Future of Mobility

Challenges ahead for US automakers

04 March 2025

25 March 2025

India sets ambitious electric vehicle sales target on route to net zero carbon emissions by 2070

India has announced its ambition to achieve net zero carbon emissions by 2070 and, to help it get there, has set interim milestones including a 30% electric personal mobility vehicle sales target by 2030. In this fast growing vehicle market, Jeenal Patel, Infineum Industry Liaison Advisor, looks at the drivers and barriers to passenger car electrification, the impact of consumer behaviour and some of the factors that he expects to influence the market in the coming years.

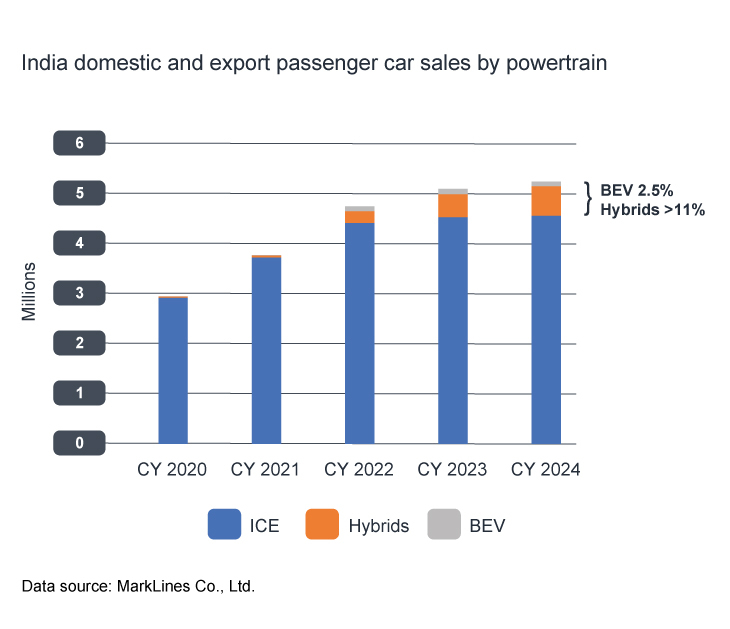

Following the post-Covid slump, the passenger car market in India has grown quickly, reaching more than 4.2 million domestic sales in 2024 – up almost 8.5% on the previous year with sales exceeding five million when export sales are included. In total just short of 30 million personal mobility vehicles were sold in India last year. Passenger cars accounted for less than 20% of sales in this sector, and two wheeler sales continued to grow, reaching almost 18 million.

Despite this continued interest in small two wheelers, we are seeing a different trend in the passenger car market. Here, there is a shift away from smaller entry-level cars and a growing preference for compact sports utility and multi-purpose vehicles. The major OEMs in India, including Maruti Suzuki, Mahindra, and Tata, who together account for two thirds of the market, are responding by ramping up their efforts in these vehicle segments.

However, to date, consumers in India’s burgeoning car market have been relatively slow to embrace electrified cars (battery electric vehicles (BEV) and hybrids) – something that will need to change if the country’s decarbonisation ambitions are to be met. While hybrid sales are still relatively small, there has been some growth since 2020, and hybrids now account for more than 11% of India’s passenger car sales. With hybrids providing a good way to reduce CO2 emissions today, OEMs, including for example Maruti Suzuki in collaboration with Toyota, are investing in new hybrid models.

We can anticipate further growth in the hybrid segment in India on its journey towards net zero.

At COP26 in 2021, India announced its ambition to achieve net zero carbon emissions by 2070, and stated new 2030 targets that include:

The impact of India's journey towards its net-zero emissions aspiration will be far reaching and the decarbonisation of the personal mobility sector, through increased vehicle electrification and hybridisation, is one key aspect. To achieve this will involve a combination of legislative measures, OEM commitments, end user acceptance, and various incentives to help promote sustainable practices in the passenger car sector.

The Indian government has implemented several policies designed to help accelerate the transition to electric vehicles (EVs). Here, EVs are defined as vehicles that use an electric motor instead of a gasoline or diesel engine and can be powered by electricity from a battery or a fuel cell. Currently, EVs are taxed at only 5%, whereas hybrids are taxed by as much as 43%.

The Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) scheme, was introduced with the aim to reduce the reliance on fossil fuels and to address vehicle emissions. FAME II, introduced in April 2019, with a budget of ₹10,000 crore (~1145 million USD) led to a significant rise in total personal mobility EV sales, from less than 7,000 in 2015 to over two million in 2024. However of the more than four million domestic passenger car sales in 2024 only 2.5% were EVs.

FAME III had been expected, but the government has not allocated funds for the scheme in its 2025 Union Budget, indicating a shift in EV policy and its gradual phase-out. Instead, ₹4,000 crore has been allocated to the newly introduced PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE). This scheme aims to accelerate the adoption of EVs by offering upfront incentives for purchases of e-2 and e-3 wheelers and other emerging categories of EVs, funding to establish a comprehensive charging infrastructure, and building a robust EV manufacturing ecosystem in the country.

However, the scheme does not include subsidies for electric cars, since they already benefit from a reduced Goods and Services Tax rate.

India’s Corporate Average Fuel Economy (CAFE) Standards include CO₂ emission targets for car manufacturers, with Phase II introducing a target of 113 gCO₂/km from April 2022. In addition, India offers supply side incentives to manufacturers of EVs and EV components, as well as for advanced chemistry batteries for EVs via two Production Linked Incentive (PLI) schemes. These are part of a major government programme aimed at boosting India’s manufacturing competitiveness in different sectors.

In March 2024, the government approved the Scheme for Promotion of Manufacturing of Electric Passenger Cars in India (SPMEPCI) to encourage electric car production by requiring applicants to invest a minimum of ₹4,150 crore and achieve specific domestic value addition targets within set timelines.

According to the Ministry of Heavy Industries, by leveraging the potential of electric vehicles, the scheme not only promises to mitigate air pollution, reduce the trade deficit, and lessen dependence on imported crude oil but also heralds a new era of innovation, employment generation, and economic prosperity.

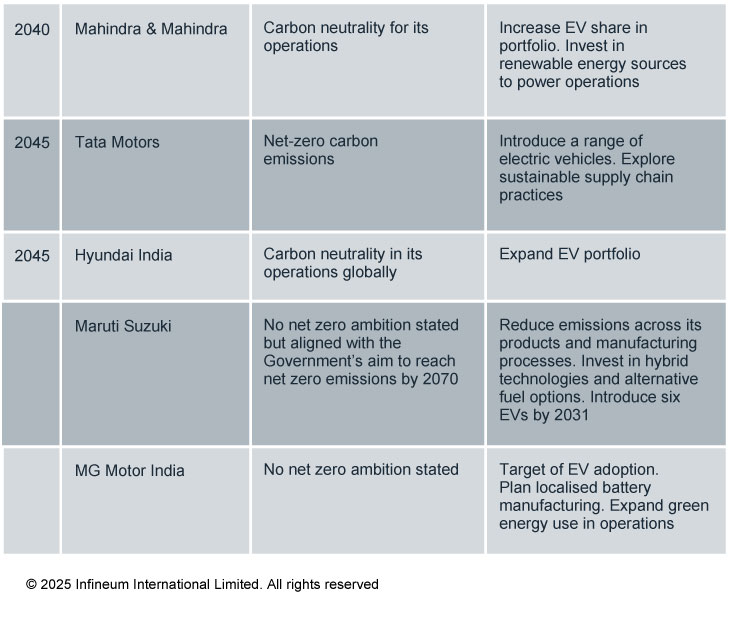

Indian passenger car manufacturers are gradually aligning their strategies with India's net-zero target. Many of the major OEMs have publicly stated net zero emissions commitments, as shown below, and are investing in lower and zero carbon energy sources and introducing new EV models.

Clearly increasing the uptake of EVs is not just down to the OEMs. Consumers must want to buy an EV rather than a hybrid or conventional internal combustion engine (ICE) vehicle. To encourage consumers to adopt EVs, the government offers various incentives including purchase subsidies under FAME II. Tax reforms, including reduced import tariffs on electric vehicles and components, are also designed to make EVs more affordable for consumers. In addition, state-level policies including tax exemptions, registration fee waivers, and subsidies are being offered to consumers who opt for EV models. But, despite all these initiatives, the adoption of electric cars is fairly slow.

