Passenger cars

ASEAN a market in transition

09 December 2025

22 January 2025

CO2 emission regulations drive change in the European automotive sector amid economic challenges and uncertainty

The European automotive industry is entering a period of unprecedented change shaped by emissions reduction regulations and sustainability ambitions at a time when strong global competition along with economic and regulatory pressures are increasing uncertainty. Uwe Zimmer, Infineum Industry Liaison Strategy Advisor, explores how, against this backdrop, OEMs are working to meet upcoming EU carbon reduction targets, which are driving the market towards electrification, in a market where consumer demand for full electric vehicles appears to be waning.

Our first Future Mobility Hub article said it already, ‘the automotive industry is currently undergoing perhaps the most significant transition in its history’.

Automotive news is dominated by reports on the economic difficulties faced by many OEMs, especially the traditional big players. A common theme is the upheaval in the automotive industry, owing to the transition from fossil energy fuelled propulsion to ‘carbon free’ propulsion. Technology change is not the only factor in this capital intensive industry, with increasing global competition, up and coming new big players, and diverse and demanding customers, being just a few examples of the many additional factors in play.

The European automotive sector is navigating a very complex landscape marked by carbon reduction targets, modest consumer appetite for full electric vehicles (EVs), strong global competition and economic and regulatory uncertainties.

The European Automobile Manufacturers’ Association (ACEA) has repeatedly expressed concerns about the pace of the transition, urging policymakers to consider economic realities. Stellantis has warned that the financial viability of European automakers is under threat due to high EV development costs, the lack of scale in EV manufacturing, and supply chain constraints.

Volkswagen's current difficulties exemplify the challenges of transitioning to EVs. The company is facing a crisis with declining sales and shrinking market share, attributable, among other internal issues, to economic pressures. High energy and labour costs in Germany, compounded by slowing demand for EVs in Europe, have forced Volkswagen to consider factory closures and cost cutting measures.

But, Volkswagen is not on its own, many other OEMs are struggling, and these crises draw wider circles. For example, Bosch, the world's largest car parts supplier, has announced staff reduction schemes that, according to Reuters, put around 8,000-10,000 jobs at risk in Germany.

EV uptake in Europe is slower than had been expected, which poses a significant challenge for the European automotive industry.

Let’s first take stock of the current market situation before we look closer at the underlying drivers.

At the time of writing, the 2024 full year registration figures were not yet available from ACEA. Comparing vehicle registrations up to and including November, the market in the European Union is relatively flat.

Narrowing down on the propulsion systems, the combined share of battery electric vehicles (BEV) and plug-in electric vehicles (PHEV) remains at the 20% mark.

The data published by ACEA to date indicate a slight year-on-year drop in BEV registrations. Affordability issues, range anxiety and a lack of sufficient EV infrastructure are often cited as barriers for wider consumer acceptance of BEVs.

European countries show varied progress in their transition to being carbon neutral passenger vehicle markets. The adoption rates for BEVs and PHEVs reveal sharp contrasts influenced by national policies, infrastructure availability, and economic factors.

Nordic countries: high EV adoption. In Norway, a non-EU member, 89% of new car sales are fully electric, and the combined EV (BEV + PHEV) share is 92%, thanks to robust incentives, high taxes on fossil fuel cars, and extensive charging infrastructure. Sweden followed by Denmark and Finland also have high EV market shares, driven by aggressive government subsidies, green taxation frameworks, and strong consumer environmental awareness.

Western Europe: growth but regional gaps. In Netherlands and Belgium, EVs make up 47% and 44% of new registrations, respectively, followed by Luxembourg and Malta both at 36%, supported by purchase subsidies, urban emission zones, and automaker investments. The UK, despite its exit from the EU, has maintained momentum with its zero-emission vehicle (ZEV) mandate.

Southern and Eastern Europe: lower adoption rates. Countries such as Italy, Spain, and Poland have lower adoption rates for BEVs and PHEV, often below 5–10% of new sales. Economic constraints, limited subsidies, and underdeveloped charging networks are primary barriers.

The high regional variation in EV shares seems to suggest some countries are smarter than others when it comes to incentivising EV adoption, although we should not lose sight of the absolute figures. For example, countries such as Germany, UK and France have many times higher absolute EV registration figures compared to Norway.

