Passenger cars

ILSAC GF-7 ready

08 April 2025

28 May 2024

Passenger car OEMs reassess powertrain mix with sustained importance of electrified hybrid models

While full powertrain electrification seems likely to be the end game for most passenger car makers, in the near term we are seeing a growing trend for these OEMs to broaden their hybrid vehicle line up. Etienne Martin, Infineum Personal Mobility Product Manager, explores the drivers for this hybridisation strategy and assesses the opportunities it presents for fluids specifically tailored to meet the needs of the growing hybrid vehicle fleet.

A quick look across the automotive press tells you that things in the passenger car world are changing. Just a year ago, despite the barriers to adoption, mainly around vehicle cost and recharging, you could have been forgiven for thinking that within a very short timeframe we would all be driving vehicles solely powered by batteries. However, this is far from the case. Today we are seeing revised strategies from many OEMs – particularly in Europe and North America – which include increased production of well-established hybrid architectures. Why? Well, it’s a good lower outlay option that can significantly cut overall emissions now while we wait for the e-charging infrastructure to catch up and for consumers to fully embrace battery electric vehicles.

Electrification comes in many different shapes and forms and the terminology can be confusing. We’ll use the following definitions throughout this article to be clear.

From my perspective, three key themes are emerging:

While the growth of BEV sales will undoubtably continue, especially in personal mobility applications, these themes generate questions about the timeframe for their market dominance. What we are seeing is that OEMs are looking for ways to cut costs, attract customers and reduce carbon today – a set of requirements to which hybrid configurations are well matched.

There have been a number of OEM announcements regarding the rebalancing of their electrification strategies. Ford for example has stated that while it continues to work to build a full BEV line-up, it is in parallel expanding its hybrid vehicle offerings. By the end of the decade, the company says it expects to offer hybrid powertrains across its entire Ford Blue line-up in North America. Ford has dubbed its new direction as a unique ‘Freedom of Choice’ vehicle line-up, which offers a range of gasoline, hybrid, and electric products to suit almost every customer need based on demand today. In Q1 2024, the OEM reported its hybrid sales rose 42% versus the previous year’s Q1.

And it’s not just Ford that are considering an electrified rather than electric future – here’s a quick round up from some of the major OEMs.

In its 2023 Annual Report, the Mercedes-Benz Group, says the proportion of ‘electrified’ vehicles in total car sales was 20%. Looking ahead it says it plans to be in a position to cater to different customer needs, whether it‘s an all-electric drivetrain or a combustion engine, until well into the 2030s. This is a departure from its initial 'Ambition 2039' strategy presented a few years ago which said, ‘by the end of this decade, Mercedes-Benz Cars aims to be fully electric – where market conditions allow’. The 2023 report suggests plug-in hybrid and BEVs combined are now projected to account for 50% of total sales by 2030.

Volkswagen Group reports that in 2023 it sold 9.24 million vehicles – of which 8.3% were BEV. It says that in the next five years investments will primarily be in new products in the battery business and platforms for BEVs and in models with modern, increasingly hybridised combustion engines. The automaker says it is convinced that the future of mobility is electric, but the ramp-up of electric mobility in some regions is unfolding less quickly than expected. Volkswagen Group says its strategy is therefore characterised by flexibility. While extensive investments are being made in the expansion of electric mobility, highly competitive, efficient, and attractive models with combustion engines will remain part of the product range during the transition phase. Improved and new plug-in hybrids will complement the range in many markets.

In 2023 the Renault Group says electrified passenger car sales were up 19.7% versus 2022, accounting for 39.7% of the brand’s passenger car sales in Europe, a trend that was supported by a 62% increase in HEV sales. At the 2024 Geneva Auto Show the automaker said it will offer BEV and HEV options in every segment for the foreseeable future.

Hyundai Motor announced sales of over 4.2 million in 2023, of which 6.3% were BEV and 8.9% hybrid models. The company says it plans to expand sales of electrified vehicles by increasing global awareness of its dedicated BEV brand and further strengthening its hybrid vehicle line-ups. Recently, amid slower-than-excepted adoption of BEVs in North America and revised emissions rules that take hybrids into account, it is considering producing hybrid vehicles at a $7.59 billion plant in Georgia in addition to BEVs.

