Base stocks

The latest on base stock trends

30 September 2025

Please note this article was published in September 2013 and the facts and opinions expressed may no longer be valid.

01 September 2013

Sustainable base stock production is gaining ground

Re-refined oils are taking a place in the base stock and finished lubricant markets. Insight talks to a number of industry participants about the future potential for these high quality sustainable mineral base oils.

Across the globe there are thought to be over a billion vehicles on our roads – that’s a lot of oil in use, and a lot of oil to dispose of every year.

With such an abundance of feed stock and a growing desire for sustainability it is no surprise that in recent years the re-refined industry has really taken off, which means larger volumes of these used oils are being collected and reused.

The first re-refining activities were carried out in Germany in 1921, and over the years the industry has developed its treatment technology from simple distillation over clay and sulphuric acid, to thin film evaporation with solvent extraction, through to the hydro-treatment process technology of today.

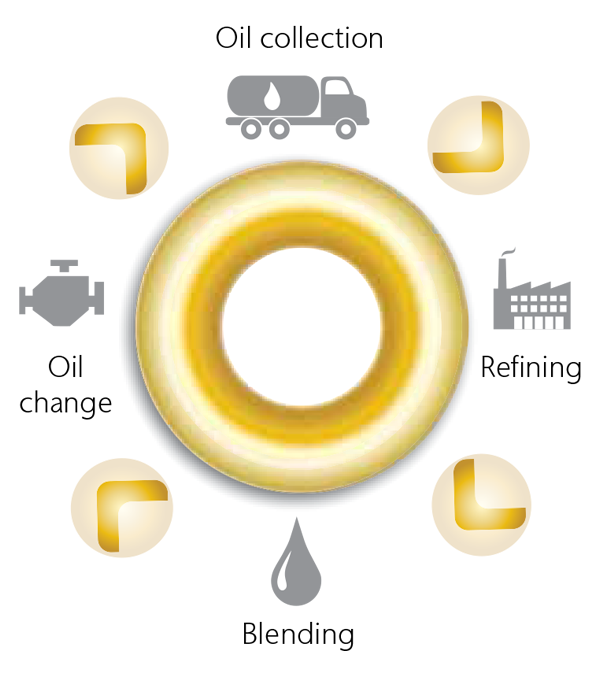

Re-refining is essentially no different from standard refining in that it takes a feed stock and processes it into a higher value stream through a combined physical and chemical transformation. What makes re-refining different is that the feed stock is a waste product.

Until recently most new re-refinery announcements have been in North America. But now we see a fairly steady stream of new facilities coming on line across the globe.

Although North America (NA) still leads the way in re-refining capacity, Europe is expanding its production, while Latin America and Asia Pacific are also starting to open re-refining facilities.

However, these new plants are coming on stream at a time when virgin base stock supply is plentiful in most Groups and in most regions. This may slow the introduction of new plants and raises questions about the ability of smaller plants to be profitable.

It is likely that tax credits and feed cost advantages will be needed to make the use of these base stocks worthwhile in this oversupplied climate.

Currently in North America nine re-refiners have the capacity to process some 18,000 barrels/day of used oil, and re-refined base stocks are thought to represent 5-10% of the base stock used in the region.

“Re-refined base oils have been around and in commercial use in NA for over 20 years,” says Steve Haffner, Infineum Crankcase Market Manager. “Infineum completed its first program with a certified ILSAC GF-1 product using Safety Kleen base stock, and we have seen continuous improvement in the quality and performance capability of these stocks ever since.”

Using the latest technologies these plants can produce Group II type materials profitably, while being consistent with ecological contributions towards a more responsible use of fossil resources.

Safety Kleen, the world’s largest re-refiner, collects some 200 million gallons of used oil annually, which it turns into high quality base oils at its two re-refineries in East Chicago and in Breslau, Ontario.

The company is also in the finished products market, blending its EcoPower® passenger car and heavy-duty engine oils at its 20 million gallons per year facility.

“We’ve been re-refining for more than 20 years so we have the most experienced people and the largest oil collection network in North America.”

Curt Knapp, Safety Kleen Executive Vice President, Marketing and Oil Re-refining Sales

In Safety Kleen’s view, the demand for low NOACK base oils will increase, especially if the PC-11 NOACK for SAE 10W-30 is set at 13 maximum as proposed.

Another major player in NA, Universal Lubricants, collects over 40 million gallons of used oil each year from across several states. Its 12 million gallon re-refinery in Wichita produces Group II base oils for direct sale or for blending to manufacture its ECO ULTRA premium engine oils, hydraulic oils and automatic transmission fluids.

“Our re-refined base oil and finished lubricant products answer a lot of green questions,” says Rick Palmore VP of Sales at Universal Lubricants. “They not only help the environment, conserve energy and preserve natural resources but also, they perform at the highest standards demanded in the industry.”

