Middle East and Latin America, where it has been motivated by the desire to reduce oil import dependency, increase utilisation of domestic gas and improve urban air quality. However, the International Energy Agency mid-term report showed that the shale gas revolution has triggered strong interest in natural gas as a transport fuel in the United States.

Gas use in road transport represented 1.4% of global gas demand in 2012. The main driver for its growth in this sector is the sustained gap between the price of diesel and natural gas, as fleet owners look to reduce their fuel costs.

It appears that gas is now filling the gap in transport energy demand in preference to electricity – with natural gas vehicles now on the road in more than 80 countries.

The largest uptake of natural gas is in vehicles that return to base for refuelling each day, for example municipal refuse vehicles and buses. In North America for example 40% of refuse collection trucks purchased in 2011 were natural gas. In addition, gas is gaining popularity in locations with their own fuel infrastructure - such as airports - as they strive to improve their green credentials.

NGV still have barriers to overcome - higher initial purchase costs mean that despite reduced running costs of 20 – 25% per mile the average payback period is still in the region of three years.

Another issue is the current reduction in power. For example a natural gas fuelled truck might produce 330 horsepower (hp) compared to a typical 450 hp for the diesel equivalent – the loss of acceleration and reduction in pulling power is unattractive to many.

In our view, the growing number of OEMs investing in NGV is contributing to the health and competitiveness of the natural gas market, and now positions natural gas as a mainstream global alternative to diesel.

Natural gas vehicle barriers and drivers

It is not just in the ‘on-road’ sector that we are seeing a growing interest in natural gas - its economic and environmental benefits are also appealing to the railroad, marine and construction industries.

In the US, a number of railroad OEMs are currently running trials of natural gas powered locomotives. Recent figures from one Canadian firm compared the price of diesel and the natural gas equivalent as four dollars vs 43 cents – which clearly demonstrates the strength of the economic driver.

The marine industry is facing the challenge of tightening emission limits and the rising price of marine fuel, so is looking to both dual fuel and dedicated natural gas engines to meet these restrictions.

In the construction industry Caterpillar has announced it is aiming to provide natural gas fuel options for engines across its high horsepower lines for marine, rail, mining, earthmoving and drilling operations.

Many tractor and agricultural manufacturers, from John Deere in America through to Sinotruk and JAC in China, are also looking into natural gas versions of their products.

There was also recently a proof of concept flight in a natural gas powered aircraft – although there is no evidence that this will become mainstream in the near future.

All these markets will require the development of a robust infrastructure - perhaps the largest hurdle to the potential success of natural gas as a transport fuel. Currently the different regions show a high degree of variance in their capacity.

The right balance must be set between having enough refuelling stations to make it attractive for consumers to switch to natural gas, and having enough consumers to make it worthwhile for companies to invest in refuelling stations.

In North America there is a rapid increase in both private and public natural gas stations in so called ‘corridors’, which provide high mileage routes for NGVs.

Europe is a long way behind North America, while it has more refuelling stations, there is little ability for NGVs to follow major routes across Europe. To address this situation the European Commission has launched the ‘LNG Blue Corridors’ and CNG ‘GasHighway’ projects.

In Asia, China has over 2,500 filling stations - second only to Pakistan, which had 3,300 in 2011. China’s high number of refuelling stations has been driven by the desire to reduce oil import dependency, increase the use of their natural gas reserves and improve urban air quality.

Market research and consulting company, Navigant Research, suggests that by 2020 there will be 30,000 refuelling stations globally. Until 2015 a large proportion (about 40%) of the installations will be in North America – which will dramatically increase the viability of a NGV fleet in this region.

All the market studies and OEM activity indicate that natural gas has a future as a transport fuel. And, while early gains are likely to come in the medium and heavy-duty vehicle markets, there are also significant potential gains to be made in the marine and rail sectors.

To guarantee growth, many fleet owners say they need long-term commitments from regional governments on tax concessions. The cost benefit of natural gas vs diesel and other alternatives is essential to develop individual business cases, with any major change in the cost balance likely to reduce the anticipated growth.

Politically the benefit of a larger percentage of the vehicle parc relying on domestic gas reserves as opposed to imported oil is attractive to many governments, which means continued support is likely in economies who are utilising or exploring traditional or shale gas reserves.

We expect the use of natural gas as a transport fuel to increase in the coming years, but real success will depend on pricing of gas and NGVs and continued government support.

Infineum is following the direction of this developing market with interest as natural gas engines pose lubrication challenges. The key difference between NGVs and traditional gasoline and diesel engines is, as its name suggests, that the fuel they run on is 100% gaseous.

This means the fuel does not need to be atomized, and combustion is more efficient and cleaner – resulting in no soot production and less unburnt hydrocarbons. However, the higher combustion temperatures lead to higher oxidation and nitration of the engine oil, which can result in corrosion and deposit problems. In addition, gaseous fuel does not provide any valve lubrication, which means these engines rely on ash from the engine oil to protect them.

Key differences between NGVs and traditional gasoline and diesel engines

We are clearly entering an exciting time in the development of gas engines for mobile applications. Infineum is working closely with OEMs and lubricant companies to develop oils that are specifically designed to provide the base number retention, valve protection and nitration control that these engines demand.

Sign up to receive monthly updates via email