Passenger cars

ASEAN a market in transition

09 December 2025

Please note this article was published in September 2014 and the facts and opinions expressed may no longer be valid.

09 September 2014

Conventional vehicles still first choice for most consumers

Recent headlines might lead you to believe that we will all be driving electric cars in the near future. But in reality, sales of electric vehicles remain sluggish in all but a very few countries. Insight looks at the trends in this emerging market and explores the latest vehicle technologies that help OEMs to keep pace with legislative targets.

It really does depend on where you stand as to how you see the pure electric vehicle (PEV) market picture. For the environmentalists, keen to reduce greenhouse gas (GHG) emissions, electric cars make sense and they report ‘a doubling in PEV sales in 2013’, or at least a ‘huge acceleration’.

Other motoring and market analyst reporters present a less exciting growth picture, attributing consumers’ lack of appetite for PEVs to high purchase costs, long refueling times and poor driving range.

So what is the Infineum picture?

In the right conditions sales of PEVs certainly seem to be increasing, but slowly and from a very small base – although as you might expect there are exceptions.

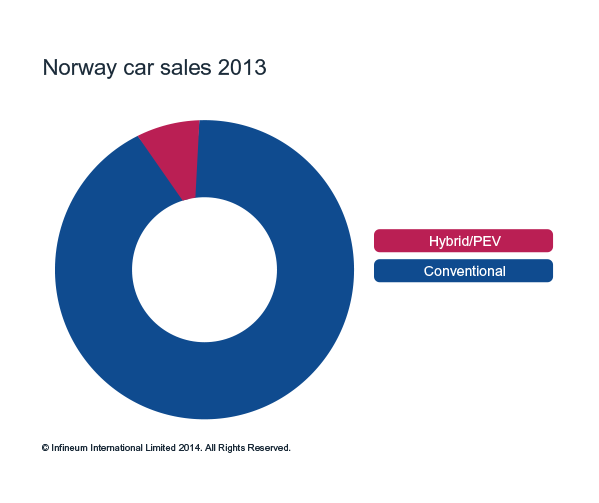

Norway for one seems to be the perfect market for PEVs – in part because the country generates most of its electricity from renewable hydroelectric power (which means Norway’s PEVs really are green). In addition, Government investment in refueling infrastructure and vehicle subsidies, along with heavy taxation and restrictions in the use of conventional technology has encouraged more Norwegians to go electric.

In 2013, more than 5.5% of the 142,000 vehicles sold in Norway were hybrids or PEVs. Although in terms of a market to watch it’s hardly one to get excited about, because the numbers in real terms are so low.

Norwegians’ enthusiasm for PEVs is in sharp contrast to the apathy of consumers in the rest of Europe.

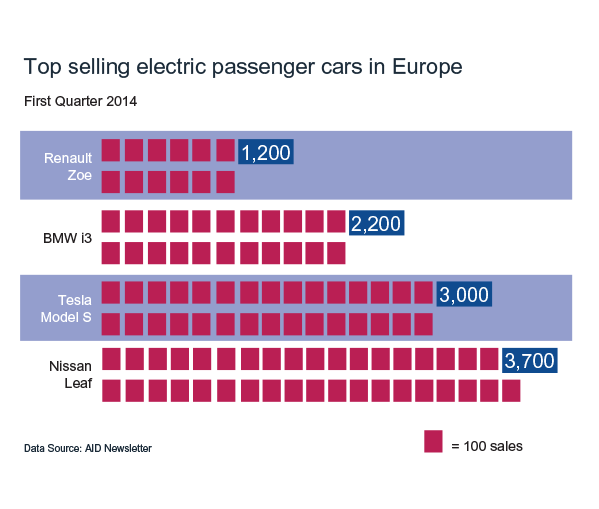

Here, despite the availability of some highly engineered vehicles, including the Nissan Leaf, BMW i3, Renault Zoe, VW E-Up, Mercedes Benz Smart, and the Tesla Model S, PEV sales are still very low. And, despite this wide vehicle choice, 2013 electric vehicles sales in Europe as a whole accounted for less than 0.3% of total light-duty vehicle sales.

Yes, for the first quarter of 2014, you could say PEV sales have ‘almost doubled’ over the same period last year, but the actual numbers continue to be absolutely negligible in terms of the whole passenger car market in the region.

