Future of Mobility

ASEAN a market in transition

09 December 2025

05 November 2024

Launching the ‘Future of Mobility’, an Infineum initiative on powertrain trends, designed to support global fluid formulators

Undoubtedly, decarbonisation and sustainability are the biggest factors driving vehicle OEMs to introduce new technology. However, regional differences in regulations, terminology and the pace of change can make future scenario planning challenging for fluid developers and marketers trying to support these new systems. That’s why Infineum is launching the ‘Future of Mobility’ Insight resource that aims to help organisations making strategic business decisions in this area. The new resource will take a deep dive into personal mobility trends and set out a view of the various drivers for change and rate of technology adoption globally and in different regions.

The automotive industry is currently undergoing perhaps the most significant transition since Henry Ford revolutionised the industry with the mass production of the Model-T more than 100 years ago. The overall drivers for change today are a globally recognised need to create a more sustainable world and to reduce CO2 emissions from transportation to help combat global warming.

These drivers are rewriting the selection criteria for the powertrains of the future and have the potential to shake up the traditional power structures in the global automotive industry.

The main focus to date has been on electrification, and we’ve seen wide reporting of success stories about the growing share of electric vehicles. However, something that tends to be overlooked or masked in the electrification euphoria is the ongoing and important role of the internal combustion engine (ICE). Establishing a common understanding of the future powertrain mix is complicated by the countless reports and forecasts on this topic.

To help clarify the picture, Infineum is monitoring the automotive transition in our new ‘Future of Mobility’ Insight resource, where we will be keeping a close eye on the life expectancy of the ICE.

Let's be clear, Infineum relies on the data and forecasts from third parties. The added value we will bring is a deep dive into the regional drivers for fleet transformation along with Infineum's interpretations of the impacts to the regional and global transitions. This feature lays some groundwork, subsequent articles will look at the different regions in more detail.