Individual reporting months with significantly higher EV registrations (Dec. 2022 and Aug. 2023) and high EV shares in some European countries suggest that customers are willing to go electric if the conditions are right.

This can also be seen in other regions, as reported in Infineum’s recent Future of Mobility Article about China, with an anticipated NEV market share already over 40% by close of 2024.

After leaving the European Union, the United Kingdom needs to be considered separately. With the above-mentioned ZEV mandate the UK takes a slightly different path than the EU. The ZEV mandate requires 80% of new cars and 70% of new vans sold in Great Britain to be zero emission by 2030, with a goal of reaching 100% by 2035.

The European Union has a target for climate neutrality by 2050 and an intermediate target of reducing net greenhouse gas emissions by at least 55% versus a 1990 baseline by 2030. The ‘Fit for 55’ package puts measures in place to meet the 2030 targets.

The EU's Regulation (EU) 2019/631 represents the most direct policy tool in shaping the decarbonisation of Europe’s automotive sector. It regulates tank-to-wheel fleet average CO2 for new vehicles, complemented by incentives for low or ZEVs and mandates a progressive reduction in fleet-wide CO2 emissions, aiming to achieve a 100% reduction by 2035.

The regulation effectively bans the sale of all vehicles with internal combustion engines (ICE, HEV, PHEV) unless they are powered by synthetic fuels.

The share of ZEVs is not directly regulated. However, there are ZEV incentives and, to meet the progressively tighter fleet average CO2 targets, increasing the share of ZEVs is imperative.

