Lubricant trends

Formulating for the future

17 February 2026

28 August 2024

The impact of proposed Harmonised Classification and Labelling in Europe on vehicle lubricant formulations

Whatever powertrain you are designing lubricants or fluids for – combustion engine, hybrid or electric – the effectiveness of the lubricant relies on the advanced chemistry that lies within. Increasingly stringent chemical regulations, designed to protect producers, consumers, and the environment, are being introduced across the world. Mark Grimwood, Infineum Principal Regulatory Projects Advisor and ATC SDPA Task Force Chairman shares how the latest proposal in Europe may impact lubricant formulations, supply chains and sustainability and even stop consumers changing their own oil. In addition, he assess how the industry may need to come together to manage the challenges posed by such an event.

Volatility, uncertainty, complexity, and ambiguity are increasing. Many of the market trends most pertinent to the lubricants industry are accelerating and driving change. The pace of energy transition, for example, is advancing, with increasing investment in transition technologies, such as renewables and new fuels. Even taking into account the recent slow-down in global electric vehicle uptake, and moderated OEM strategies focusing on hybridisation, pure-internal combustion engine transport solutions are still predicted to decline over the long term. Logistical and supply chain challenges are increasing, driven by unnatural climate events and regional conflicts, impacting product integrity and availability. In addition, inflation and fiscal concerns continue to worry consumers, resulting in increasingly cost focused customers, while regulations and social consciousness drive greater focus on sustainability, across all elements of the value chain.

There have been some excellent articles written across the trade press recently regarding how change is coming, and the need for the industry to be prepared for the challenges it must face. Perhaps most topical at this moment is the impact of increasingly stringent chemicals regulations; designed to protect consumers and the environment, which can have a substantial impact on the lubricants industry, and ultimately those very consumers they are designed to safeguard.

In Europe, new regulatory proposals have been made for two antioxidants that are widely used in a large number of industries.

The French Agency for Food, Environmental and Occupational Health & Safety (ANSES) has submitted a proposed new Harmonised Classification and Labelling (CLH) for two substituted diphenyl amine (SDPA) antioxidants under the framework of the EU Classification, Packaging and Labelling Regulation.

The two SDPAs in question, C4:C8 and C9, are used as antioxidants in approximately 90-95% of all engine oils and have been proposed by the French authority for fulfilling criteria as Reprotoxic Category 1B, so qualifying as Substances of Very High Concern (SVHCs).

If this materialises, short-term, those SDPAs would not be allowed in consumer products at levels ≥ 0.3%.

This would lead to consumer products being removed from the market, preventing end users from changing and ‘topping-up’ their own engine oil. In the longer-term, authorities might decide to implement additional regulatory measures, such as a wider scoping Authorisation or Restriction to also include professional and, potentially, industrial uses.

In addition, the proposed CLH of Aquatic Chronic Cat. 1 with an M-Factor of 10 for C9 SDPA would lead to most downstream lubricant oils being classified as Dangerous Goods. This could increase costs and controls for their storage and transport, as well as lead to a potential constraint on capacity available for the total volume of oils classified as Dangerous Goods in the market.

The ATC (The Technical Committee of Petroleum Additive Manufacturers in Europe) has noted its opinion, based upon an analysis of the available toxicology data, that the proposed CLH for both substances are not scientifically justified. In summary, ATC disagrees with the assessment of the dossier submitter (DS) and says the proposed classification of C4:C8 SDPA as Repr. 1B / Aquatic Chronic 2 and C9 SDPA as Repr. 1B / Aquatic Chronic 1 with an M-factor of 10 is not warranted.

A complete compilation of all available evidence and a scientifically sound data assessment is essential for a robust decision on classification.

Thus, ATC has asked the DS, rapporteur and ECHA’s Risk Assessment Committee to consider the comments it has provided through the Public Consultation on the CLH in respect of the toxicology as well as the socio-economic consequences of an overly precautionary CLH, before concluding on the proposed hazard classification for the substances.