The key barriers to electric car adoption include limited charging infrastructure and the higher upfront costs compared to ICE and hybrid vehicles. Additionally, the promotion of hybrid vehicles by some state governments has sparked debate among automakers regarding the best path to achieving net zero targets.

Alongside legislative initiatives and OEM commitments, a number of other drivers and barriers are influencing the adoption of EVs in India.

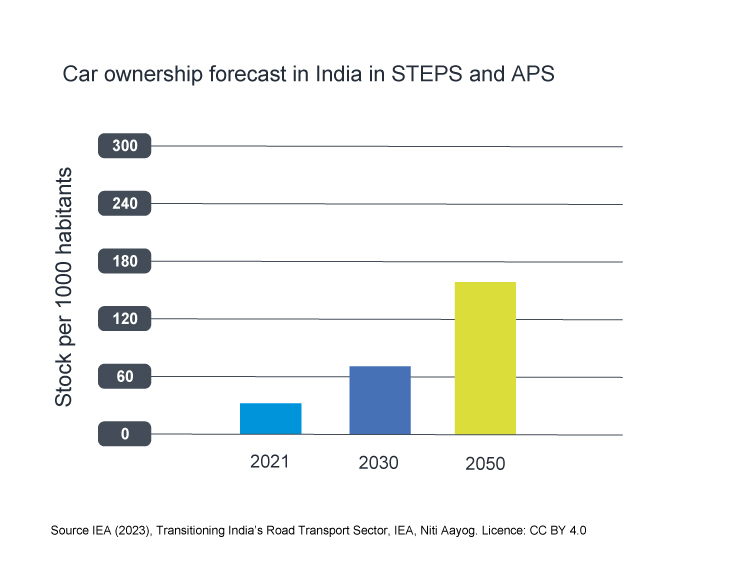

According to research from the International Energy Agency (IEA), in both the Announced Pledges Scenario (APS) and the Stated Policies Scenario (STEPS) India’s car ownership is set to surge. The organisation forecasts an increase from 30 to about 150 cars per 1000 inhabitants between 2021 and 2050. This would increase the passenger car fleet in India to 250 million vehicles by 2050.

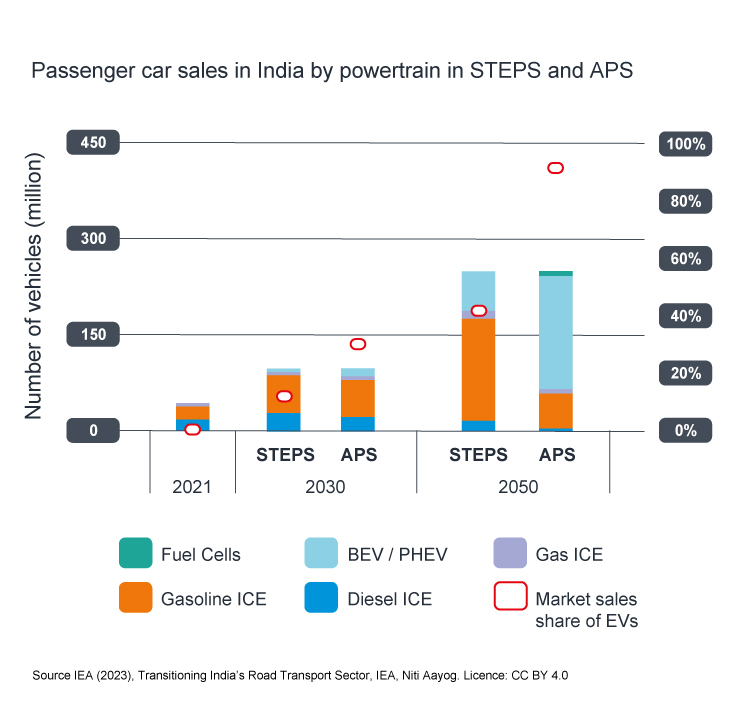

Such a rapid expansion, in combination with a strong urbanisation rate, will pose challenges for urban traffic management and could result in increased air pollution, depending on the technologies used by the new vehicles. While currently almost exclusively consisting of ICE vehicles, India’s private vehicle fleet is projected to gradually shift to electric powertrains in the future.

