Marine engines

OEMs outline challenges ahead

08 December 2025

04 April 2016

Impacts of meeting the tightening sulphur emissions limits

As the International Maritime Organization (IMO) continues its drive to reduce sulphur emissions from ships, Insight examines the effect of current and future measures on lubricants and fuels.

IMO’s Marine Environment Protection Committee (MEPC) is tasked with the introduction of measures to prevent and control the pollution caused by ships. MARPOL Annex VI, first adopted in 1997, limits the main air pollutants contained in the exhaust gas, including sulphur oxides (SOx).

The reduction of sulphur has been high on the agenda for some time and, since 2008, sulphur limits in open waters have fallen from 4.5 to 3.5% - a drop that did not preclude the use of heavy fuel oils (HFO). In the next decade the sulphur level at sea is set to fall again from 3.5% to 0.50%.

Sulphur limits continue to fall

However, this change will require significant investment and, because there are some concerns about the readiness of refiners and ship owners to meet the new target, there is some uncertainty about the exact implementation date.

MEPC has agreed the terms of reference for a review of the availability of fuel oils that meet the new sulphur target.

A Steering Committee consisting of 13 Member States, one intergovernmental organisation and six international non-governmental organisations has been established to oversee the review. Depending on the outcome of this feasibility review, which is to be completed no later than 2018, the requirement to cut sulphur to 0.50% outside emission control areas (ECAs) could be postponed five years to January 1 2025.

In coastal waters that have been designated as ECAs sulphur was cut by a factor of ten in January 2015 to 0.10%, and right now there are no plans on the table to reduce this further. This huge change means ships entering these waters that burn HFO at sea must now either install scrubbing equipment or switch to low sulphur fuel or liquid natural gas inside ECAs.

The dual and single fuel approaches being adopted to meet these new limits present a number of challenges including cost, availability, reliability and handling.

The successful implementation of a cut from 1% to 0.10% sulphur fuel in ECAs was handled using standard diesel, low sulphur marine gas oil and hybrid fuels. Alternative solutions such exhaust gas scrubbers, liquid natural gas or other alternative fuels were not considered to be economical options, given the low crude price scenario.

The forthcoming reduction of the global sulphur cap from 3.5% today to 0.50% in 2020 or 2025 means we can expect major adjustments in supply patterns and a significantly increased demand on refinery conversion processes handling residual streams.

Current estimates suggest that well over 100 million tons per year of residual fuel will need to be switched to distillate type molecules to meet the requirements of the 0.50% global sulphur cap. That is a significantly bigger step than the introduction of the 0.10% sulphur ECA fuel.

The industry has a number of potential options, the use of low sulphur bunker fuel being one solution. However, we are now less than four years away from the earliest possible implementation date, which is a very short period of time for refiners to decide on and implement major refinery investments to meet changes in fuel quality and demand. This could result in real availability issues of low sulphur fuels.

And, although diesel fuel could be redirected towards the marine market, it is unclear whether the marine fleet will be prepared to pay additional price premiums for low sulphur fuels. In our view, it is likely that the impacts this legislation has on fuel availability will not be limited to the marine world, but will be felt across all sectors and world markets

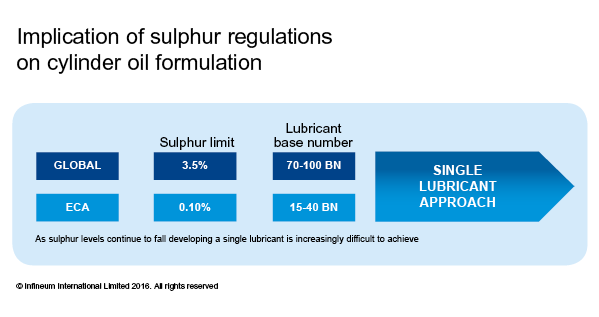

While low sulphur distillates have been used widely in medium speed engines, the new sulphur limits will impact low speed engine lubricant formulations since base number (BN) needs to match the fuel type. High BN is needed for use with high sulphur fuels to neutralise the acids that are produced, while in low sulphur fuels OEMs are looking for lubricants with 40 BN or less.

Ship owners would value a single lubricant, which could provide sufficient protection whatever fuel the vessel is using. But, as sulphur levels continue to fall this will be increasingly difficult to achieve.

In our experience, the wide variety of fuel options means OEMs will typically recommend engine lubricants that are suitable for the most severe fuel in use.

Infineum is already involved in a number of projects with OEMs, ship operators and with fuel and lubricant producers to ensure products, which meet the requirements of all stakeholders, are co-engineered in time to meet these regulatory challenges.

Sign up to receive monthly updates via email