Fuels

Reported sludging incidents rise

04 November 2025

Please note this article was published in May 2015 and the facts and opinions expressed may no longer be valid.

13 May 2015

Emissions regulations look set to spur further China diesel quality improvements

Analysis of the data obtained from diesel fuel samples collected in China for the Infineum 2014 Winter Diesel Fuel Quality Survey indicates that, while there are signs of quality improvement, high variability may be cause for concern as the country moves to tighten emissions regulations.

In December, we reported on the data collected from the 2014 Winter Diesel Fuel Quality Survey (WDFQS), which analysed over 340 diesel fuel samples from 50 countries. However, at the time, we were unable to include the samples collected in China as they were still being analysed. Now the results are available, Insight can present an analysis of these data separately.

Infineum collected 19 diesel fuel samples from a variety of locations in China for the 2014 WDFQS. The fuels were obtained from both urban and rural retail stations in the deep winter months and analysed for 25 different parameters. The results have been used to describe fuel quality trends and to highlight issues that may need to be addressed.

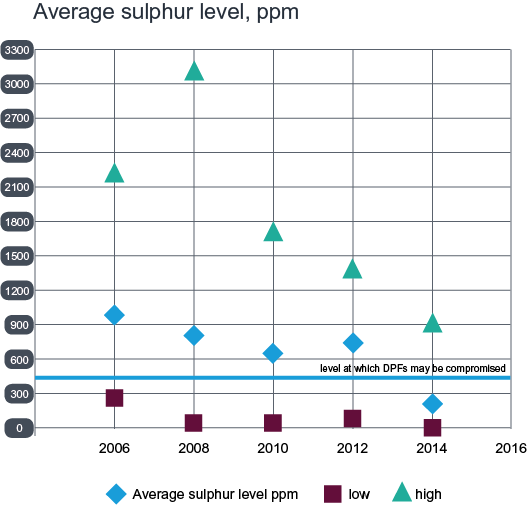

The 2014 data shows a considerable drop in the average sulphur level compared with previous surveys.

However, while some samples, including those from Shanghai and Dalian, have sulphur levels below 10 ppm, one sample collected was found to contain 900 ppm. This huge variation in sulphur content is a real concern, mainly owing to the fact that the performance of certain aftertreatment devices may be compromised if vehicles are fuelled with high sulphur diesel.

High fuel sulphur variability remains between urban and rural locations in China

Our China fuels expert, Henry Shi, explains some of the uncertainty surrounding Chinese diesel sulphur levels. “In some big cities (for example Shanghai, Beijing and Guangzhou) China 5 diesel is available. However, in other areas China 3 or China 4 quality diesel is still being sold. Another important point to make is that China has implemented two standards for diesel. The first is known as ‘automobile diesel’, which covers China 3 to China 5 quality fuels and the second is ‘common diesel’, which contains more than 350 ppm sulphur. The potential for misapplication is a real issue as some service stations sell both grades, mainly because common diesel is far cheaper than automobile diesel.”

China is busy tightening emissions regulations to curb pollution from the more than 240 million vehicles on its roads.

China 4 emissions regulations – equivalent to Euro 4 are being introduced nationwide for diesel vehicles such as light-vans and passenger cars this year and in 2018 we can expect China 5 to be the nationwide standard – a measure that significantly cuts NOx and particulate matter and introduces new requirements for particulate number. In addition, China IV limits, which have been implemented nationwide from January 2015 for heavy-duty diesel vehicles and buses, cut emissions of particulate matter and NOx. These new emissions regulations are driving the introduction of advanced engine and aftertreatment technologies.

Diesel particulate filters (DPF) have been used successfully in some regions of the world to reduce both particulate matter and particulate number. However, over time the filter fills with soot, which if not removed can lead to excessive backpressure and ultimately vehicle failure. The best way to regenerate the DPF is to burn off the soot, and the use of catalytic materials can help by substantially reducing the temperature of soot ignition, limiting its build up and aiding combustion.