According to automotive and industrial lubricant producer Valvoline, American cars and trucks use more than three billion quarts of motor oil each year.

The company says if every American switched to recycled motor oil, it would annually save 400 million gallons of crude oil. In 2011 the company launched its NextGen motor lubricants, which contain 50% re-refined base oil and exceed all API certificates.

“We see re-refining as being a long-term part of Valvoline’s portfolio of base oils, and becoming a more significant player in the base oil market globally.”

Thom Smith, Valvoline Technical Director

In 2008 the European Union ‘Waste Directive’ provided a formal advantage to re-refiners. The directive set out a hierarchy of preferred practices of waste minimisation and disposal, putting recycling top of the list.

Waste incineration of oil is not considered a form of recycling, but a form of energy recovery and more stringent quality limits have been applied to incineration, which are intended to give a strong boost to re-refining throughout the region.

“Used oil is a hazardous waste. Our advanced technology allows us to recycle it and produce a re-refined product equivalent to a virgin base stock.”

Giulio Polimeni, Viscolube Product Technical Manager

“Even though we have the European waste directive on recycling, says Viscolube’s Giulio Polimeni. “Some European countries still allow used oil or related products to be burnt, which not only threatens the environment, but also the regeneration industry – that’s the major challenge to our industry and to sustainable lubrication.”

Generally, the industry believes that more time and more lobbying are needed to boost production volumes – but despite this scepticism re-refined does seem to be catching on.

The industry players we talked to told us that key drivers for market growth in Europe include:

Currently about 40-45% of fresh lubricants sold in the European market is collected as used oil and fed into some form of recovery, with some 40% of this being sent for re-refining.

There are 26 re-refining plants in Western and Central Europe, with a used oil treating capacity estimated at 1.3 million tons per annum (TPA) of used oil feed stock.

From this 0.85 million tons of re-refined base oil is returned to the lubricant market, mostly for use in industrial applications and the heavy-duty diesel (HDD) engine oil segment, in SAE 15W-40 based mineral formulations with quality ranging from API CI-4 to CF-4.

“The increased use of these low sulphur, high viscosity index and highly saturated base oils in Europe is driven by a desire to reduce formulation costs and by the ‘green labelling’ benefits they can bring.”

Yannick Jullien, Infineum EMEA Crankcase Market Manager.

In Germany, Avista and Puralube are two key players. Avista reports an annual recycling capacity of approximately 700,000 tons, and appears to be rapidly expanding its European operations through several acquisitions.

Puralube operates two recycling plants, with a total throughput of 150,000 TPA. Using its UOP-HyLubeTM technology it produces about 100,000 TPA of OEM approved API Group II/II+ base oils, and the company has plans for expansion.

“As well as optimising our production we also intend to increase capacity by building new refineries in Europe, USA and Asia. As I see things, the main limiting factors will be the availability of suitable feed stock as well as the collection of used oil,” says Dr Harry Wadle, Puralube Sales Manager.

Italian company Viscolube is a globally recognised re-refiner thanks to a patented process, which they sell worldwide. The company has two refineries, which produce around 100,000 TPA of re-refined base oils, and has plans to increase production.

“In my view there is currently not enough high quality re-refined base stock production to meet demand. Over capacity is related to the lower quality re-refined products. Our severe hydrogenation process allows us to obtain re-refined products with a quality comparable to or somewhat better than that of ‘virgin’ products derived from crude oil,” says Viscolube’s Giulio Polimeni.

Total and Veolia Environment added significant capacity to the French re-refined market this year with their joint Osilub used oil recycling plant, which uses the wiped-film vacuum distillation process ensuring high yields of base stocks for use in high-end engine oils.

The 55 million Euros investment has the capacity to process 120,000 metric tons of used oil annually – which is nearly 50% of the volume of used oil generated in France each year.

The re-refining presence in Eastern Europe is not well understood. However, in Russia the government has adopted a waste oil treatment regulation, which becomes effective in March 2014.

The regulation will penalise the disposal of used oil in waterways and landfills, stop it from being mixed with a number of finished products and prevent its combustion in power generation units. This is expected to give a totally new economic rationale for the use of waste oil in the region.

Demand for used oil comes not only from the re-refining industry, but also from heavy industry and shipping, where it is blended and burned as a cheaper fuel source.

“Over 1.4 billion gallons of engine oil are generated every year in the US alone,” says Safety Kleen’s Curt Knapp. “Unfortunately, a majority of that volume is burned for one-time energy use. As awareness and demand rise for sustainable solutions, it will be a change for the better.

Every 100 million gallons of greener re-refined engine oil consumed avoids over 650 million metric tons of greenhouse gas emissions – that’s equal to the carbon sequestered by growing over 19 million trees for 10 years in an urban environment.”

