Passenger cars

ASEAN a market in transition

09 December 2025

10 May 2017

Passenger car sales show consumers prefer conventional technologies

The 2016 passenger car sales results are in. And, despite tightening emissions mandates, which are driving OEMs to introduce greener and greener vehicles, figures show consumers still prefer conventional technologies. Insight explores the buying trends in some of the world’s largest markets.

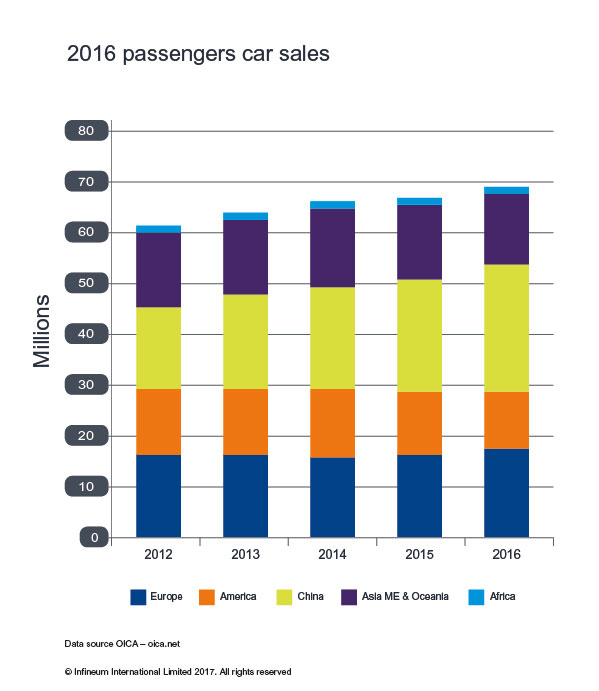

In 2016 global passenger car sales hit an all time high reaching just short of 69.5 million – up more than 4.7% on 2015. However, there were huge regional sales variations, with some seeing significant gains while others remained flat or even fell.

China accounted for 35% of global car sales in 2016

China accounted for 35% of global car sales in 2016As recently as 2012 passenger car sales figures in Europe were higher than in China, but in the subsequent four years China has experienced dramatic growth, making it the single largest passenger car market in the world.

Not only do sales volumes differ by region, but so do the type of vehicles consumers chose to buy. These are decisions that may be driven by fuel price, availability, cost, government mandates and/or incentives and even prestige and driving fun. In the three most influential markets, China, Europe and America, the trends and drivers are very different.

In 2016, fueled by tax incentives, China experienced another record year with auto sales reaching around 24 million.

The sales tax on cars with engines of 1.6 litres or below was cut from 10 to 5% in late 2015, giving the auto industry a much needed boost and increasing demand in this segment by 15.9% in 2016. At the same time, sales volumes of compact SUVs rose by some 44%. This benefited domestic manufacturers with strong brands, such as Great Wall, and is a trend that is expected to continue in 2017.

According to the China Association of Automobile Manufacturers, sales of electric and plug-in hybrid vehicles, which are known locally as new energy vehicles (NEVs), rose 53% to 507,000 units last year. These figures comprise over 350,000 cars and 115,700 buses. This might sound like a big increase, but in terms of the Chinese passenger car market they still represent less than 1.5%.

The government has promoted NEVs and offered subsidies as it works to curb urban air pollution and help the domestic auto industry establish itself at the forefront of the technology. State media has announced an 800,000 target for NEV in 2017 and, with growth in charging facilities and falling manufacturing costs, they could be attractive to consumers.

It remains to be seen if the reduction in subsidies will hinder sales or if, as the government hopes, the NEV segment will be driven by market demand.

As the tax cut on small-engine cars comes to an end, subsidies on electric vehicles are cut and the broader economy slows, 2017 could be a tough year for the auto industry in China.

In North America a record 17.55 million light-duty vehicles were sold in 2016. While two-thirds of these sales were passenger cars, low fuel prices saw sales of compact and mid-sized vehicle fall, as customers opted for larger pickup trucks, SUVs and crossovers. Light-duty sales are forecast to continue to grow, but the current timeline for the introduction of tighter fuel economy and emissions legislation means we could expect a change in the vehicle market.

