Passenger cars

ILSAC GF-7 ready

08 April 2025

04 December 2014

Understanding the lubricant requirements of hybrid vehicles

Hybrid vehicles might account for only a small proportion of the global vehicle fleet but, as consumers look for improved fuel economy, their popularity is growing. Insight reveals the findings of New York City field trials, designed to assess the opportunities these vehicles present to lubricant marketers for specifically tailored lubricants.

As part of their overall strategy to lower fuel consumption and reduce CO2 emissions to meet current or projected requirements, OEMs have been looking at the electrification of the powertrain and other low emission technologies.

One option is hybrid-electric, where vehicles are driven by a conventional internal combustion engine and by the power from the electrical system. Features of hybrid electric vehicles (HEV), such as regenerative braking or stopping the engine during idle, can significantly improve fuel economy and lower CO2 emissions - making them increasingly popular with OEMs.

Toyota has been the market leader in this segment for some time. But now a number of large manufacturers are developing and launching HEVs because they see the technology as a good bridge until more advanced diesel and electric vehicles are fully developed.

However, the global uptake of HEVs is far from homogeneous, and OEMs still have work to do to gain acceptance of hybrid technology by consumers in many regions.

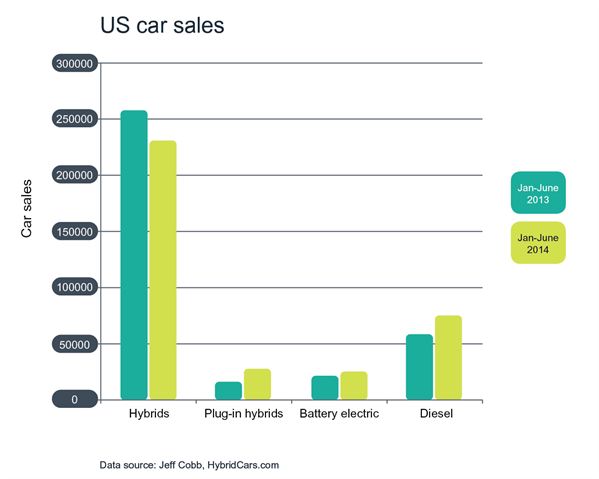

In the US for example, it has been a pretty good year for the passenger vehicle market as a whole, with total auto sales up over 4% for the first half of 2014. But a closer look reveals that while diesel, plug in and battery sales are all up, hybrid sales are down by almost 10% over the same period last year.

In Europe it has also been a good first half of the year, with total car sales growing by 6.2% - reaching over 6.8 million vehicles. Toyota reports sales in Europe of its hybrid models reached 75,623 units for the first half of the year. While this is a 17% increase versus last year, it represents just 1% of the European market.

China is the largest single-country car market in the world, and in the first half of 2014 new vehicle registrations were up 14.5% over the same period last year. China has high green transportation aspirations and to encourage sales the government has exempted hybrid and electric cars from its 10% purchase tax from September 2014 to the end of 2017. But despite these measures and increased availability, electric and hybrid cars together represented just 0.2% of the 11.7 million cars purchased during the first half of this year.

Although as a proportion of total new vehicle registrations HEV sales are still relatively small, every vehicle owner has the right to be sure that the lubricant they put in their vehicle will sufficiently protect the engine.

A distinguishing feature of HEVs is the ability to turn off the conventional engine when the power available from the electrical system exceeds that required to propel the vehicle.

The engine-off feature saves fuel and engine hours but also results in cooler operating temperatures of the internal combustion engine and increases engine stress through the more frequent starts of the engine.

These distinct operating conditions prompted Infineum to initiate a research project to determine the lubrication requirements of HEVs relative to non-hybrid vehicles. This understanding will then be used to assess the opportunities available to lubricant marketers to develop specifically tailored lubricant systems.

In the fact-finding phase of the project, a 2009 Toyota Camry Hybrid taxi from New York City (NYC), with over 260,000 miles on the odometer was inspected for hardware distress or unusual features. Results were compared to those obtained from a NYC non-hybrid limousine after 200,000 miles of operation. Both vehicles were lubricated with ILSAC GF-5 SAE 5W-30 oils.

Average sludge and varnish results and wear on the valve train and piston rings were all slightly worse for the hybrid engine relative to the non-hybrid engine.

However, it should be noted that the limousine service was less severe than that of the taxi. Some unusual broken 2nd land pieces were found in the hybrid pistons, but these were held in place by deposits and the vehicle was still operable.

Phase two of the project, which is still ongoing, began in May 2012. In this round of testing we are working with a New York City taxi firm to assess lubricants with varying rheological and performance properties in their hybrid vehicles.

The six test oils have different high temperature high shear (HTHS) viscosities and performance additive technologies, and each oil is running in three Toyota Camry Hybrid taxis. Data loggers are being used to record drive cycle and fuel consumption data from selected units on a rotating basis.

Six different oils are being tested in New York City Toyota Camry Hybrid taxis

Oil drain intervals are set at 10,000 miles - the interval recommended by Toyota for this vehicle type - and oil samples are being taken at 7,500 mile intervals throughout the trial. Interim engine inspections have been carried out at 100,000 test miles, with the final tear down inspections scheduled after the completion of 200,000 miles.

So far over 100,000 miles have been completed and through regular oil sampling and interim inspections the following observations can be made:

A fuel economy credit has been observed with reduced HTHS oil. Infineum International Limited.

A fuel economy credit has been observed with reduced HTHS oil. Infineum International Limited.

The final engine tear down inspections will reveal whether the engine oils with HTHS below 2.6 cP were able to provide adequate protection to the engine parts throughout the 200,000 mile test. In addition we will learn if any of the test lubricants can deliver improved cleanliness in the HEV engines when compared to conventional ILSAC GF-5 oils.

This feature is based on SAE paper 2014-01-1476 © SAE International. A complete copy of the SAE paper may be obtained from SAE at www.sae.org

Sign up to receive monthly updates via email