In contrast, the market for diesel-powered cars in Western Europe is growing at a reasonable rate, rather than gradually declining as some had expected. Recent figures published by AID Ltd show that almost 1.7 million diesel cars were sold in the region in the first quarter of 2014 - 6.1% more than during the corresponding period last year.

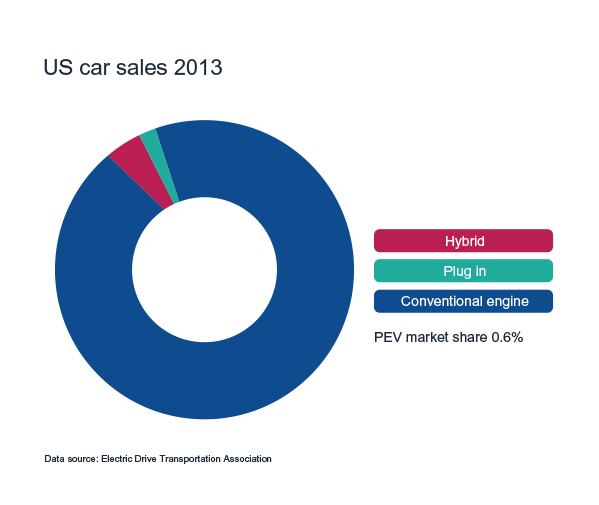

In the United States (US), despite Government incentives, the reported uptake of electric vehicles remains very low. Although almost half a million hybrids and just over 96,000 PEVs were sold in 2013, just as in Europe, this still only accounts a tiny proportion of the total number of passenger cars sold.

For the first half of 2014 the picture looks very similar – of the 8.2 million vehicles sold in the US to date just 0.7% were PEVs.

While some analysts suggest that the US is likely to be the largest market for PEVs during the next 10 years, their forecasts indicate that light-duty PEV sales will still only just exceed half a million units by 2023.

Lack of a wide recharging infrastructure can make PEVsless attractive

In its efforts to ease pollution and reduce reliance on oil imports, the Chinese State Council is keen to encourage sales of fully electric, hybrid and fuel cell vehicles. Sales targets for these so called 'new energy' vehicles have been set at half a million by the end of 2015, rising to five million by 2020. But China currently has only 70,000 in use, with high prices, lack of infrastructure and consumer acceptance being the main obstacles to growth.

Again we see exciting headlines reporting a huge expansion in the Chinese electric car market in 2013, but it has to be recognised that this is from a very small base. With total vehicle sales exceeding a staggering 21 million last year, the meagre 17,600 PEVs and hybrids sold are still an insignificant portion of the market.

Although the Chinese Government is keen to be green, PEVs do not really make great environmental sense here because most of the country’s electricity is generated by burning coal, which is neither clean nor sustainable.

Despite this fact, the Government has recently introduced tax incentives for new energy vehicles through to the end of 2017, and is mandating that this type of vehicle make up at least 30% of Government vehicle purchases by 2016.

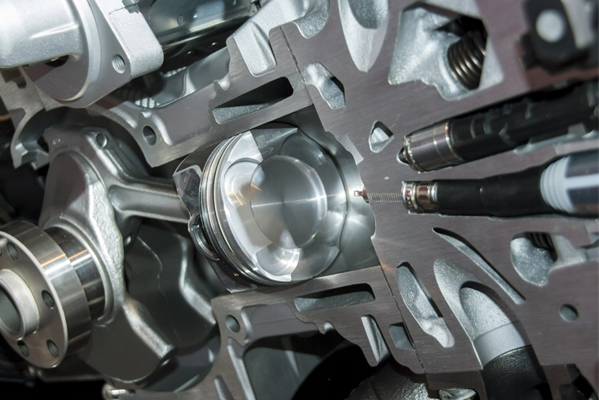

Clearly, within the next 10 years, electric drivetrains are expected to gain some limited market share across the globe. However, the traditional petroleum-powered internal combustion engine (ICE) will continue to dominate the light-duty market way beyond 2025, a fact that is driving OEMs to look for innovative ways to improve its efficiency.

Mandatory fuel consumption and/or CO2 emissions standards for light-duty vehicles are currently in effect in more than 70% of the global new vehicle markets.

In the US for example, carmakers need to significantly improve fuel efficiency to meet tightening standards. By 2016 vehicles must meet a corporate average fuel efficiency (CAFE) of 35.5 mpg; resulting in an average tailpipe CO2 level of 250 g/mile. The limit tightens again in 2024, when fleet average CO2 emissions will be cut to 160 g/mile.

