Fuels

Reported sludging incidents rise

04 November 2025

Please note this article was published in July 2016 and the facts and opinions expressed may no longer be valid.

13 July 2016

Investment in Middle East refining changes fuel market dynamics

As the demand for diesel fuel continues to grow, new capacity coming on stream in the Middle East is increasingly likely to be destined for the export market. Dr David McLeary from Saudi Aramco talks to Insight about the impact of this trend and the challenges ahead for Middle East refineries.

In contrast to Europe, where refining capacity is contracting, production in the Middle East has continued to grow. David McLeary, Research Science Consultant from Saudi Aramco, the state owned oil company of the Kingdom of Saudi Arabia, explains the plans for continued investment in refining capacity in the coming years. “Middle East refining capacity has grown from about 8 million barrels per day (bpd) in 2010 to about 10 million bpd at the end of 2015 and it is estimated that more than 2 million bpd of additional refining capacity will be added in the Middle East by 2020.”

In David’s view, this expansion is being driven by a number of factors. “The Middle East countries are diversifying their economies away from a dependency on upstream earnings and are trying to add value to their crude oil production by monetising it as exported refined products. This approach also helps provide security of supply and provides the ability to satisfy increasing regional domestic demand, which is currently growing at around 2% - 4% annually, and which until recently has seen countries like Saudi Arabia import refined products at great cost.”

Regional domestic demand is currently growing at around 2% - 4% annually.

David also sees an increase in the integration of refineries with petrochemical and base oil manufacturing plants, which provides the opportunity to offer higher value products to consumers. In 2015, Saudi Aramco achieved a major milestone with the start up of the Sadara Chemical Company, its joint venture with The Dow Chemical Company. As he explains there is a significant amount of activity in downstream integration.

“Saudi Aramco has recently brought on-stream the YASREF and SATORP joint venture refineries, which have a total crude oil processing capability of 800,000 bpd. There are also plans, in the near term, to bring the Jazan refinery online and upgrade the Ras Tanura refinery in the Eastern Province, which will result in a similar capacity increase. In addition, the expansion of Petro Rabigh, our integrated refining and petrochemical venture with Sumitomo Chemical of Japan, advanced toward its start up in 2016. These new builds along with upgrades to existing refineries, like Riyadh and SAMREF aim to ensure the sulphur content of the gasoline and diesel fuels produced is less than 10 mg/kg.”

Saudi Arabia is the world’s largest exporter of crude oil and aims to be the second largest exporter of refined products.

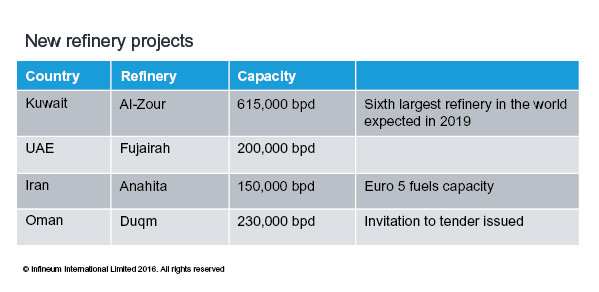

Right across the Middle East region a number of projects are progressing to add capacity.

In addition to these new projects a number of expansions are also underway in the region. “Kuwait is upgrading two existing plants as part of its clean fuels project, the UAE has doubled refining capacity at the Ruwais refinery to over 800,000 bpd and Oman is expanding capacity from 212,000 to 312,000 bpd.”

David McLeary, Research Science Consultant, Saudi Aramco Infineum International Limited

Clearly, the recent change in crude oil pricing will cause project viability and timing to be reassessed, but it is evident that the region has signalled its intent to be a major supplier of refined products to the domestic and global markets.

The increased regional refining capacity will result in significant volumes of diesel fuel going to the export market. David sees a number of challenges ahead for Middle East refineries as they look to meet the different specifications of their various target markets – with the biggest challenge being the reduction of fuel sulphur content.

David McLeary, Research Science Consultant, Saudi Aramco Infineum International Limited

Where new refineries are being constructed or upgrades contemplated, the drive to export refined products means that so-called Euro 5 quality fuels are targeted for production, so the complexity and hydroprocessing requirements of these plants are clearly defined. With older plants, the low sulphur fuel challenge will require a review of the economic viability of the plant and the case for upgrading facilities, coupled with an assessment of the supply logistics possibilities. The result may be some plant closures such as the Shuaiba plant in Kuwait, which has been flagged for closure.

The progressive reduction of sulphur levels for road transportation fuels is a trend that is also likely to affect the domestic market.

“The Middle East recognises the global trend for diesel fuel specifications to reduce sulphur content. This will allow the latest technology to be introduced to improve fuel efficiency and reduce pollution from vehicles,” he confirms. “However, the rollout of low sulphur content diesel fuels across the region has been slow for a number of well understood political and economic reasons. There is a commitment by both major refiners, like Saudi Arabia and Iran and smaller refiners, like Kuwait and Oman, to provide low sulphur content diesel fuels, so it is only a matter of time before these fuels are widely available throughout the Middle East.”

David McLeary, Research Science Consultant, Saudi Aramco Infineum International Limited

The new build refineries and those being upgraded in the Middle East are aiming to produce, so called Euro 5 or 10 ppm by mass maximum sulphur content diesel fuels. These fuels are intended for both the export markets, such as Europe, which are driving global fuel and air quality standards, as well as the local markets.

Clearly, as diesel fuel exports increase and the trend for low sulphur content fuels continues refiners will need to ensure they meet the specifications of their export markets to ensure a fit for purpose product. In David’s view, some specifications can be met by using fuel additives. “Diesel fuel cold flow performance can be addressed by blending or the use of diesel cold flow improver additives. To meet diesel fuel conductivity and lubricity requirements it is important to use well understood fuel additive technologies.”

Improving refinery profitability by squeezing more on-specification diesel fuel from every barrel of crude and then producing the right fuel for the various target markets is clearly a priority for refiners in the Middle East.

Sign up to receive monthly updates via email