Curt Knapp, Safety Kleen

The demand for used oil as a fuel clearly affects the price of feed stock. Thus, when used oil prices go up or down, re-refinery economics can be impacted substantially.

Gerald Jackson VP Sales and Marketing at premium base oil distributor Renkert Oil told us: “Certainly building a re-refinery sounds like the right thing to do from an ecology standpoint and from a sustainability perspective.

But as more re-refineries are built, they’re competing for the better quality quick lube molecules and you would think that would drive up that cost and make it even more difficult to compete in an oversupplied market.”

Universal’s Rick Palmore says two main challenges for re-refiners pertain to feed stock. “The viscosity of the used oil collected today is dominated by passenger car engine oils, which consist of lighter viscosity base oils. This affects the amount of heavy base oil needed to support HDD applications.

The other challenge is around cost. As the used oil collection industry changes due to economy affected road programs, natural gas availability and collection logistics, pricing of our feed stock will always be a challenge.”

Another factor that affects the cost of the feed stock and the viability of the plant in all regions is the used oil collection process.

In NA obtaining feed stocks from used oil at quick lube shops is the ideal scenario, while used oil containing Polychlorinated biphenyls (PCBs), such as transformer oils, cannot be used. Other contaminants have also been found to shorten the life of the catalyst used in the re-refining process, which significantly increases production costs.

“They’ll [re-refiners] have to just run their plants very efficiently, and even more importantly, run their collection very efficiently,” Renkert Oil’s Gerald Jackson suggests. “That to me is a key part of how a re-refinery operates – having a very good and efficient collection capability at the plant.”

In Europe, the availability of public or private entities with the capabilities to collect waste oil and to make it available at reasonable costs to users varies significantly from country to country.

In regions where no local tax benefits or subsidies are in place to support re-refining vs. incineration the collection network is often under developed and the feed stock price is high. This means that the strong buying power of heavy industries may mean they have an advantage against re-refiners.

Clearly the well-managed collection of high quality used oil is key to efficient refinery operation.

We were keen to understand how the increase in the capacity of conventional Group II and Group III base oils might impact the future quality of re refined oils.

“As more Group II and III base oils are used in lubricating oils so the quality of the feed stock for re-refining improves. In our view, using appropriate process technology, it will soon be feasible to produce re-refined Group III type base oils.”

Harry Wadle, Puralube Sales Manager.

“Based on pilot plant test results, we could invest in an additional isomerisation step to facilitate the manufacture of real Group III base oils says Puralube’s Harry Wadle. “However, the real challenge for the re-refining industry remains market acceptance.”

Safety Kleen’s Curt Knapp agrees, “Yes, Group III re-refined base stocks can be a reality with a combination of ongoing improvements in feed stock, due to increasing presence of Group III and our re-refining innovation. We already produce a high-end Group II. And, with our scale and resources, we can collect better feed stock each year.”

“Research has demonstrated that these re-refined base stocks can produce high quality lubricants, such as ILSAC GF-5 and API CJ-4,” says Infineum’s Steve Haffner. “We have also seen these base stocks perform well in engine tests including the Sequence IIIG and in both passenger car motor oil (PCMO) and HDD field tests.”

Safety Kleen and Infineum have worked together to conduct a real-world million mile engine test in which two fully loaded, long haul service HDD engines were run on EcoPower® API 15W-40 CJ-4 engine oil.

“The oil change interval exceeded 40,000 miles and when we disassembled and inspected the engines at the end of the test there was no sign of distress anywhere, and the original cams met the visual guidelines for reusability,” says Safety Kleen’s Curt Knapp.

“But, despite repeatedly achieving excellent engine protection and cleanliness results in field tests, one of the key challenges is to continually increase awareness, understanding and acceptance of blended re-refined engine oils in the marketplace.”

On the PCMO side Universal and Infineum have run field tests in the harshest applications.

“The success of our current field tests in taxi cabs, rental cars and federal government fleets are proving the point regarding passenger car performance. At the same time the extended drain intervals we can offer our on- and off-road HDD customers prove that re-refined base oil can meet and exceed the requirements that OEMs demand,” explains Universal’s Rick Palmore.

In an industry looking for sustainable options, re-refined oils clearly have an increasingly important role to play. But, in our view, action is required to increase the pace at which these ‘green-oils’ move into a more mainstream position in the lubricants industry.

Not only is significant work needed to educate potential customers, but also investment in infrastructure, the introduction of tax incentives and a strong regulatory push are likely to be needed.

*Prior to 1999 work was undertaken by Paramins (the additives division of Exxon Chemical Company), which together with Shell Additives (a division of The Shell Petroleum Company Ltd and Shell Oil Company) formed the Infineum joint venture.

Sign up to receive monthly updates via email