Commercial vehicles

PC-12 on track for 2027

26 August 2025

28 May 2024

Assessing the potential impacts of new emissions regulations on vehicle hardware and automotive engine oils

To help meet the European Green Deal's zero-pollution ambition the European Commission proposed tough Euro 7 emissions standard for new cars, vans, trucks and buses sold in the European Union. Following significant changes from the first draft to the final version, which was adopted by the Council on April 12 2024, Infineum’s Uwe Zimmer and Mourtaza Taheraly share their views on the impacts the new regulation may have on future light-duty and heavy-duty engine lubricants.

The Euro 7 proposal was first published by the European Commission (EC) in November 2022. Its aim was to reduce pollutant emissions from light and heavy-duty vehicles and to improve air quality. The initial proposal was very ambitious, aiming for maximum emissions reduction, but perhaps losing some sight of statistical relevance and affordability. In its journey through the ordinary legislative procedure the proposal has been the subject of much discussion between the different participants, which has led to significant change.

In December 2023, following several months of debate, the European Parliament and the Council reached a provisional agreement for the Euro 7 framework. On March 13 2024, with 297 votes in favour, 190 against and 37 abstentions, the European Parliament adopted the deal reached with the Council on the Euro 7 regulation. Following the Council’s approval of the European Parliament's position on April 12 2024, the legislative act has been adopted.

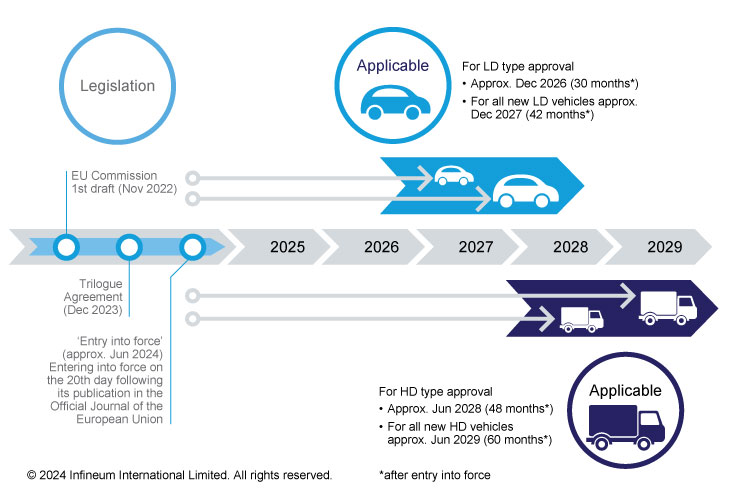

After being signed by the President of the European Parliament and the President of the Council, the regulation will be published in the Official Journal of the European Union - entering into force on the twentieth day following its publication.

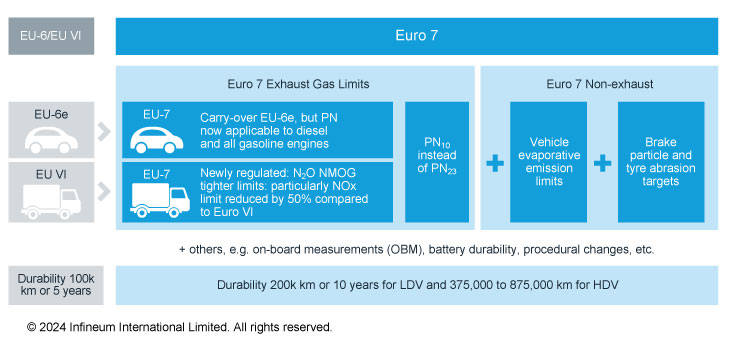

As expected, this last agreement differs substantially from the initial version. Cars and vans will now retain Euro 6 test conditions and exhaust emissions limits. Trucks and buses will be subjected to stricter limits for exhaust emissions measured in laboratories and real driving conditions, while keeping the current Euro VI testing conditions.

The timings initially proposed by the commission have been revised, and now include staged timings for new type approvals and new vehicle approvals. Assuming prompt publication in the Official Journal of the European Union, the following timelines would apply.

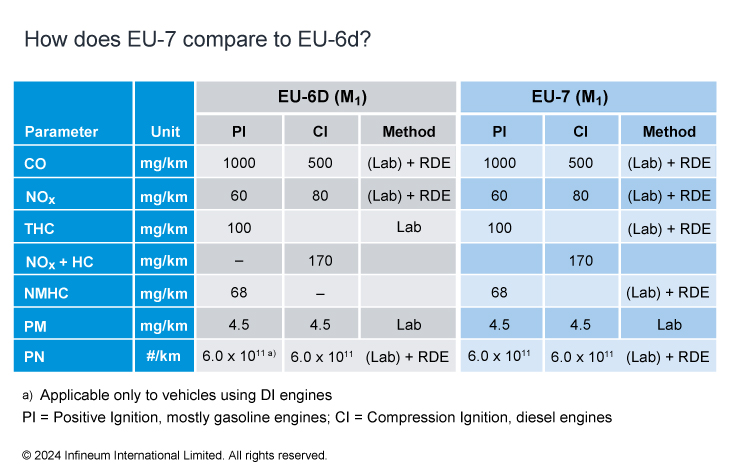

The final version of Euro 7 does not increase emissions severity for passenger cars, the anticipated ammonia limit has not been applied, nor has the severity of Euro 7 real driving emissions (RDE) duty cycle vs Euro 6 been increased.

However, some significant changes are not immediately obvious:

It is unlikely that Euro 7 will have transformative impact on light-duty engine oil lubricant formulations. Existing platforms should remain largely effective for Euro 7 light-duty vehicles, while evolving with other emerging needs such as sustainability and specific OEM requirements.