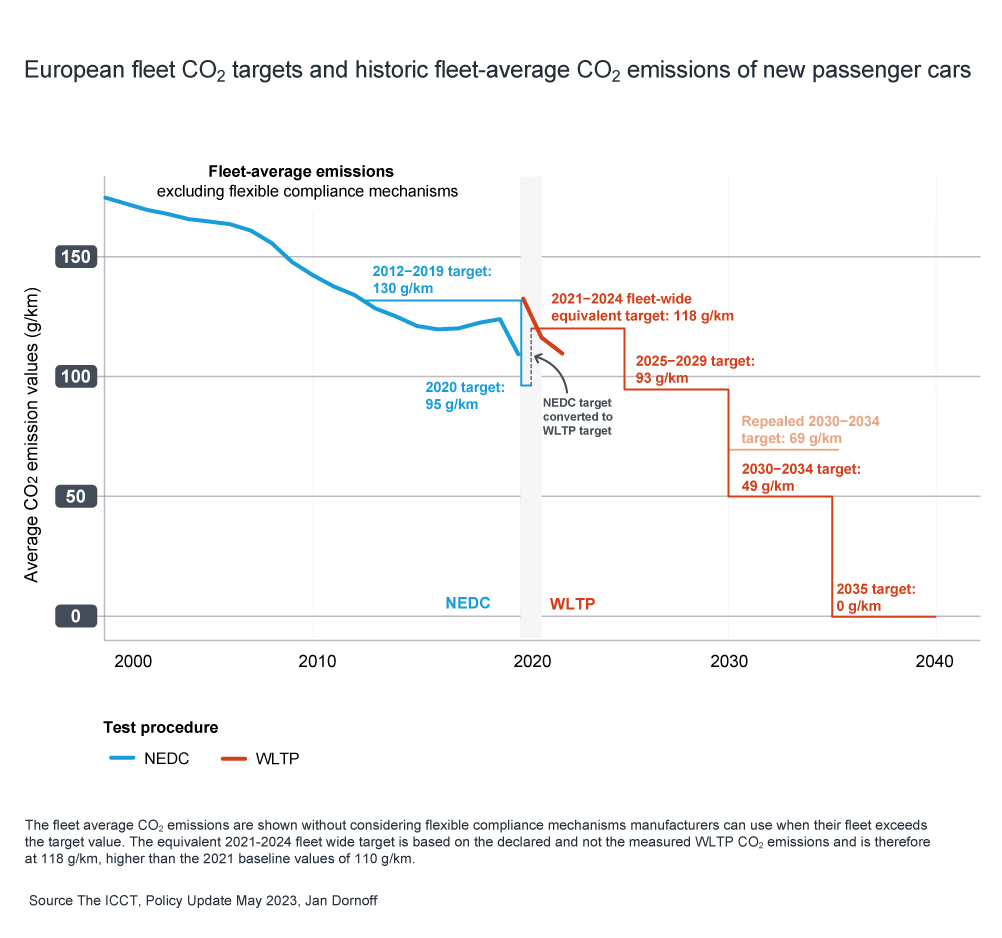

Regulation (EU) 2019/631 set a fleet-wide target of 95g CO2/km for the years 2020-2024 for new passenger cars, based on the New European Driving Cycle (NEDC) emission test procedure. This is equivalent to 115.1g CO2/km when using the Worldwide Harmonised Light Vehicle Test Procedure (WLTP).

To help achieve the EU’s climate targets, in 2023 the Commission Implementing Decision (EU) 2023/1623 set stricter EU-wide fleet CO2 targets (WLTP):

In 2026 the EU Commission will assess, among other aspects, if a revision of the 100% CO2 reduction target for 2035 is necessary and evaluate the impact of introducing energy efficiency requirements for ZEVs.

Chart above licensed under a Creative Commons Attribution 4.0 International license.

The 2020 to 2024 applicable limits, as well as the 15% reduction in 2025, were already defined in 2019. While one would intuitively think OEMs aim to gradually prepare for the 2025 targets, in fact, many OEMs are just meeting the 2023 targets. Preliminary 2024 data confirm this trend, and many OEMs need to make a step change in 2025.

The step change 15% tightening of fleet-wide CO2 targets in 2025 is seen as a pivotal moment for the industry, requiring automakers to significantly ramp up BEV and PHEV sales.

Chart above licensed under a Creative Commons Attribution 4.0 International license.

Failure to comply results in fines of €95 per g/km of target exceedance, for each new vehicle registered in that year. For example, if an OEM delivered four million passenger cars in the EU and exceeded the target by only 1 g/km their fine would be a staggering €380 million.

It’s estimated that on average a 12% increase in the BEV share of new EU car sales is required to meet the EU’s 2025 CO2 fleet targets for passenger cars. Ford and Volkswagen are the furthest away from their 2025 targets with an estimated gap of 25 g/km each. It is further estimated that they would have to increase the BEV share in new sales by at least 17% versus 2023 to comply with the 2025 CO2 targets. Though, as shown above, the EU electric car market is at best stagnating, if not on a downward trajectory.

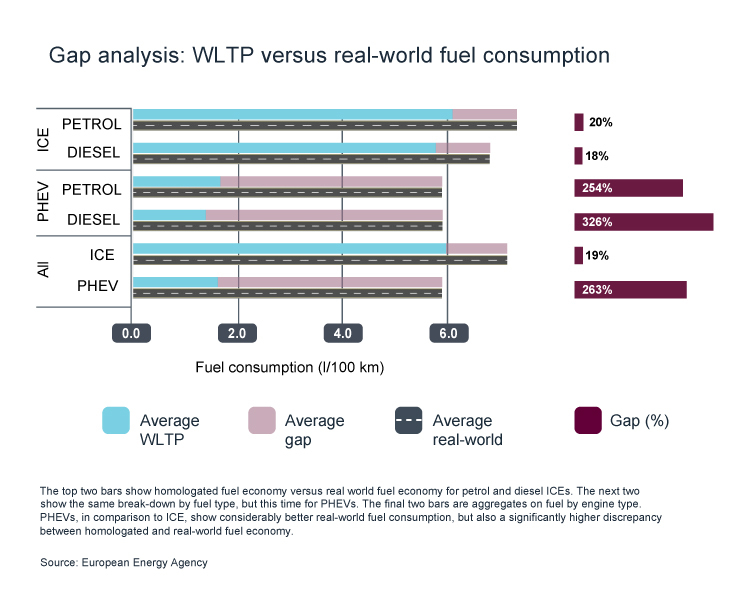

CO2 regulation reviews. EU vehicle CO2 legislation requires the effectives of the regulation to be monitored to prevent regulated and real-world CO2 drifting (further) apart.