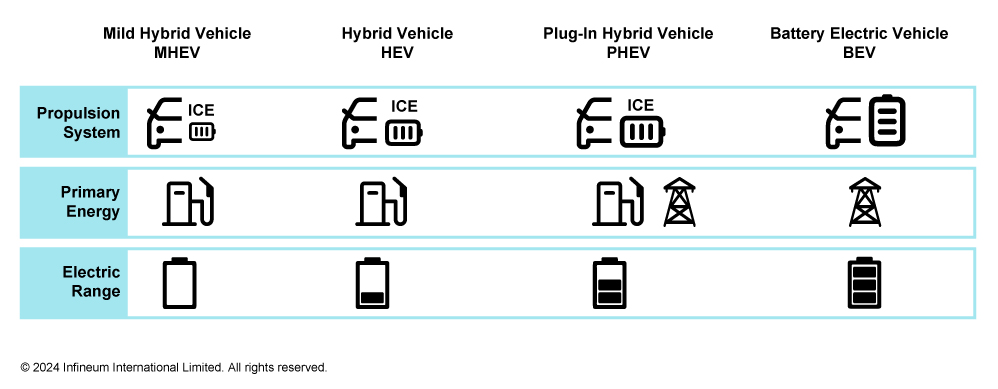

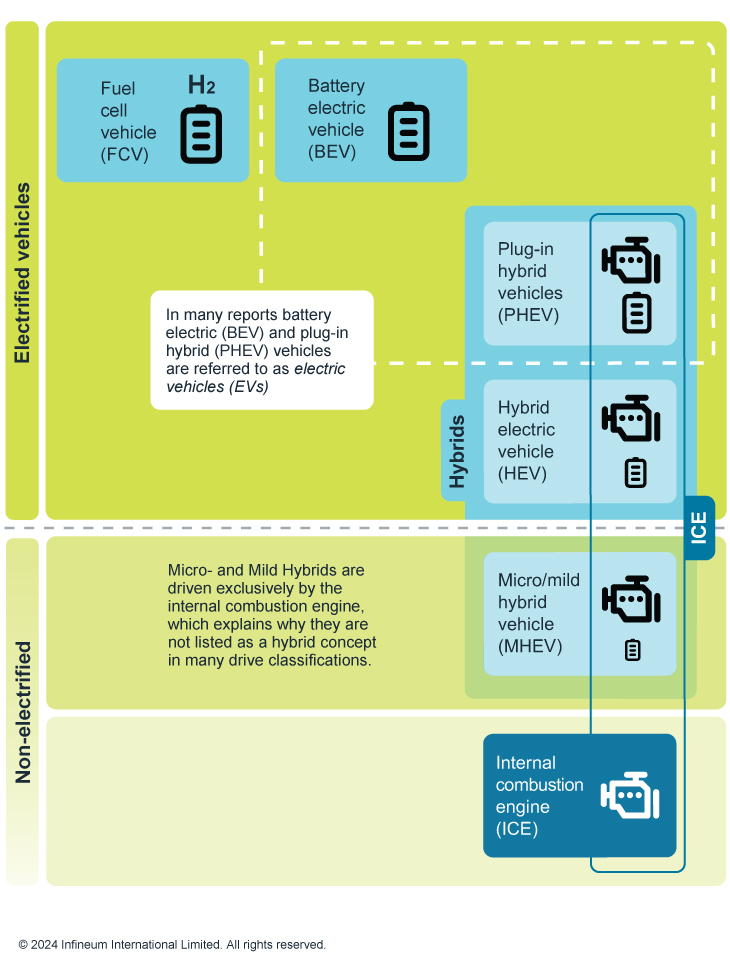

On the extreme ends of the scale, the distinction between non-electric vehicles and electrified vehicles is clear. Vehicles exclusively propelled by an internal combustion engine are at one end of the scale and fully battery electric vehicles at the other. However, there is a large middle ground of electrified vehicles where this distinction becomes blurred and even confusing.

The United Nations Economic Commission for Europe (UNECE) World Forum for Harmonisation of Vehicle Regulations provides some helpful definitions:

While the UNECE vehicle propulsion system definitions are a good starting point, other acronyms are more popular:

Micro Hybrids (Start-Stop) are the first step towards hybridisation, they come with an electrical machine in place of starter motor and generator. The engine drives the vehicle mechanically. The motor generator can act as a starter motor and an overrun generator to charge the battery. The automatic start-stop system can be used to recuperate braking energy and store it in the battery. Micro hybrids typically have a classic 12 volt battery.

Mild Hybrids extend the features mentioned above, they usually run on a 48 volt electrical system and allow electric boost for vehicle take-off and acceleration. Because of the higher voltage, a mild hybrid can recuperate more braking energy than a micro hybrid.

However, like micro hybrids the vehicle is driven exclusively by the internal combustion engine, which explains why micro and mild hybrids are not listed as a hybrid concept in many drive classifications.

HEVs are also known as ‘full hybrids’. They can be further classified by the hybrid configuration, primarily distinguished between serial- and parallel-hybrids. In the former, the vehicle is propelled by the electric motor only, in a parallel configuration both combustion engine and the electric motor are connected to the drive. The power-split hybrid is a combination of serial and parallel hybrids. In this hybrid, the power of the combustion engine is divided into a mechanical and an electrical component.

Depending on the configuration, the engine and battery can run independently or seamlessly together. The energy from the battery can be used to propel the vehicle, usually only for a short distance. The engine is used as a standalone power source providing extra power to supplement the electric motors whilst driving, and as a generator to recharge the batteries.

PHEVs are full hybrids, but they can be charged from an external supply. In comparison to HEV vehicles, they typically come with a higher capacity battery pack, which allows all-electric driving for longer.

BEVs run on electric energy only. Battery size and advancements in battery technology dictate the driving range. Vehicle segment, available space and economics are the key battery design criteria.

Let’s explain the acronyms and where the vehicles fit into the classifications:

While strictly speaking all hybrids are electrified vehicles, you will find that many ‘electrification reports’ cluster Pure Electric Vehicles and Plug-In Hybrid Electric Vehicles as ‘Electric Vehicles’ and the remainder as ICE Vehicles.

Decarbonisation of the transport sector is on the agenda of the international community as it works to deliver on its climate commitments under the Paris Agreement. However, there are different regional government approaches, some more, others less descriptive about the technology options towards net-zero. China, for example, has set a target to become carbon neutral by 2060, with a wide range of technologies acceptable as so-called New Energy Vehicles. In contrast, Europe has a 2050 carbon neutrality target and a declared internal combustion engine ban by 2035.

