Lubricant trends

Advances in automotive lubricant design

04 March 2025

Please note this article was published in March 2015 and the facts and opinions expressed may no longer be valid.

11 March 2015

New emissions regulations will drive demand for higher quality fluids

Dong Hoon Lee, Sales Manager and Representative Director of Infineum Korea Ltd, talks to Insight about the challenges facing South Korea and the exciting opportunities these may present to fluid manufacturers

South Korea has rapidly become an economic powerhouse and is now one of the most affluent nations in Asia. Innovations like unrivalled superfast broadband and considerable investment in higher education, combined with the global success of companies like Hyundai and Samsung, have helped to make the nation the eighth largest country in terms of international trade.

The automotive industry has played a key role in the nation’s development, with domestic manufacturer Hyundai Motor Corporation (HMC) now the fourth largest car manufacturer in the world. But it is not just on the global stage that HMC is excelling.

Local sales are steadily increasing and of the 1.66 million vehicles sold in 2014, 69% were delivered with a Hyundai or Kia badge on the front.

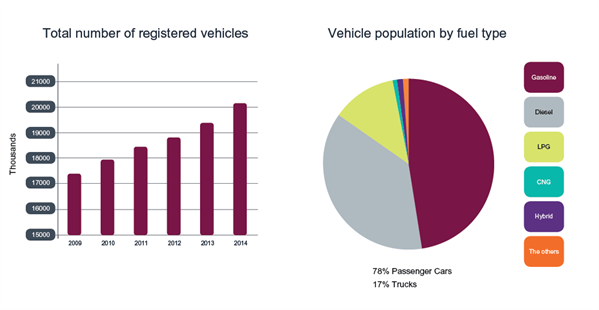

The vehicle population has been steadily increasing – with passenger cars accounting for more than three-quarters of todays 20 million vehicles. There is a reasonably diverse fuels mix and although almost half of the vehicles have gasoline engines, 39% are fuelled by diesel and 12% by liquid petroleum gas. With fuel economy of growing interest, what is surprising perhaps is the lack of penetration of hybrid vehicles, which account for less than 1% of the market.

The country appears to be on a modest economic recovery, and this combined with the release of new models by the mainstream manufacturers means we can expect this growth in domestic sales to continue.

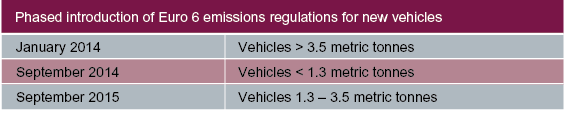

The phased implementation of more stringent Euro 6 vehicle emissions, which began in January 2014, presents a major opportunity for the fuels and lubricants industry as higher quality products will be required to meet the new targets.

This legislation has led to an increased demand for advanced aftertreatment technologies, such as diesel particulate filters, catalysed particulate filters, diesel oxidation catalysts and selective catalytic reduction. Engine oil formulations with less sulphated ash, phosphorus and sulphur (SAPS) are needed to facilitate these technologies.

Experience with the implementation of Euro 3 to 5 means we can expect a smooth transition to Euro 6 standards - particularly because oil marketers have made preparations for the technology that is required to accompany the changeover.

One area of complexity for lubricant formulators is the fact that South Korea applies Euro standards to control emissions from diesel engines, but follows US limits for its gasoline-powered vehicles.

Over the past decade, the South Korean government has implemented measures to tighten fuel efficiency standards to accelerate the development of hybrid or clean-energy cars, such as electric and fuel cell vehicles. These initiatives were also part of a wider push to contribute to the government’s aim for a 30% cut in greenhouse gas emissions by 2020.

The Ministry of the Environment has announced that by 2020 it will tighten the nation’s average fuel efficiency standards for cars from the current level of 17.3 km/l to 24.3 km/l. It will also cut the limit for greenhouse gas emissions from 140 g/km to 97 g/km. This will be a phased approach, with the Ministry requiring 10% of cars produced in 2016 to meet the target – a figure that will increase every year until 100% meet the target in 2020.

With an eye on increasing exports, these limits are partly designed to help improve the fuel efficiency competitiveness of locally produced cars on the international market.

These are tough requirements and Korean manufacturers will have to work hard to meet the 2020 target. We expect increased use of top tier lubricants as OEMs look for contributions to fuel economy improvements. Clearly the market for low viscosity lubricants should experience growth, which is slightly different from other Asian markets.

Initial biodiesel blend targets have been scaled back

In 2007, as a key component of the government’s fuel efficiency plans, a programme to promote the use of biofuel was implemented. However, the initial blend targets have been scaled back, and the legislation appears to have caused as many issues as it has solutions.

The country currently has a B2 biodiesel mandate in place, which means that all diesel fuel sold in the country must contain a minimum of 2% biodiesel. In 2013 the oil industry petitioned the government to keep the biodiesel blend at 2% owing to the increase in production costs that would have ensued, which would have to be passed on to the consumer.

However, delaying the higher blending mandate has, according to the national biodiesel industry, hurt local producers. Heavy investment in large-scale facility upgrades to keep pace with the government’s original plans has resulted in reduced exports and weakened margins.

As supply continues to exceed demand, a number of South Korean biodiesel facilities have been forced to close.

Although details on the future of biofuel regulations remain vague, if the threshold is raised fuel companies will need to minimise any associated risks, such as filterability above cloud point.

South Korea is set for a major development in legislation in 2015 with the implementation of Korean Registration, Evaluation, Authorisation and Restriction of Chemicals (K-REACH).

REACH was first implemented by the European Union in 2007 to streamline and improve the previous legislative framework on chemicals. It places greater responsibility on the industry to develop information on and manage the risks that chemicals may pose to human health and the environment. REACH has had a major impact over the past seven years and has inspired an increasing trend of regulatory activity across the globe.

K-REACH was introduced in Korea on January 1 2015 and will eventually overhaul the current Toxic Chemicals Control Act.

K-REACH, which mirrors many of the concepts set out by its European counterpart, requires manufacturers, importers and sellers to report information about substances to the South Korean Ministry of Environment. This will have a significant impact on foreign manufacturers and exporters, who will be required by law to appoint local representatives to carry out pre-registration and registration for K-REACH on their behalf.

Clearly there are a number of opportunities in South Korea. The introduction of Euro 6 and fuel economy regulations will play an essential part in shaping the future for fuels and lubricant suppliers.

However, many challenges also lie ahead. What is needed is a well-defined path and open discussions between the government, OEMs and oil marketers on how to address the challenges so that the industry can capitalise on the available opportunities.

Based on a feature originally published in Fuels and Lubes International

Sign up to receive monthly updates via email