The monitoring of real-world emissions of passenger cars aims to ensure that the CO₂ emissions of vehicles determined during laboratory testing remain representative of real-world emissions of vehicles in circulation. The procedures for collecting and reporting the real-world data from onboard fuel consumption monitors and for comparing it with the corresponding laboratory WLTP data are set out in Regulation (EU) 2021/392.

The chart below shows the main results of this monitoring exercise for the second reporting year based on the data collected and reported by manufacturers that covers new vehicles first registered in the EU in 2021 and 2022.

Life cycle CO2 emissions. By end of year 2025, the Commission will publish a report setting out a methodology for the assessment and the consistent data reporting of the full life cycle CO2 emissions of passenger cars and light commercial vehicles.

Progress report. By end of year 2025, and every two years thereafter, the Commission shall submit a report on the progress towards zero emission road mobility, including life cycle emissions of new passenger cars and new light commercial vehicles placed on the market. The report will in particular monitor and assess the need for possible additional measures to facilitate a just transition, including through financial means.

Efficiency review. In 2026, the Commission will review the effectiveness and impact of this Regulation. In particular, the progress made under this Regulation towards achieving the reduction targets set out should be assessed. This should take into account the technological developments, including as regards PHEV technologies, and the importance of an economically viable and socially fair transition towards zero emission mobility. Based on that assessment, the Commission shall assess the need to review the targets set out.

The 2035 target for a 100% reduction in CO2 emissions effectively bans all types of vehicles that include an ICE in Europe, except for vehicles running solely on e-fuels. This has spurred ongoing discussions between automakers and policymakers, particularly regarding exemptions and adjustments that could make the transition smoother.

Automakers warn that without adequate support, Europe's automotive sector could lose its competitive edge globally.

We have already noted the concerns expressed by ACEA and Stellantis about the pace of the transition. Meanwhile, Renault and BMW are navigating similar hurdles, where high R&D investments, particularly in BEVs and PHEVs, are being offset by lower than expected returns in the early stages of market adoption. All of these companies are urging EU regulators to take a more measured approach, including calls for extending deadlines or adjusting the 2025 target.

As outlined in the previous section, the EU vehicle CO2 legislation includes provisions for review and adjustments, auto manufactures are now urging the European Commission to bring forward the CO2 regulation reviews, currently scheduled for 2026, to 2025.

Compared to other regions of the world, where CO2 reduction targets are largely technology neutral, European regulators are taking a radical path, with the decision to phase out combustion engines in 2035. This course of action brings with it a number of issues, which are challenging to overcome - particularly in such difficult market conditions.

Pressure for the EU to rethink this strategy is mounting. For example, the European People's Party (EPP), which is the largest political group in the new European Parliament, says it wants to tackle the growing crisis in the European car industry by revising this planned ban on combustion engines. The EPP’s positioning paper published in December 2024, says The Group supports the proposal of the President of the Commission to open a strategic dialogue on the future of the automotive sector. It also sees the following immediate and long-term measures as key for preserving a globally competitive industry, whilst achieving climate neutrality by 2050.

In addition the EPP proposes that the EU should accelerate infrastructure roll out, improve supply chain resilience, promote innovation and simplify the regulatory framework.

ACEA says with the 2025 clock ticking, manufacturers face mounting challenges in meeting CO2 reduction targets due to sluggish demand for battery electric vehicles and a deteriorating economic climate. The Association says it welcomes the EPP’s proposed list of conditions for competitiveness and enabling conditions, and pragmatic efforts to ease CO2 compliance challenges for light-duty vehicles. It also strongly supports the EPP’s call for additional flexibilities within the CO2 regulation to enable manufacturers to achieve compliance.

Trying to predict the outcome of this would be pointless. However, we can share our view on potential moves:

In the longer term, a move away from tank-to-wheel based legislation towards cradle-to-grave based legislation seems to be the most appropriate approach. The Commission’s report on life cycle CO2 emissions is eagerly awaited.

In the short and medium term, it is to be hoped that regulators will focus on specifying the goal rather than the path. A comparable level of technological openness as in other regions of the world would allow automobile manufacturers to develop global product strategies to reduce CO2, instead of having to take a special path for Europe.