Toyota, who has pioneered the development of hybrid vehicles for over 25 years says it is making millions of BEVs available to customers. But, it sees that including HEV, BEV and fuel cell electric vehicles in its line-up is the way to reduce the most net carbon emissions globally and will optimise the proportions of each based on regional needs.

While this is just a snapshot of some of the majors, it is indicative of the mood of the industry.

BEV sales are slowing and inventory is building as consumers’ concerns over the cost, charging infrastructure and range drive them towards conventional and hybrid options. Many OEMs are now re-considering BEV investments and new product launches and are revising product roadmaps that embrace hybrid vehicles.

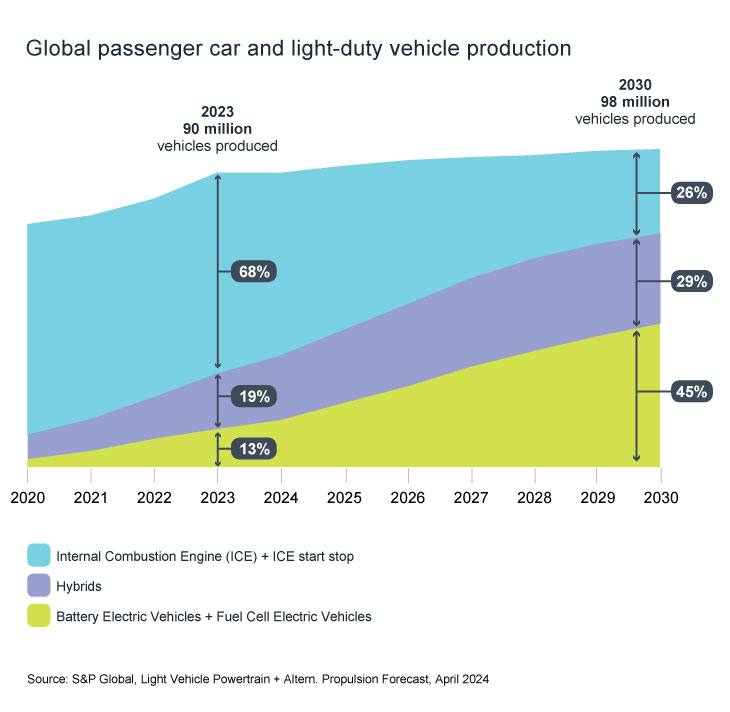

With so much industry activity, electrification forecasts may not yet reflect the changing market picture. In our view, the situation remains fluid. How quickly electrification grows is multi-factorial and likely to depend on customer acceptance, infrastructure availability along with regional/government regulations and incentives. But, what we do expect is that hybrids will be a growing segment for many years to come. Even if, as S&P Global predicts in the chart below, the BEV growth rate increases further, more and more of the remaining ICE-based vehicles will be electrified.

In 2030, it is forecast that 55% of vehicles produced will still contain an internal combustion engine and 29%, or more than 28 million, will be HEV.

Our projections suggest a new look vehicle parc in the future. By 2030 we expect there will be some 266 million hybrids on the road, which is around 1.2 times the volume of projected BEVs. These lower emissions vehicles will still contain an ICE that, owing to the hybrid operating environment, will benefit from specifically tailored engine oils.

It’s becoming apparent that OEMs see the continued use of internal combustion engine technology, combined with electric propulsion as a great lower carbon solution for today. As the industry continues to work towards a zero emissions future, we can expect the barriers to BEV adoption to be removed. In addition, other technologies such as fuel cells, hydrogen ICE and e-fuels will be further developed and commercialised although they are not expected to achieve maturity and a material market share for several years.

In our view hybrids are more than just a bridge to net zero. With the average age of passenger cars thought to be around 12 years in Europe and North America, hybrid cars have the potential to retain a large share of the overall carparc for many years to come.

Finished lubricant marketers have an excellent opportunity to provide lubricants designed to deliver the specific protection hybrids need.

Our next article will investigate why hybrids need specialised lubricants and explore the results of our recent hybrid field trials.

Sign up here to receive an email alert when it is published.

Based on the articles you've read

Sign up to receive monthly updates via email