In Europe CO2 emissions reduction regulations are coming into force as the region works to ensure it meets its GHG emission reduction targets. Car manufacturers must ensure that by 2015 their new car fleet does not emit more than an average of 130 gCO2/km, a figure that drops to 95 g/km by 2021 – which equates to approximately to 4.1 litres/100 km of petrol or 3.6 litres/100 km of diesel.

Car manufacturers who produce vehicles with extremely low CO2 emissions can claim so called 'Super Credits', which can help to reduce the average emissions of their new car fleet. While this is quite an incentive to produce electric cars, it also enables OEMs to sell more of the larger conventionally-fuelled vehicles without penalty.

To meet the ever tightening GHG emissions targets OEMs are looking at every area of the powertrain for fuel economy improvements. However, they face a pretty daunting task: trying to boost vehicle performance and improve fuel economy – all the while designing vehicles consumers want to buy.

We know that currently only about 30-40% of the energy available in conventional fuel is actually used to drive the vehicle, which means major changes to engine hardware are now required.

To meet future GHG emissions targets OEMs need to make major changes to engine hardware

Turbocharging of gasoline engines, which makes the combustion process cleaner and more efficient, is expected to increase, especially in North America and China. In diesel vehicles turbocharging is also being used to not only improve efficiency, but also to deliver better performance - boosting drivability and making them more fun to drive.

Turbos also play an important role in increasing power density, which helps with engine downsizing – another major fuel economy enabler. Many OEMs are also looking at advanced combustion techniques to create gasoline engines that are as efficient as diesels, but that are cheaper to buy and run.

Light-weighting is another way the auto industry can improve fuel economy and we are already seeing aluminium and plastics being used more widely. For example, the recently released aluminium bodied Ford F-150 pickup is more than 700 pounds (>300kg) lighter than the current steel-bodied model. However, barriers to the broad application of new materials include cost, compatibility and end of life recycling.

Auto Start-Stop systems, which we began to see as long ago as the 1970s, are gaining momentum. With manufacturers quoting fuel savings anywhere from 2 to 5%, the technology is expected to be commonplace by 2018. Ford for example, plans to offer the technology on 70% of its US model range by 2017 and GM plans to increase the use of the system in its vehicles. BMW already fits Auto Start-Stop to all BMW 1 and 3 Series models with four-cylinder engines and manual transmissions to help reduce both fuel consumption and emissions.

In reality, the relative uptake of fuel saving vehicle technologies will depend on their reliability, cost, ease of implementation and - probably most important of all - consumer acceptance.

However, advances in ICE design will clearly have a knock on effect to fuel and lubricant formulations. Close industry collaboration and co-engineering are essential to ensure fluids of the future not only contribute to fuel efficiency, but also offer excellent protection to the engine and all its components.

PEVs make the most environmental sense incountries that produce the majority of theirelectricity from renewable sources

To really eliminate greenhouse gases, and specifically CO2, it is imperative that electricity for PEVs is not sourced from fossil fuels, like coal, oil or natural gas. Otherwise the emissions are simply being transferred from the car exhaust to the production plant chimney. If we look at coal in particular, the overall emissions from the generation of electricity to its use are worse than the ‘well to wheel’ emissions for conventional gasoline or diesel fuels.

Improvements in gasoline and diesel-powered vehicles have made real reductions in GHG emissions and these vehicles tend to be more viable than non-conventionally powered alternatives, and can be sold without government subsidies.

PEVs make the most environmental sense in countries that produce the majority of their electricity form hydro, wind, solar and nuclear sources. But, with renewables accounting for only 20% of world electricity production, this environmental utopia is clearly still some way off.

Government subsidies might help to stimulate sales, but in the long term the competitive market will drive success. PEVs have strategic disadvantages including: high purchase cost, insufficient battery range, long recharging times and lack of recharging infrastructure, which must be overcome before they are more widely accepted by consumers.

In addition, lithium mining, which produces a key raw material for batteries, is also very energy intensive and the disposal and recycling of old batteries will also raise new environmental issues.

In our view, although hybrid vehicles will gain popularity faster than PEVs, the huge strides OEMs are making to improve the fuel economy of gasoline and diesel vehicles mean the internal combustion engine will still dominate the new vehicle market for many years to come.

Sign up to receive monthly updates via email