Take PHEVs as an example, while there is a gap between real-world fuel economy and WLTP fuel economy, a PHEV purchased in 2023 produces around 30% less emissions than conventional ICE vehicles over the course of their lifetime.

Under current European CO2 legislation, a strategy of scaling up PHEV manufacturing now, only to shut it down in 2035 when the ICE ban takes effect, seems highly unremunerative.

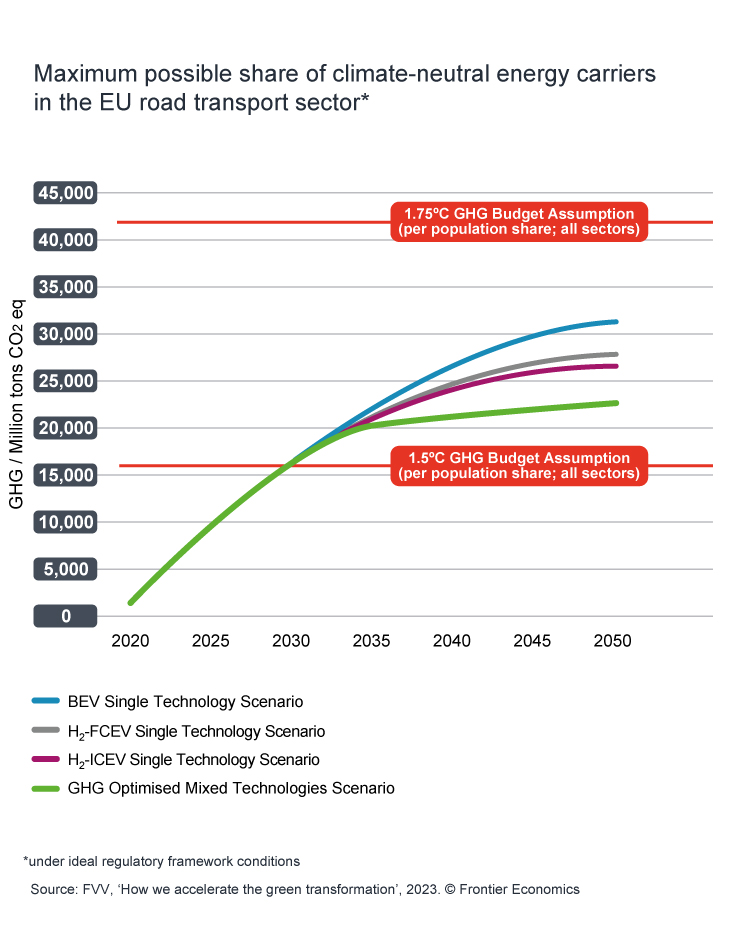

Furthermore, it may be questioned whether the sole focus on battery electric vehicles is the optimal path for the transformation.

Nature teaches us that monocultures are vulnerable, and diversity ensures survival. There are also scientific studies on the decarbonisation of the passenger car segment that indicate diversification accelerates climate neutrality. Reports also suggest that under ideal regulatory conditions, diversification could even help to achieve the 1.5 °C target faster.

Policy makers should not lose sight of the actual prime energy mix that powers electric vehicles. In the EU, available data for 2023 shows that almost 60% of electricity was produced from non-renewable power sources including fossil fuels and nuclear. Again, the Commission’s report on life cycle CO2 emissions is eagerly awaited.

We will watch with interest to see how the situation evolves as the industry works to keep the green mobility transformation on track, while also ensuring the resilience of the EU vehicle sector.

Clearly, the transition to carbon neutrality brings both challenges and opportunities across the automotive, lubricants, fuels and transportation additive sectors. Infineum is continuing to work closely with industry stakeholders to help ensure the success of the industry transition and is committed to enabling the adoption of greener technologies. If you have any questions or need further details, feel free to ask.

Don’t miss our next Future of Mobility article that will focus on the personal mobility trends in North America.

Sign up here to receive email alerts so that you never miss out on new content from Infineum - and make sure you follow Infineum Additives on LinkedIn.

Sign up to receive monthly updates via email