Fuels

Driving hydrogen forward

21 January 2025

16 January 2018

Exploring the region’s challenges and the impact of additional refinery capacity

Geopolitical tensions and low oil production may have dampened the Middle East’s economic outlook. However, refinery expansion and modernisation projects look set to propel the region into the number one position for diesel fuel exports, with GCC oil and gas projects crossing US$1.21 trillion in value.

Tension levels in many of the Middle Eastern countries are still running high. With a power vacuum in Iraq and Syria and a continuing crisis in Qatar, it is unsurprising that the region’s growth prospects have diminished in recent years. But, despite the uncertainty, some forecasters suggest 2016 could have been the bottom of the trough, and that in the next four years the region will experience slightly better economic growth.

However, even in some of the more stable countries of the region, a number of issues still cloud the outlook. For example, in Saudi Arabia there are mounting geopolitical risks and a worsening oil outlook and lower oil production in the United Arab Emirates (UAE) – all of which are decelerating growth. In addition, in Iran, oil cuts to meet OPEC requirements, new economic sanctions and structural weaknesses could jeopardise the exciting growth seen here recently.

The Middle East is effectively made up from two very different blocs – the ‘Petrostates’ and the ‘Net oil importers’.

The former is made up of the stable Gulf Cooperation Council (GCC)*, which is a regional political organisation comprising the extremely wealthy Gulf monarchies – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. These countries benefit from well developed infrastructure, relative stability and low unemployment levels.

*This bloc also includes the non-GCC members - Iran and Iraq.

Currently, the key strategy in the Petrostates bloc is to reduce dependence on oil and to diversify the economy.

A number of measures are being introduced that will look to provide alternate sources of revenue for government spending and help to reduce the overall fiscal deficit.

This process has already started with the deregulation of motor fuels. Saudi Arabia and the UAE are now gearing up for the introduction of 5% VAT on all business, goods and services. While the low rate of VAT will have a limited impact on price increases and inflation, it is estimated that the tax reform will generate between 1.5 and 2% of gross domestic product (GDP) annually.

The prominent nations of the ‘Net oil importers’ are Egypt, Syria and Yemen, all of which have high levels of instability.

With large populations, poor infrastructure, unemployment hovering around 50% and the effects of the Arab Spring still being felt, growth here is less predictable. However, with the drop in oil prices, which has proved to be a blessing, some of these countries are expected to experience growth.

Notable upturn in investment, trade and industrial production, coupled with strengthening business and consumer confidence are supporting recovery here. However, the recovery is not yet complete, and although the baseline outlook is better, growth remains weak in many countries.

Over the coming years, the Middle East is expected to dramatically increase production of middle distillates to meet growing global demand.

ME product supply balance

In recent years 1,295k barrels per day (BPD) of capacity has been added through projects at Jubail, Yanbu, Sohar and Ruwais. In order to meet future demand another round of refinery expansion and modernisation programs is already underway in many of the GCC countries.

| Country |

Refinery | Capacity addition (kBPD) |

Expected |

| Saudi Arabia | Jazan | 400 | Q2 2018 |

| Oman | Duqm | 230 | 2020 |

| UAE | Fujairah | 200 | 2018 |

| Kuwait | Al Zour | 615 | Q2 2019 |

| Kuwait | MAA-MAB | 305 | Q2 2018 |

Once complete, these new projects, which are largely focused on the production of low and ultra-low sulphur diesel fuels, will add another 1,750k BPD of capacity.

This activity means that by 2025 the Middle East is expected to become the world’s largest exporter of diesel fuel, with most of the additional capacity destined for the European, African, Latin American and Asian markets.

This growing export means refiners will need to ensure their fuels meet the specification requirements of their final destination markets.

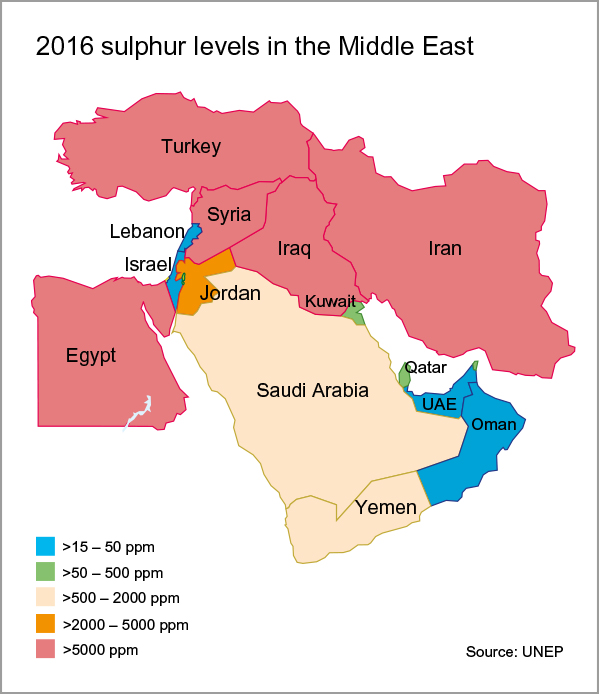

The progressive reduction of sulphur in diesel fuel is essential so that the latest vehicle technology can be used to help improve fuel efficiency and reduce emissions. Political and economic reasons mean the Middle East has been relatively slow to mandate low sulphur fuels for domestic consumption.

Figures from the 2016 Infineum Winter Diesel Fuel Quality Survey confirm high variation in the region’s fuels. In the samples collected from Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE the sulphur levels ranged from as low as 6 ppm to more than 1,600 ppm, with an average of 400 ppm. While this is still relatively high, it is significantly lower than the several thousand ppm in samples collected from some Middle Eastern countries previously.

Recently introduced governmental mandates should ensure that sulphur levels continue to fall and that low sulphur fuels become more widely available throughout the region.

To meet growing domestic and global demand for low sulphur fuels, refiners need to maximise production of on-specification diesel. The use of proven cold flow and lubricity improver additives not only ensures the production of fit for purpose products but can also help to improve refinery profitability.

Government spending on major projects, particularly in the GCC, is restricted, which means we can expect the passenger car segment to continue outperforming commercial vehicles, with 2018 sales growth forecasts running at 3.7% and 2.1% respectively.

As fuel sulphur levels fall and the population of heavy-duty diesel (HDD) vehicles using modern hardware technology grows, there will be a greater need for higher quality API approved lubricants, which presents opportunities for lubricant marketers. Read more about the region’s journey from API CF to CH-4 here.

The waves of change are rolling across the entire region and, if the overall macroeconomic situation improves, lubricant marketers will have the opportunity to develop a sustainable business model within the automotive lubricant space.

Sign up to receive monthly updates via email