However, some systems use platinum group metal-based catalysts, which are notoriously sensitive to sulphur poisoning, making them unsuitable for use with fuels containing high levels of sulphur. And, as we have seen from our Survey data, fuel sulphur levels in China can still be as high as 900 ppm.

Infineum’s iron-based fuel borne catalyst (FBC) technology can successfully regenerate DPFs in low and high sulphur fuels in both new vehicle and retrofit applications.

Experience gained over the past 10 years has demonstrated the benefits of using the Infineum FBC technology for DPF regeneration and in our view it is ideally suited to help OEMs meet the stringent targets set by the latest Chinese emissions regulations.

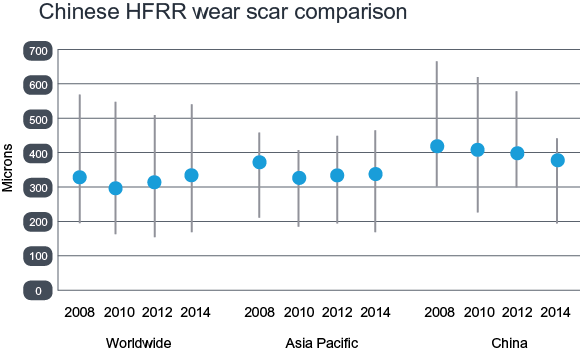

On a global level, the 2012 and 2014 WDFQS reported a stalling of the previously observed downward lubricity trend – something that has been attributed to a backing off in the use of biofuels. However, in China we are seeing the reverse: a continued downward trend, and a general flattening of the HFRR data. In the 2014 samples levels ranged from just over 200 to 439 microns, which means all samples were below the 460 micron local limit. In previous years we have seen spikes at well over 600 microns.

As sulphur emissions limits are tightened hydrotreatment is increasingly used to reduce fuel sulphur levels. This has the knock on effect of lowering the natural lubricity of the fuel. OEMs regard lubricity as a key performance criterion because certain parts of the fuel injection equipment depend entirely on the fuel for lubrication, and fuels with poor lubricity can cause catastrophic levels of wear to fuel injection system components.

As vehicle quality in China continues to improve and fuel sulphur levels fall, proven lubricity additives are required to prevent field performance issues.

Since no FAME is used in China, refineries rely on lubricity additives to ensure low sulphur fuels are fit for purpose in modern diesel engines. Although we have seen some lubricity additive use in Chinese fuels in the past, this is the first year where, owing to the lower HFFR value, we expect all the samples to contain lubricity improvers..

While operational issues have been associated with the use of some acid-based lubricity additives Infineum research has confirmed the use of proven ester-based additive technology results in trouble-free operation.

Some of the CFPP data give us cause for concern in that certain samples do not seem to provide the level of cold flow protection that would normally be expected for the winter months.

Some samples do not seem to allow a large enough CFPP margin over standard winter temperatures

For example, the sample from Beijing had a CFPP of -4°C whereas records show that the minimum daily temperature is -9°C on average in early January, with temperatures at or below -13°C one day in ten.

This is in stark contrast to Korea for example. The mean minimum daily temperature in Seoul is also -9°C in January but the national CFPP specification is set at -18°C maximum, with refineries generally meeting the spec with a wide safety margin, ensuring that protection is provided on even the very coldest days.

In our view it is essential to ensure fuels leaving the refinery have sufficient margin for all controlled parameters.

The investment needed to produce fuels that meet the latest targets will put some Chinese refineries under significant pressure. While the majors are likely to handle the changes fairly easily, smaller outfits may find it difficult to cope, which means variable sulphur fuels could be here for some time to come.

Infineum has been at the cutting edge of fuel additive developments for seven decades. And we are continuing to invest in new manufacturing and technology facilities to support our global customer base. Our new business and technology centre in Shanghai opened in July 2014, and now we are finalising the construction of the first phase of a new manufacturing facility in Zhangjiagang.

Part of our technology leadership role is to advise customers and OEMs on the quality of diesel fuels across the globe – something we will continue to monitor via the biennial WDFQS.

Download the full 2014 Infineum Winter Diesel Fuel Quality Survey

Sign up to receive monthly updates via email