In the STEPS, the uptake of electrified cars is modest, with sales reaching 13% in 2030 and about 40% of total passenger car sales by 2050. In contrast, in the APS, electrified cars are forecast to reach a market sales share of 30% in 2030 and more than 90% by 2050. In this scenario BEVs dominate the car fleet (about 70%) while most of the remaining vehicles are gasoline-fuelled ICEs. However, it should be noted that BEVs in this forecast include plug in hybrid vehicles, which also contain an ICE – and the split between BEV and hybrids in the future is uncertain.

Several factors could impact passenger car sales and EV adoption forecasts in India. In the short term (1-3 years) while slowing GDP growth or rising inflation could reduce consumer spending and impact total vehicle sales, on the flip side rising fuel prices mean consumers may consider EVs more seriously. Over this time period we can also anticipate supply chain disruptions, which could include microchip shortages, rising raw material costs, and battery supply chain bottlenecks, all of which could limit the availability of EVs.

There is a level of uncertainty over the impact of policy change. New subsidies or tax incentives under the FAME India scheme could either encourage or slow EV adoption. At the same time, new import duties or trade policies could increase the cost of components or imported EVs, making them less attractive to consumers. The same is true for charging infrastructure, where the rate of progress could boost sales or deter buyers as range anxiety and charging time remain key concerns.

Currently estimates suggest there is only one public charger for every 135 EVs in India, far below the global average of one per 6-20 EVs.

Although from March 2023 to February 2024, the number of operational public EV charging stations in India almost doubled, reaching more than 12,000. Urgent expansion is required if the goal of 3.9 million charging stations by 2030 is to be met.

On the upside the expected OEM investment in new EV models with better range, battery life, and affordability could quickly change market dynamics. Battery innovations, such as the use of solid-state batteries, may accelerate EV adoption by reducing costs. And, last but by no means least, changing consumer sentiment and the awareness of the environmental benefits and potential in-use cost savings of EVs could drive higher sales.

In the longer term, a number of broader factors come into play, but there is an even higher level of uncertainty regarding their impact on total EV sales. The Indian Government is aiming for a 30% share of EVs in new personal mobility sales by 2030 – achieving this, or not, will have a huge impact on overall market trends. If the country transitions to renewable energy for EV charging the sustainability narrative of EVs could improve, which might encourage wider adoption. In addition, volatile energy prices may either accelerate or slow the pace of EV adoption, depending on the direction of change.

If global and domestic automakers expand EV production and launch affordable models tailored to the Indian market, sales of EVs could rise at a faster pace.

With more market players, intense competition may push the initial purchase cost of EVs down, making them more attractive to budget-conscious buyers. In addition, the shift to EVs could accelerate if stricter emissions norms and bans on ICE engines were to be introduced in the future. On the other hand, technology breakthroughs, including the full commercialisation of hydrogen internal combustion engines, or H2ICE, could present new and attractive alternatives to EVs.

There are also high levels of uncertainty around future battery technology evolution. Advances in lithium-ion or alternative battery technologies could reduce battery costs and improve range, while localised battery manufacturing could reduce costs and boost availability – all of which would help to drive higher EV adoption.

The Indian Government has set its ambition to achieve net zero carbon emissions by 2070. One of the key strategies is a target of 30% of all sales to be EVs by 2030. Currently with EVs across all transport types accounting for some 6% of sales and only 2.5% of all passenger car sales being electric, there is a long way to go to achieve this goal.

While the exact route to net zero is uncertain it is clear that significant change in the personal mobility market in India is coming.

We will watch with interest to see how the situation evolves and keep you updated on future trends.

Clearly, the transition to carbon neutrality brings challenges and opportunities across the automotive, lubricants, fuels and transportation additive sectors. Infineum is working closely with industry stakeholders to help ensure the success of the industry transition and is committed to enabling the adoption of greener technologies. If you have any questions or need further details, please contact us.

Sign up here to receive email alerts so that you never miss out on new content from Infineum - and make sure you follow Infineum Additives on LinkedIn.

Sign up to receive monthly updates via email