OEM product managers need to find the best technology fit for regional and global markets.

As the transition towards net zero progresses, there’s unlikely to be a single solution that suits all regions, all transport modes and all end users, which means constant adaptations to the changing environments will be required.

Not only are technology roadmaps subject to constant adaptation but also some government approaches could change, as elections or other forces change the political dynamics. For example, in Europe, the 2035 ICE ban might be revisited in the post 2024 election parliamentary term.

It's challenging for OEMs to keep pace with all these various regulations and to invest in new technology and scale up production capacity to ensure they comply. But, in addition, it is ultimately the customer who decides which technology best fits their needs and budget. For the customer, vehicle CO2 emissions are just one of many vehicle purchase decision criteria to be considered alongside others such as vehicle cost, availability of charging infrastructure and potential government incentives.

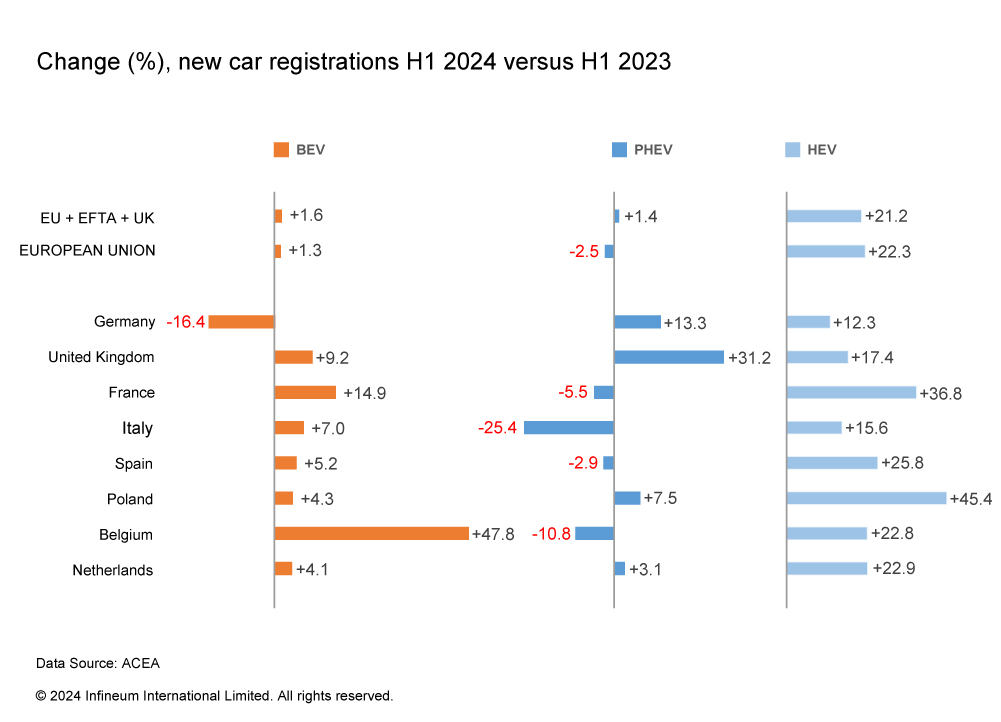

Figures published by the European Automobile Manufacturers’ Association (ACEA) on 2024 January to June new car registrations, for example, show high regional variation in customers’ buying behaviour, while the OEM technology offerings should broadly be the same across these markets.

Given the myriad of potentially changing input factors, it is important we do not simply take third-party long-term predictions about the future powertrain portfolios at face value. Constant monitoring is required to make informed decisions. Over the coming months our ‘Future of Mobility’ resource will develop to give an overview of our analysis of regional powertrain trends.

We can see a multi-fuel, multi technology future and, in order to have the right products ready to service this evolving market, we all need to make data-based decisions today.

Our intelligence is helping to shape our future as a sustainable world class specialty chemicals company. And, we are happy to share our findings.

What do you need to do next? Make sure you sign up to receive our Infineum Insight email which will alert you to new content and follow Infineum Additives on LinkedIn, where we will also publish updates on a regular basis.

Sign up to receive monthly updates via email