The only important change is the reduction of particle size (10 nm instead of 23 nm, more details above), which will generalise the use of gasoline particulate filters (GPF) on all types of gasoline engines - port fuel injection (PFI) and gasoline direct injection (GDI). More performant particulate filters might require lubricants with reduced sulphated ash phosphorus and sulphur (SAPS), with established mid-SAPS deemed suitable.

To better control particulate emissions, especially for sizes between 10 nm and 23 nm, oil viscosity and volatility might be more scrutinised. This comes in addition to the fuel economy trade-off and could almost prevent the further emergence of ultra-low viscosity grades.

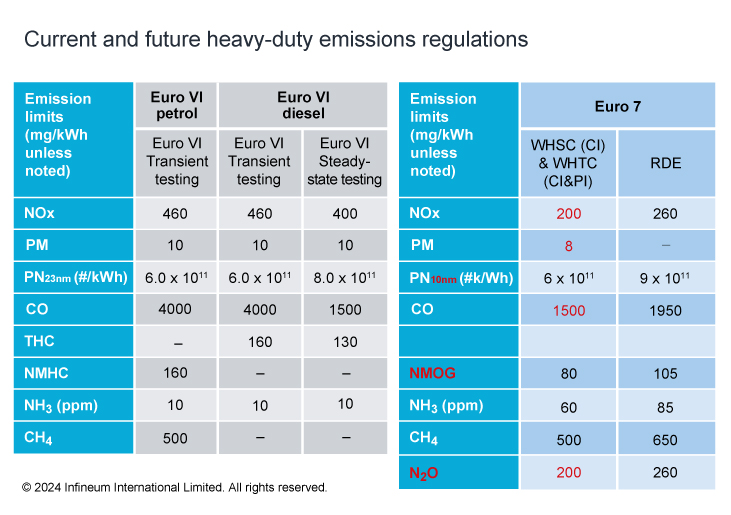

Comparing Euro 7 to Euro VI for heavy-duty vehicles is not straightforward but, as shown in red, some new and tighter limits have been introduced.

Comparatively, these new heavy-duty vehicle regulations are more stringent than those for light-duty vehicles. In addition, since heavy-duty vehicles are more challenging to electrify than smaller modes of transport, the internal combustion engine (ICE) is expected to be the powertrain of choice for many years to come. As a result it is likely that Euro 7 will drive substantial changes and bring new technologies to the market.

In our view one of the biggest challenges will come from the 50% reduction in NOx emissions. We can expect OEMs to use more complex emission aftertreatment systems (EATS) with one or two selective catalytic reduction (SCR) systems, the potential for electrically heated catalysts (EHC) and closed coupled diesel oxidation catalyst (ccDOC). In addition, cylinder deactivation for fast aftertreatment warm up and fuel economy improvement could be more widely adopted. In our view, the wide variety of available options and configurations means EATS design is likely to become more fragmented across the different OEMs. These hardware changes may drive the use of lower SAPS lubricants.

The particulate number will require improved filtration systems and maintaining their efficiency will be imperative. Balancing lower viscosity requirements for fuel economy vs associated increased volatility will be important. EATS compatibility will also be important, with a possible interest in novel antiwear and cleanliness components with reduced ash. Ammonia and nitrous oxide (N2O) emissions will also increase the complexity of the aftertreatment system, again putting a focus on lubricant/EATS compatibility.

As already mentioned for light-duty vehicles, the more stringent durability requirements mean that the focus could be expected to shift towards aged EATS compatibility. In addition, poisoning of new sensors used for onboard monitoring could also put the lubricant under higher scrutiny.

We can expect OEMs to initially prioritise the design and validation of Euro 7 hardware and calibration strategies. Looking further ahead, it is likely that engineering and cost optimisation initiatives could include the engine oil.

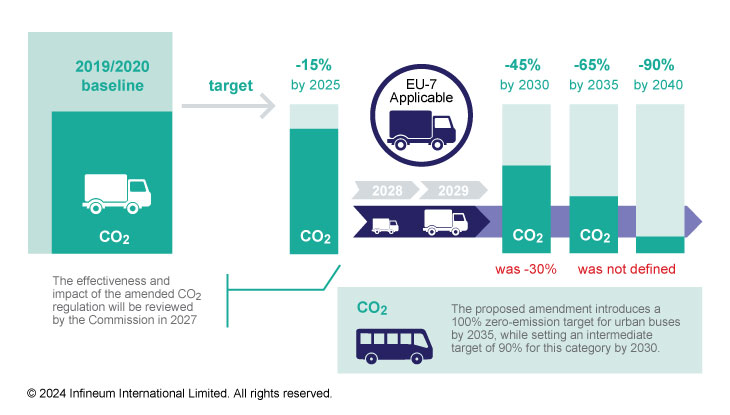

On January 18 2024, just one month after the agreement on Euro 7, the European Council and the European Parliament reached a provisional political agreement on CO2 emission standards for heavy-duty vehicles. Overlaying the Euro 7 timeline and the heavy-duty CO2 reduction targets in the diagram below highlights the challenge facing OEMs.

Compliance with both Euro 7 and CO2 regulations gives OEMs the ‘license to operate’. However, we can expect that compliance with Euro 7 will require OEMs to temporarily reallocate some resources back to ICE technology improvements. While electrification is progressing, OEMs will need to continue selling ICEs to maintain or grow their revenues to help fund the expensive electrification of their portfolio as they work to decarbonise.

Infineum’s impact assessment clearly shows that lubricants have a role to play in the Euro 7 context. Advanced Euro 7 compliant ICE technology will need to be supported by advanced lubricant technologies, but neither can be developed in isolation or overnight. Infineum is committed to working with its OEM and industry partners to address the challenges ahead for a more sustainable future.

Sign up to receive monthly updates via email