OEMs are introducing more and more environmentally conscientious technologies, although to date consumers have been slow to respond.

Hybrids are currently the most popular amongst the alternative fuel vehicle (AFV) categories. This is broadly because the price penalty for hybrids is less than other AVs and there is greater model variety. However, sales were down by 9.7% in 2016 and, with 347,029 sales, the technology represents only 2% of the total light-duty market.

Sales of battery and hydrogen fuel cell electric cars reached just over 85,000 in 2016 and sales of plug in electric vehicles reached almost 73,000. These figures might be up on 2015, but they are still way behind target. The US government has announced investment in an electric infrastructure, and a number of vehicle manufacturers have agreed to work together to jump-start additional charging stations on the main travel corridors. This activity may finally spark the electric vehicle market, although sales are likely to be slow to materialise.

For the coming years it looks highly likely that North American consumers will continue to choose vehicles at least partially powered by a gasoline internal combustion engine.

In 2016, absolute diesel sales increased in Europe compared to 2015

In 2016, absolute diesel sales increased in Europe compared to 2015Europe has seen the third consecutive year of growth, with passenger car sales up 5.4% from 2015. While sales were up in most countries, Italy and Spain were particular hot spots, both experiencing double digit percentage growth.

Many had predicted the ‘dieselgate‘ scandal to have a large negative impact on the region’s diesel passenger car sales. Yes, there has been a slight decline in market share, but not as significant as many expected.

Petrol vehicle sales grew from 43.7% of the market in 2015 to 45.8% last year and, over the same period, diesel’s share fell by about two percentage points to 49.5%. However, absolute diesel sales still increased compared to 2015.

2016 also saw an increase in sales of hybrid, electric and other AFVs with over 609,000 new registrations. Most uplift was from hybrid electric vehicles, which were up over 27% from the previous year. Electrically chargeable vehicles took second place in the AFV segment - proving to be more popular than cars running on liquid petroleum gas, natural gas or E85. However, AFVs still only represent 4.2% of new EU passenger car registrations.

The absence of incentives or mandates means that, for the foreseeable future, consumers are highly likely to continue to choose vehicles that are at least partially powered by an internal combustion engine. It will however be very interesting to watch the diesel/petrol split for new vehicle sales over the coming years.

According to the latest figures from Society of Indian Automobile Manufacturers (SIAM), domestic passenger car sales reached record levels in 2016/17 surpassing the three million mark – up 9.23% on the previous financial year (FY). This positive trend continues, with passenger vehicle sales maintaining their growth streak during April 2017, which means FY '18 is starting on a promising note. However, it must be said that two-wheels still dominate this market, with the SIAM’s latest figures showing over 17.5 million two wheeler sales in 2016/17.

The Indian government is currently working on ways to incentivise consumers to purchase electric vehicles with a target to have a 100% electric car fleet by 2030. However, end users have shown little interest so far, most likely due to the lack of basic infrastructure to support electric vehicles.

In Brazil, tough economic times have slowed car sales, which fell by 21% to 1.68 million in 2016. Tight credit, rising unemployment and continued economic uncertainty mean this picture could continue. In the current Brazilian fleet, flex or gasoline fuel cars prevail. The introduction of electric and hybrid vehicles requires significant investment in technology and infrastructure and is highly dependent on government incentives.

Over in Japan, car sales have fallen slightly, with most of the decline reflecting a shortfall in the minicar segment. The two most popular cars in 2016 were both both hybrids, together accounting for 10% of total passenger car sales.

To meet ever tightening emissions and fuel economy mandates, OEMs need to develop cleaner and greener vehicles that consumers want to drive.

Clearly we are entering the era of powertrain electrification, but it is likely to be a long and evolutionary journey.

Consumer reticence means full electrification is unlikely to become commonplace in the near future. Forecasts suggest that by 2025 more than 90% of passenger cars will still contain an internal combustion engine. And, even beyond this point, advanced conventional technology will still have a strong role to play in future mobility solutions.

The emergence of advanced hardware will offer significant opportunities to create fluids of very high value to fluid developers, marketers and automotive OEMs. However, collaboration early on in the development cycle will be essential to ensure maximum value generation for all industry stakeholders.

Sign up to receive monthly updates via email