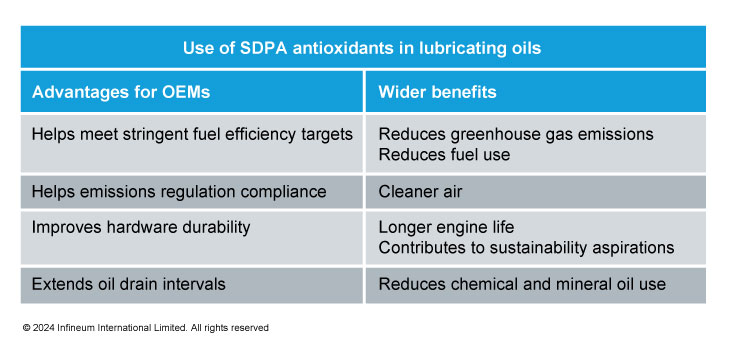

The two SDPA antioxidants are widely used in lubricants for transport and power generation applications, where they deliver a wide variety of benefits.

Clearly these attributes benefit the European economy, society and environment. In addition, they are contributing to the sustainability goals of the EU Green Deal, which aims to reduce greenhouse gas emissions by at least 55% by the end of this decade and to have a climate neutral Europe by 2050.

The implications for these CLH changes go far beyond the transportation and energy sectors.

These very effective antioxidants are also used in applications by a wide range of other industries, such as in greases and fluids for agricultural and engineering machinery, metalworking fluids and in the production of plastics. All of which could be impacted by their re-classification.

Unfortunately, there are currently no commercially available alternative ‘label free’ antioxidants that can deliver the required performance levels, at least for engine lubricants. And, while it may be possible for innovative organisations such as Infineum to develop novel alternative chemistries, it would take many years and millions of euros to test and bring them to the market in sufficient quantities. Even then, there would be no guarantee of equivalent cost/performance or of an improved toxicological/hazard profile. This level of development activity represents an unprecedented challenge to achieve before the end of 2027, when the proposed CLH and associated consumer restriction might become mandatory.

It is clearly of the highest importance for the industry to remain in close dialogue with regulators.

We must seek to jointly implement sensible, scientifically justified measures that ensure the protection of human health and the environment, but still allow the European chemicals industry to remain competitive.

If the proposal is accepted and enters into force around mid-2026, users would have until the end of 2027 to amend labels and safety data sheets. It is likely that end user restrictions would come into force in the same timeframe, with potential restrictions on professional and industrial use perhaps coming into force early in the next decade.

Infineum intends to continue working with its industry partners as data relevant to the regulatory process is further developed. In addition, Infineum is exploring the development of possible new antioxidants.

Whatever the outcome of the SDPA assessment, the global trend is for increasing regulation of chemicals. We as an industry must closely monitor and take respective measures to remain compliant. To prevent unwanted consequences, the industry needs to better engage with the regulators and advocate, where appropriate, for pragmatic approaches. For example, the continuation of the approach where chemicals are banned only in uses posing a real unacceptable risk (based on an assessment of both exposure and hazard) to human health or the environment. And, what if change is unavoidable?

The lubricants industry has been built through collaboration. Consider the European Engine Lubricant Quality Management System (EELQMS) or the American Petroleum Institute’s Engine Oil Licensing and Certification System (EOLCS) that provide the framework for the development of lubricants carrying industry claims.

EELQMS and EOLCS were developed jointly by industry stakeholders representing OEMs, lubricant marketers and additive companies. These stakeholders all share a mutual interest in the development of fit-for-purpose engine lubricants that meet the increasing technical requirements of the automotive industry.

Both the EELQMS and EOLCS systems are designed to assist lubricant marketers in assuring the quality of their lubricants and the validity of performance claims being made for them in the marketplace. They provide a detailed process and structure covering lubricant development and performance validation, e.g., performance test registration, guidelines covering minor modifications or viscosity grade read-across, documentation requirements and compliance auditing.

EELQMS and EOLCS can be considered the framework for a data-driven methodology that permits a level playing field, in which all the stakeholders can operate and trust the quality of the products developed.

Much as the earlier noted logistic and supply chain issues, change driven by regulatory challenge can impact product integrity and availability. The industry must begin to explore mechanisms by which such change can be managed, through for example, substitution protocols. These solutions may sit within the current lubricant development processes or indeed may sit outside of the EELQMS and EOLCS frameworks. But they must offer a suitably robust method that can allow extraordinary change requirements to be managed, cost- and time-effectively, with no detriment to lubricant performance, and end user value.

Change is accelerating, the industry must be ready to work together to solve the challenges it faces.

Sign up to receive monthly updates via email