Marine engines

OEMs outline challenges ahead

08 December 2025

Please note this article was published in May 2013 and the facts and opinions expressed may no longer be valid.

06 May 2013

Change drives demand for advanced lubricants

Sylvain Leblanc, Marine Segment Manager and Dean Clark, Specialties Segment Manager at Infineum, look at how changes in the marine and gas engine worlds will increase the demand for specifically tailored lubricants.

The marine lubricants market is effectively divided into two distinct categories: Trunk Piston Engine Oils (TPEO), which lubricate the four-stroke engines of coastal and cruise ships, and Marine Diesel Cylinder Lubricants (MDCL), which are used in the large two-stroke engines found in container ships.

MDCL accounts for around 65% of the 2.2 million ton global marine lubricant market. And, although volumes were impacted by the global recession, with MDCL suffering the most as freight volumes shrank, we expect some growth going forward.

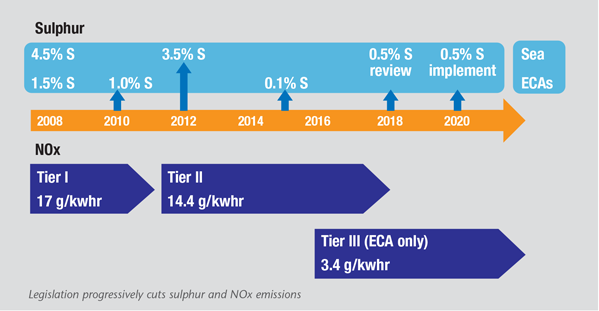

Both markets are being affected by the increasingly stringent NOx and sulphur emission limits being introduced by the International Maritime Organisation (IMO). At the same time Emission Control Areas (ECAs), where limits are even more stringent, are also spreading.

Two options are being used for sulphur reduction.

The decision on which to implement is likely to come down to cost and fuel availability.

Aftertreatment systems, such as exhaust gas recirculation (EGR) and selective catalyst reduction, are likely to be required to meet Tier III NOx limits.

While these technologies are tried and tested in the automotive industry, their introduction in marine engines is unlikely to be straightforward.

To meet environmental and cost drivers, medium speed engine OEMs are introducing technology to cut oil consumption. At the same time, engine output is increasing, sulphur levels are falling and the quality of residual fuel is poor.

All of these factors mean better quality lubricants with higher total base number (TBN), better TBN retention and improved oxidation and liner lacquer control are needed to help ship owners reduce their maintenance costs.

As Group I base stock volume declines, these marine lubricants are increasingly being formulated in Group II base stocks, which brings a new set of lubricant formulation challenges.

Lower sulphur fuels introduce a requirement for lubricants with lower TBN and improved wear control. Also, if OEMs use EGR to meet Tier III NOx limits, marine lubricants with enhanced soot handling and dispersancy will be needed.

And, as OEMs work to reduce feed rates in order to reduce ship operating costs, field trials are increasingly essential to ensure standard lubricants are still effective.

The REACH regulations on chemicals and their safe use are also impacting MDCLs. Formulations must not only meet these regulations but also deliver the required level of performance.

Growth in shipping means the industry’s contribution to global greenhouse gas (GHG) emissions is expected to double by 2050. The IMO believes there is significant potential to reduce these emissions through technical and operational measures.

However, despite their continued efforts, there is currently no international regulation to limit GHG emissions from ships. In our view regulations will be implemented in the near future.

CO2 reduction has been on the industry radar for some time and wind propulsion, slow steaming, use of alternative fuels, new propeller design and improved aerodynamics are just some of the solutions being explored.

Lower viscosity lubricants could also offer some fuel economy benefits, although the balance between fuel economy and wear protection needs careful consideration.

Clearly there are a number of ways the industry can tackle these emissions, but further testing is needed so their effectiveness at reducing CO2 and their impact on lubricant formulations is understood.

Gas engines

As new finds form unconventional sources come to market, natural gas has been making the headlines. Until recently, the slow pace of gas fuelling infrastructure introduction means gas engines had largely been limited to the traditional applications of power generation and gas transmission.

For these applications high conventional fuel prices make the use of cheaper hydrocarbons including natural gas, biogas, landfill and shale gases attractive.

But now, a growing number of incentives for the use of natural gas in both transportation and stationary applications, together with investments in fuelling infrastructure mean that we can expect to see an increase in the number of gas engines in all these applications.

These changing demand dynamics press OEMs to develop higher output, more fuel efficient engines, which increase oil stress factors.

Together with the ‘special gas’ introduction, there is a need for high performing gas engine oils to protect these high output, high cost investments, not just now but for many years to come.

In the US, a network of compressed and liquid natural gas (CNG and LNG) fuelling stations is being built at strategic locations along major trucking corridors to form the backbone of a national fuelling infrastructure. Natural gas has a number of advantages over diesel or gasoline fuels – it is in abundant supply, vehicles are cheaper to run and it produces fewer greenhouse gas emissions – which means OEMs are keen to increase their gas engine product lines.

Caterpillar for one has publically stated its intention to go “all in” and produce even more natural gas-fuelled engines. The company says it will provide natural gas fuel as an option for engines across its many high horsepower lines for marine, rail, mining, earthmoving and drilling operations and reports users of this equipment are realising cost savings of 30 to 50%.

As OEMs increase their use of natural gas engines we expect the fuel to play a more significant role in PC-11 product claims than in API CJ-4.

However, the current oils recommended for both converted and dedicated mobile gas engines are typically low ash CES 20074 (ash 0.4- 0.6%) type and therefore not compatible with the proposed ash limits for PC-11 (typically 0.9-1.0%).

There is a need for OEMs to determine whether low ash oils are required for converted diesel engines going forward and this may only be determined by the exact nature of the fuelling systems being used. Right now Cummins CES 20074 is still the key claim for this market.

Changes in stationary gas engines look set to drive substantial increases in the demand for gas engine lubricants. New engines are being introduced to support the development of natural gas pipeline infrastructure and to generate more electricity from renewable gas sources.

A large population of gas engines currently transfers gas from the wellheads to compression stations and then on to consumers.

New gas finds mean miles and miles of new pipe will be installed every year in the US, Russia and Latin America for the foreseeable future, and new compressor installations, running gas engines, will be required to get the gas to market.

On the power generation side, reciprocating engines fuelled by a range of gases can be used to generate electricity and heat. The use of waste gas, including waste landfill and farm biogas is increasing and the introduction of laws and incentives could drive growth in this sector and spur gas engine oil demand.

The latest US Environmental Protection Agency (EPA) gas engine regulations, which come into force in October this year, add emission and management practice standards that will affect over 300,000 engines in operation.

Oil analysis must be performed as part of the routine engine maintenance program and once an oil receives a failing result it must be changed within two days, which means some operators may choose to reduce their drain interval. This scenario would result in lubricant volume growth, but there are also opportunities for lubricants that can keep engines reliably in service for longer.

This is an exciting time in the marine and gas engine markets and the lubricants industry is already developing high quality oils so that it can be ready to meet growing demand. The articles featured in this marine and large enrines sections of our expertise portfolio reveal some of the technology developments Infineum is undertaking in these fields.

Sign up to receive monthly updates via email